Arbitrage crypto bot services

In recent years, crypto bot arbitrage services have become increasingly popular among cryptocurrency traders. These services use bots to trade on behalf of their users, in order to take advantage of price discrepancies between exchanges. Crypto bot arbitrage services have a number of advantages over traditional trading methods. They can trade 24/7, meaning that users can take advantage of arbitrage opportunities as soon as they arise. They can also place orders much faster than a human trader could, and they can monitor multiple exchanges simultaneously. However, there are also some risks associated with using crypto bot arbitrage services. Bots can make mistakes, and if a bot makes a large enough mistake, it could bankrupt its user. There is also the risk that an exchange could be hacked, or that a bot could be maliciously programmed to steal its user's funds. Despite the risks, many traders believe that the advantages of using crypto bot arbitrage services outweigh the risks. The key to successful trading using bots is to carefully research the service before using it, and to monitor your trades closely.

Arbitrage crypto bot services are computer programs that automatically buy and sell cryptocurrencies on exchanges in order to profit from price differences.

The arbitrage bot services seem to be a great way to make money in the cryptocurrency market. By using these services, you can take advantage of the differences in prices between different exchanges. This can help you make a profit, even if the market is going down.

Top services about Arbitrage crypto bot

I will forex trading bot, arbitrage trading bot, trading bot, forex ea trading bot

I will setup your rugged crypto bot,forex trading bot and mining platform

I will create an arbitrage bot for cryptocurrency trading

I will develop crypto mining bot, bitmex arbitrage trading bot

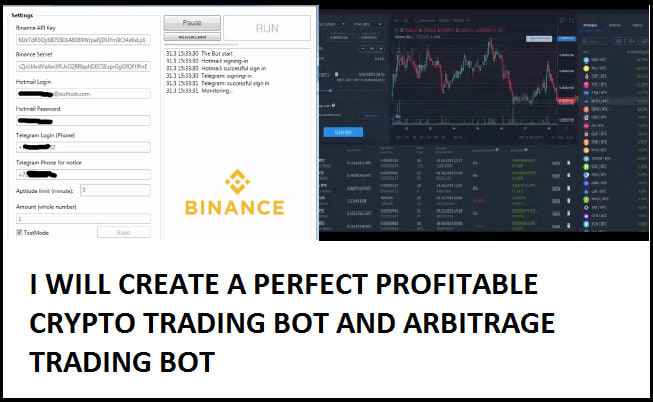

I will create a profitable crypto trading bot,arbitrage trading bot

I will create arbitrage crypto trading bot, stock forex trading bot, crypto mining bot

I will develop profitable mining trading bot forex trade arbitrage crypto bot

I will create profitable forex trading bot, ea robot arbitrage bot

I will develop best forex trading bot, crypto trading bot

I will develop profitable arbitrage bot, arbitrage trading bot, crypto bot forex bot

I will build crypto arbitrage bot, bitcoin arbitrage bot and trading bot

I will develop crypto arbitrage bot and bitcoin arbitrage bot

I will develop arbitrage cryptocurrency trading bot

I will develop commercial crypto trading bot, arbitrage mining bot

I will develop commercial crypto trading bot, arbitrage mining bot

I will setup profits forex trading bot, arbitrage bot, crypto currency trading bot

I will provide you already made trading bot, bitcoin software, crypto forex binary bot