Accounting auditing and bookkeeping services

The accounting, auditing, and bookkeeping services industry in the United States has a long history dating back to the late 1800s. The industry has changed significantly over the years, as new technologies and regulations have been introduced. Today, the industry is composed of a small number of large accounting firms and a large number of small accounting firms. The accounting, auditing, and bookkeeping services industry provides a variety of services to businesses and individuals. The most common services provided by accounting firms are auditing, tax preparation, and bookkeeping. Accounting firms also provide consulting services on a variety of topics, such as financial planning, mergers and acquisitions, and estate planning. The accounting, auditing, and bookkeeping services industry is highly regulated by both state and federal governments. The Sarbanes-Oxley Act of 2002 imposes strict requirements on accounting firms that provide auditing services to public companies. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 imposes additional regulations on the accounting industry, including requirements for the registration of accounting firms with the Public Company Accounting Oversight Board. The accounting, auditing, and bookkeeping services industry is expected to grow in the coming years as the economy continues to recover from the recession. Businesses will continue to demand more accounting and auditing services to comply with new regulations and to improve their financial reporting. The growth of the small business sector will also contribute to the industry's growth, as small businesses typically require more accounting and bookkeeping services than larger businesses.

There are a few different types of accounting auditing and bookkeeping services. The most common type is an external audit, which is conducted by an independent accounting firm. External audits are typically required by law or regulation for public companies. Other types of accounting auditing and bookkeeping services include internal audits, which are conducted by the company's own accounting staff, and forensic audits, which are conducted by speciality firms that investigate fraud or other financial crimes.

There is a lot to consider when choosing accounting, auditing, and bookkeeping services. Services can vary greatly in terms of price, quality, and the types of services offered. It is important to do your research and choose a service that is right for your business.

Top services about Accounting auditing and bookkeeping services

I will provide accounting, auditing and bookkeeping services

I will provide accounting auditing and bookkeeping services

I will provide accounting, auditing and bookkeeping services

I will provide accounting, auditing and bookkeeping services

I will provide accounting, auditing and bookkeeping services

I will provide accounting auditing and bookkeeping services

I will provide accounting, auditing and bookkeeping services

I will provide accounting, auditing and bookkeeping services

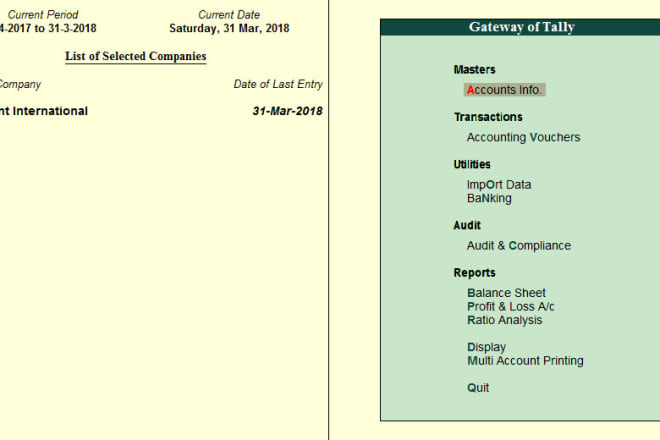

I will accounting and bookkeeping in tally erp