Back test forex services

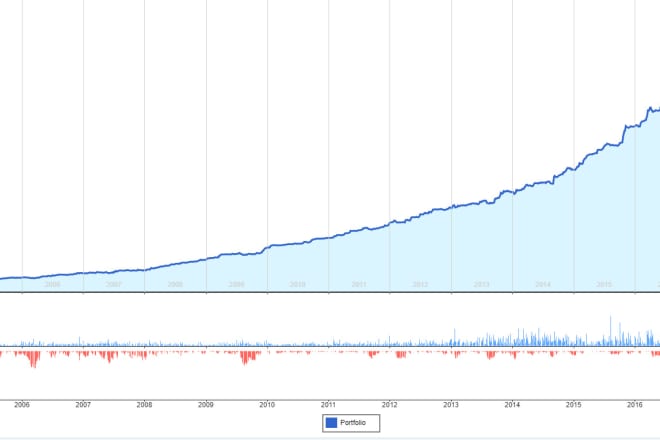

When it comes to forex trading, one of the most important things you can do is back test forex services. This will help you determine whether or not a particular service is reliable and effective. There are a number of ways to back test forex services, but the most important thing is to use a reliable data source. This data source should be able to provide you with historical data that goes back at least a year. Once you have this data, you can start to test different forex services.

