Backtest forex services

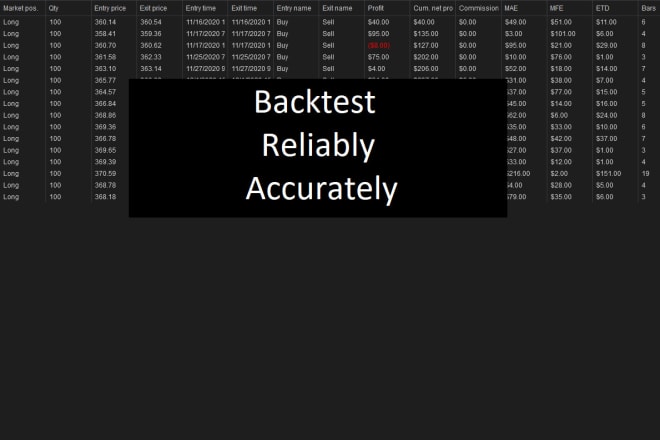

Backtesting is a process of testing a trading strategy on historical data to ensure its viability before using it in live trading. There are many backtesting services available online, which can be used to test a wide variety of trading strategies. When choosing a backtesting service, it is important to consider the features and flexibility offered. Some services only allow for simple strategy testing, while others offer more advanced features such as Monte Carlo simulation and optimization. Once a strategy has been backtested and found to be viable, it can then be implemented in live trading. Backtesting is an essential tool for any trader seeking to develop or improve their trading strategy.

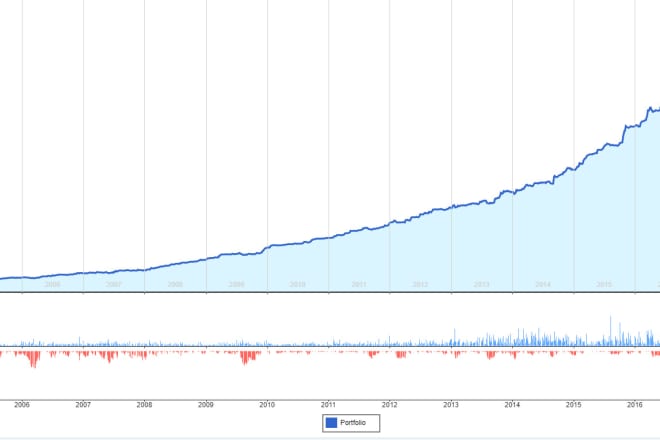

Backtest forex services are used to test how effective a forex trading strategy would have been in the past. This is done by taking actual historical data and using it to simulate what would have happened if the trading strategy was used. This can be used to evaluate a trading strategy, or to test how a new forex trading system would have performed.

Backtesting forex services can be a helpful tool for traders to use, especially when combined with other forms of analysis. However, it is important to remember that backtesting is not perfect and results may not always be accurate. In addition, backtesting forex services may not be appropriate for all trading strategies. Traders should carefully consider whether backtesting is right for their individual trading style and strategy.

