Account balance services

In today's world, it's more important than ever to keep track of your finances. That's why many banks offer account balance services. With these services, you can check your account balance anytime, anywhere. This can be a great way to stay on top of your finances and make sure you're not overspending. It can also help you keep track of your money so you can budget better. If you're thinking about signing up for an account balance service, be sure to read this article first. We'll tell you everything you need to know about account balance services, including how they work and what to look for in a good one.

An account balance service is a type of financial service that allows customers to check their account balance at any time. This service is typically offered by banks and other financial institutions.

Account balance services can be a great way to stay on top of your finances. By tracking your account balances, you can ensure that you always have enough money to cover your expenses. This can help you avoid overdraft fees and other charges that can add up quickly. Plus, by keeping an eye on your account balances, you can spot any fraudulent activity right away.

Top services about Account balance

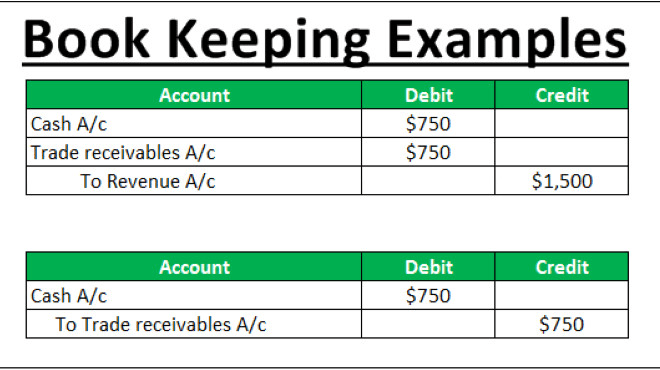

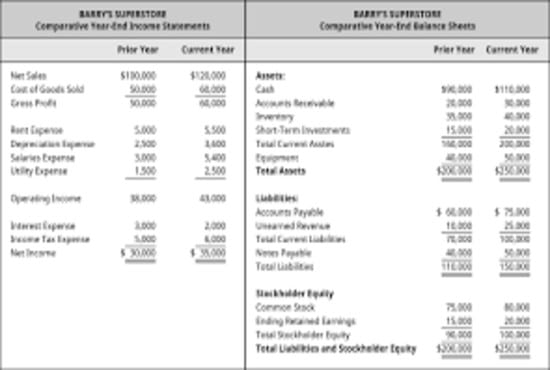

I will can do accounts related work balance sheet profit loss

I will create profit and loss accounts, balance sheet for you

I will prepare profit and loss account plus balance sheet

I will do profit and loss accounts balance sheets and cash flows

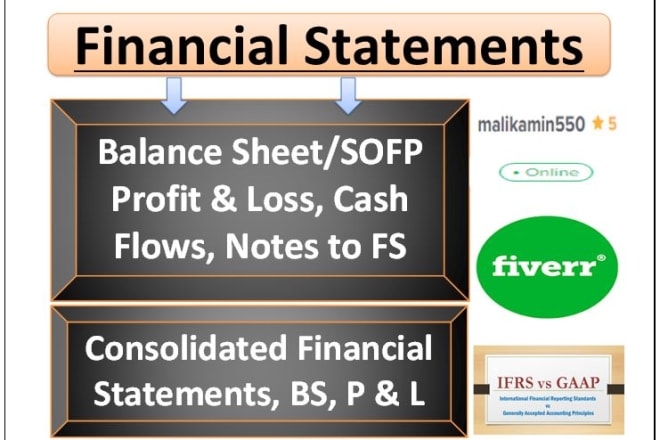

I will prepare financial statements, year end accounts, balance sheet, profit and loss

I will do balance sheet and account statement analysis

I will create an account on vip72 IP and recharge the balance

I will prepare financial statements year end accounts balance sheet profit loss, ifrs

I will help you with forex account management service

I will prepare profit and loss account and balance sheet

Thank you.

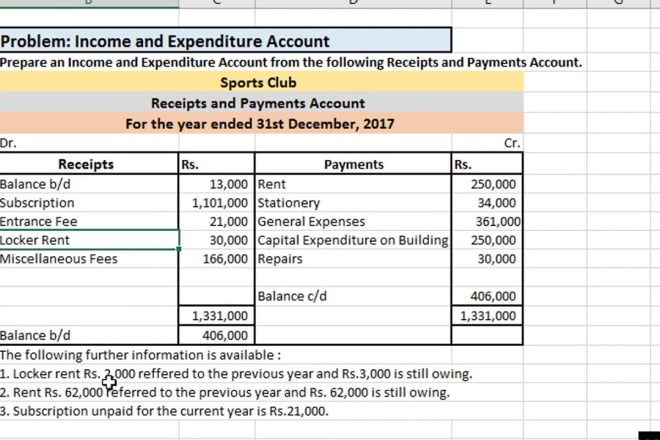

I will prepare income and expenditure account, balance sheet

I will do financial statements balance sheet income statement

I will do something i am really perfect in marketing

I will do forex account management service

I will prepare financial analysis which consist financial statements Balance sheet and Profit and Loss statement for the operation of your business

I will give you 50USD adwords voucher