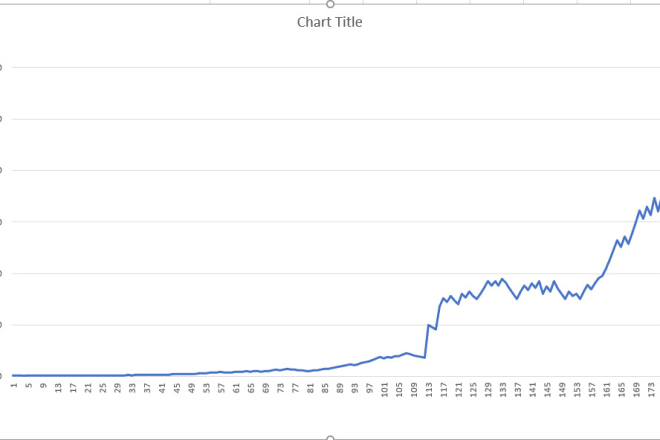

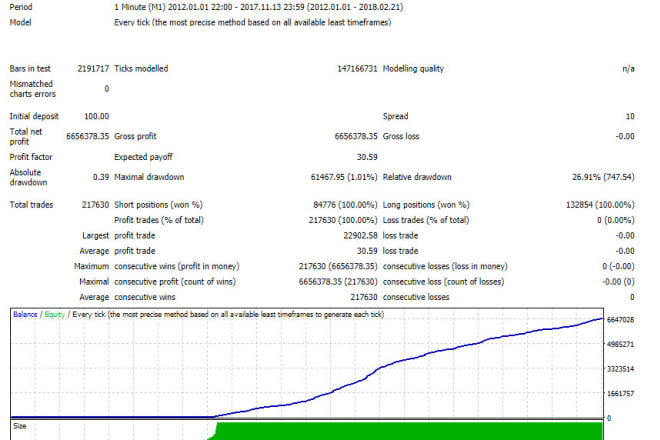

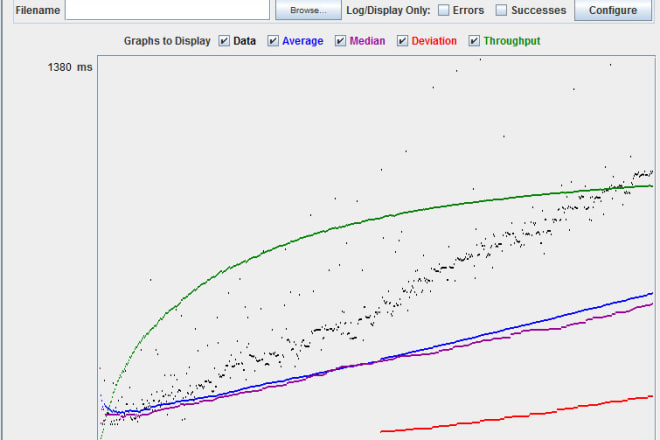

Backtesting is the process of testing a trading strategy on historical data to ensure its viability before using it in live trading. This is an important step for any trader, as it allows them to assess whether their strategy is likely to be successful. There are a number of different backtesting software packages available, which allow traders to test their strategies on a variety of different data sets. However, it is also possible to backtest manually, using a spreadsheet or other software. When backtesting a strategy, it is important to consider a number of different factors, such as the time frame of the data, the trading rules used, and the risk management strategy. It is also important to test on a variety of different markets, as this will give a more accurate picture of how the strategy will perform in live trading.

A back test forex service can be a valuable tool for traders who want to test their trading strategies against historical data. While back testing is no guarantee of future success, it can give traders a good idea of how their strategy would have performed in different market conditions.

Top services about Back test forex

I will make forex and equity market strategy backtest it

I will give 3 backtested forex trading strategies that work

I will make forex and equity market strategy backtest it and give you the ultimateforex

I will give you my profitable backtested forex strategy

I will sell mt4,mt5 expert edvisors for forex and gold backtested with 15 to 20 years

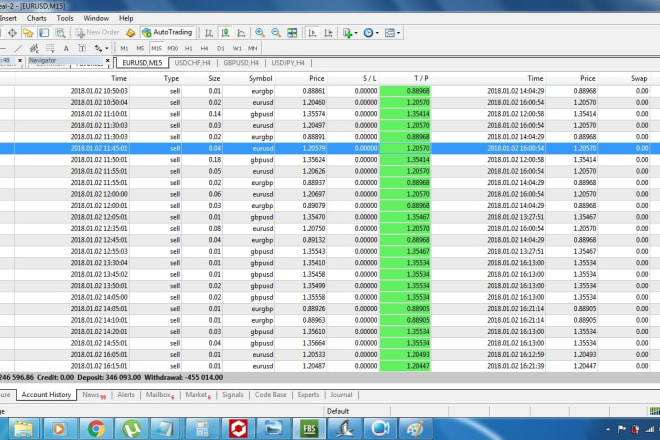

I will make a profitable forex trading,algo trader robot and a backtest historical data

I will do backtest with real data for forex ea

I will code an indicator, strategy, script for forex tester

I will code forex robot, calgo, cbot, robot for ctrader

I will provide forex robot, scalping bot, goldnix bot, gold ea trading bot

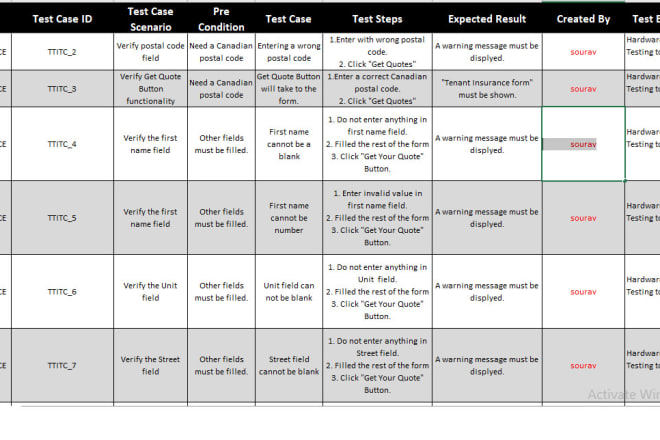

I will write test cases for software QA

I will give you my profitable forex trading bot, steam ea bot, tsr forex ea

I will code renko forex robot ea metatrader mt4 mt5

I will gives you my forex bot, forex ea robot, mt4 forex ea, forex trading bot

I will gives you my forex bot, forex ea robot, mt4 forex ea, forex trading bot

I will test your app on all platform