Germany vat number services

In Germany, a value-added tax (VAT) is levied on the sale of most goods and services. The standard VAT rate is 19%, with reduced rates of 7% and 0% applying to certain items. as a business owner in Germany, you are required to obtain a VAT number from the Finanzamt (Tax Office) in order to charge VAT on your products or services. There are a number of companies that provide VAT number registration services in Germany. These companies will typically charge a fee for their services. However, there are a few things you can do to obtain a VAT number without using a registration service. First, you can contact the Finanzamt directly and request a VAT number. This can be done online, by mail, or in person at a local Finanzamt office. Second, you can register for a VAT number through the German Chambers of Commerce. This process is typically free of charge. Finally, you can use the services of a company that provides VAT number registration services. These companies will typically charge a fee for their services.

A VAT number is a unique identifier assigned to businesses by the German government. Businesses use VAT numbers to charge VAT on their products and services.

Overall, using a Germany VAT number service can be very beneficial for businesses. Not only can it help save time and money, but it can also help ensure that businesses are compliant with VAT regulations. There are a number of different service providers to choose from, so it is important to do some research to find the right one for your business.

Top services about Germany vat number

I will create verified tiktok ad account ready to use

I will consult you, how you can get your german vat number and f22

I will register your company in germany for vat, tax purposes

I will make vat registration of your company in germany

I will do amazon ebay UK vat registration and file vat returns

I will do cold calling, telesales or telemarketing in germany, switzerland, and austria

I will translate english to germany or germany to english

I will provide business connections in germany, austria, and switzerland

I will do any germany related tasks for you

NOTE: I WILL NOT VERIFY ANYTHING WITH MY PERSONAL ADDRESS

Hi!

My name is Alex. I’m a student, born and raised in Germany. I study english for more than 12 years now.

Do you have any Germany related tasks that you want to get done? Or a question about Germany that needs to be answered? Or do you need a german interpreter for a german contact?

I can do various things for you! Just contact me and we will find a solution to your problem.

Please contact me before you order my gig.

I will buy and send you anything you want from germany

I will make vat registration in germany

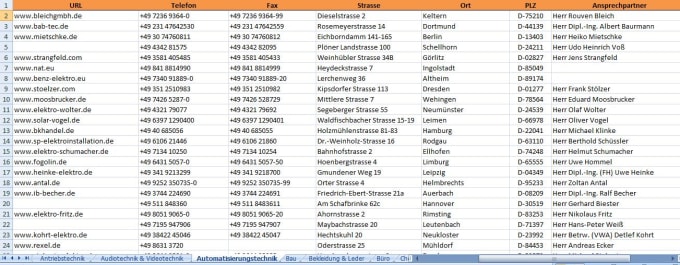

I will 210,000 Business B2B Contact List for Germany

This list has about 210,000 B2B from all over Germany. You will get these contacts in an excel spreadsheet which includes Names, Numbers, Email, Postal Addresses, Postal Codes etc.

The Data fields are:

Industry

Company Name

Website

Contact Name

E-mail Address

Postal Address

Postal Code

Phone No.

Fax No.

File Type: .XLSX