Bank funding paypal services

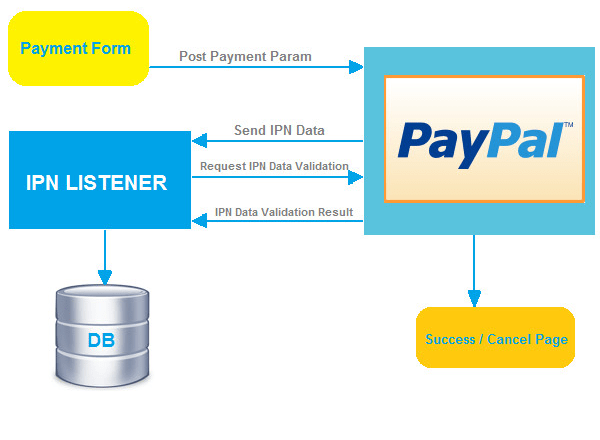

Many banks are now funding PayPal services in order to make it easier for their customers to use the popular online payment system. PayPal is a great way to send and receive money online, and with the help of bank funding, it has become even easier to use. There are many benefits to using PayPal, and with the help of bank funding, even more people can enjoy these benefits.

One of the most popular ways to receive and send payments online is through PayPal. In order to keep their service running, PayPal relies on bank funding. When a user wants to send money through PayPal, the company will take the money from the user's bank account and hold it until the recipient accepts the payment. The bank funding PayPal provides allows the company to keep their service running smoothly and keep their users happy.

While PayPal has been a boon for many small businesses, its recent foray into banking services has not been as successful. In fact, many small businesses have found that bank funding for PayPal services is difficult to obtain. This is because banks are hesitant to work with a company that is not clearly defined as a bank. As a result, small businesses that rely on PayPal for their banking needs are finding it difficult to obtain the funding they need to keep their businesses running.

Top services about Bank funding paypal

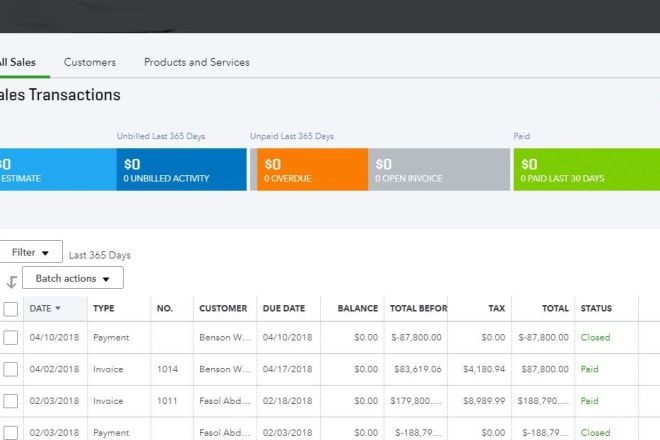

I will create sales invoice and vendors bill in quickbooks and xero

I will build a ravishing and an incredible bank website

I will develop wallet app, cash app, loan app, payment app, online money transfer app

I will wallet app,crypto wallet app,exchange website,bitcoin wallet,crypto exchange

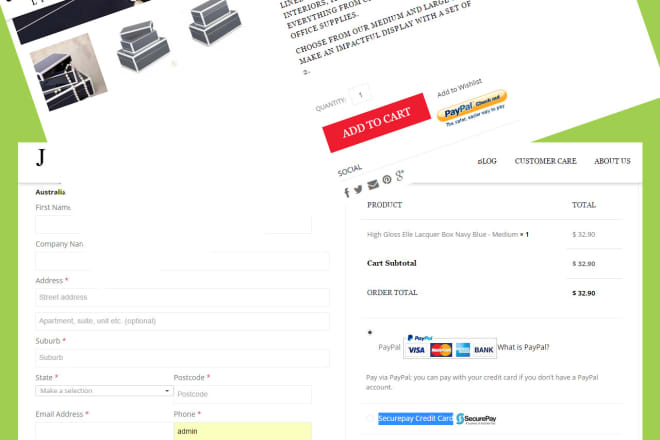

I will integrate paypal apple pay stripe amazon pay payment gateway

I will build cash app,bank app,loan app,payment app,online money transfer app

I will develop mobile app development, loan app, bank app, p2p payment app development

I will develop banking app like cash app paypal venmo or movo

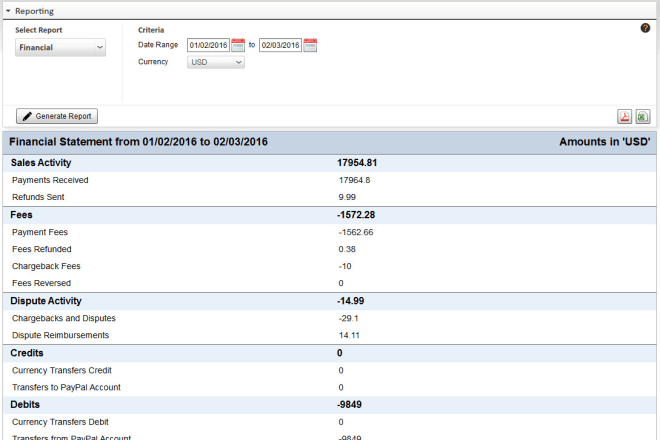

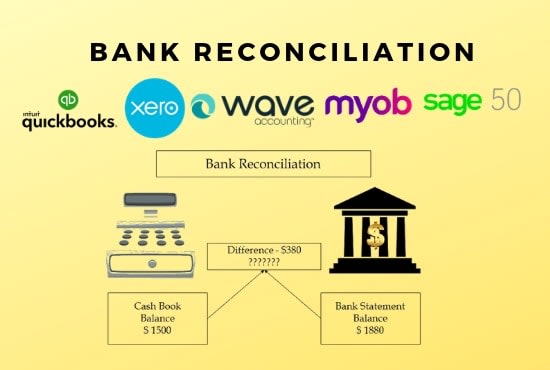

I will do reconciliation from paystub, paypal, zelle, quickbooks bank statement

I will create gojek clone apps

I will reconcile your bank, card and paypal statements

I will do reconciliation of your bank statements and paypal statements

I will do stripe or paypal integration as payment gateway

I will reconcile your paypal, bank cards, bank statements

I will do integrate paypal payment gateway for your website

I will integrate paypal, paypal express, securepay in wordpress

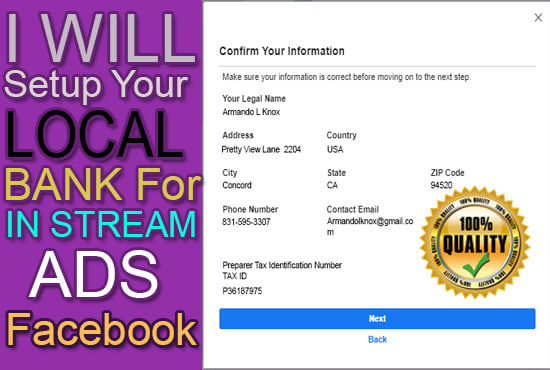

I will setup your bank for in stream ads facebook