Top services about Backtest forex

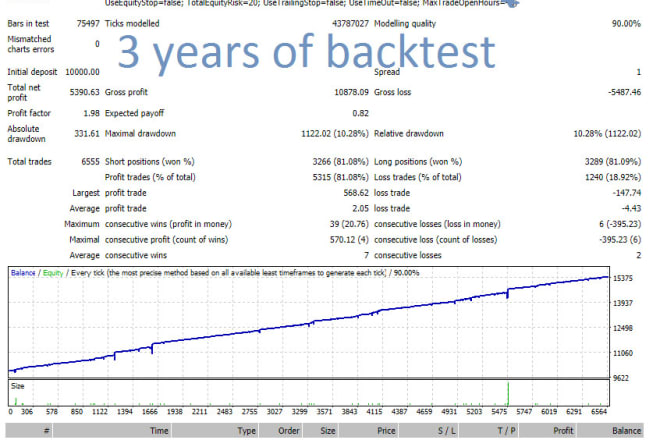

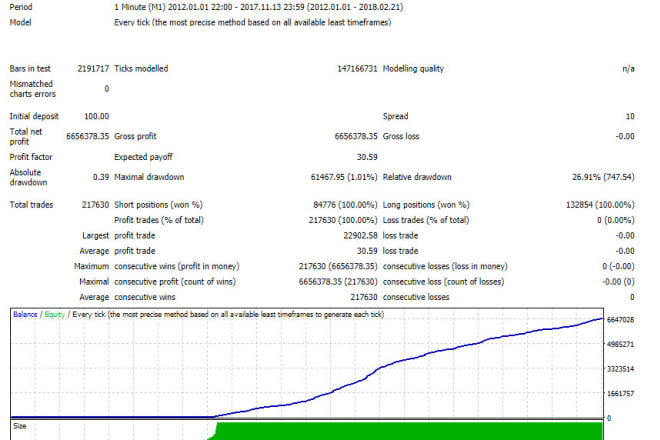

I will give profitable forex ea with 3 years of backtest

I will give guaranteed forex gold ea with 6 years of backtest

I will give my best forex ea with 7 years of backtest

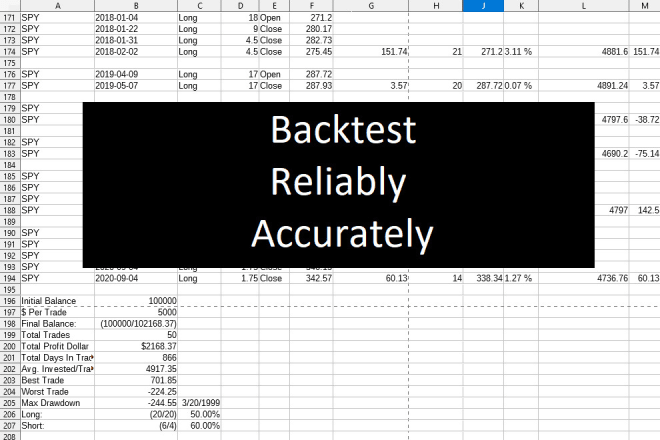

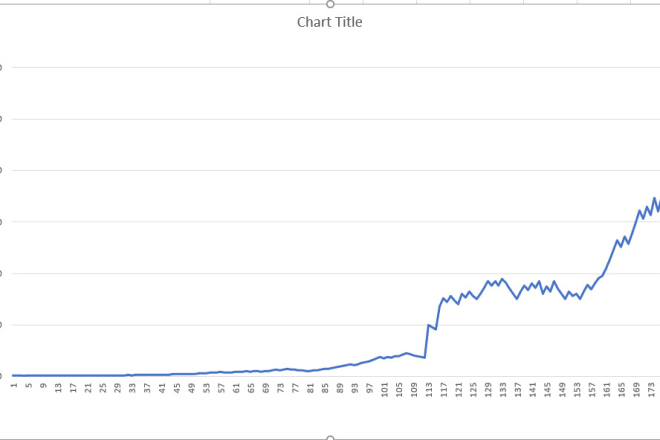

I will make forex and equity market strategy backtest it

I will give 3 backtested forex trading strategies that work

I will give you my profitable backtested forex strategy

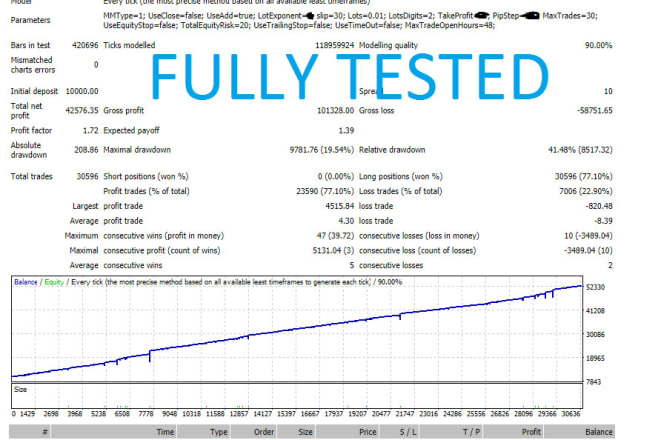

I will sell mt4,mt5 expert edvisors for forex and gold backtested with 15 to 20 years

I will do backtest with real data for forex ea

I will make a profitable forex trading,algo trader robot and a backtest historical data

I will backtest your day trading strategy

I will make forex and equity market strategy backtest it and give you the ultimateforex

I will optimize mt4 ea settings for profitable backtest result