Best tax preparation service

There are a lot of tax preparation service companies out there. How do you know which one is the best for you? Here are some things to look for when choosing a tax preparation service.

There are many tax preparation service providers available and it can be difficult to determine which one is the best. Many factors should be considered when choosing a tax preparation service, such as the cost, the level of service, the experience of the preparer, and the reputation of the company.

The best tax preparation service services can save you a lot of money and time. They can help you find deductions and credits that you may not have known about. They can also help you file your taxes electronically.

Top services about Best tax preparation service

I will do accounting and bookkeeping in quickbooks online, xero, and microsoft excel

I will do all types of accounting for UK based clients

I will prepare USA tax return business and personal including form 1040, 1120, and w2

I will prepare, sign, and file your tax return as a CPA

I will prepare USA income tax return and provide related services

I will write finance article and personal finance blog

I will do accounting and finance, tax preparation and audit for you

I will prepare personal federal tax return and state tax return

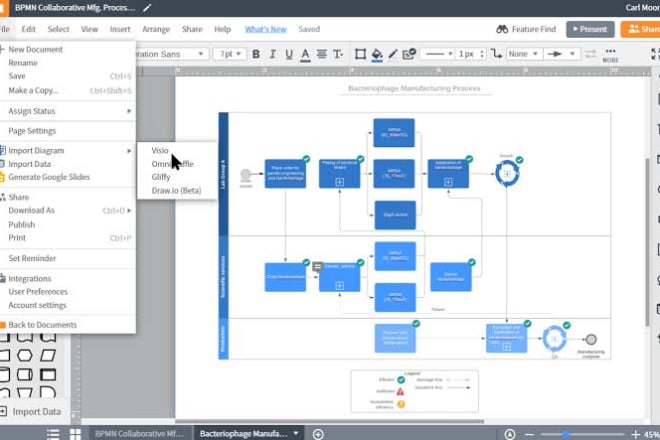

I will prepare flowcharts and diagrams on ms visio for you

I will do amazon, shopify, ebay accounting by using a2x, quickbooks and xero

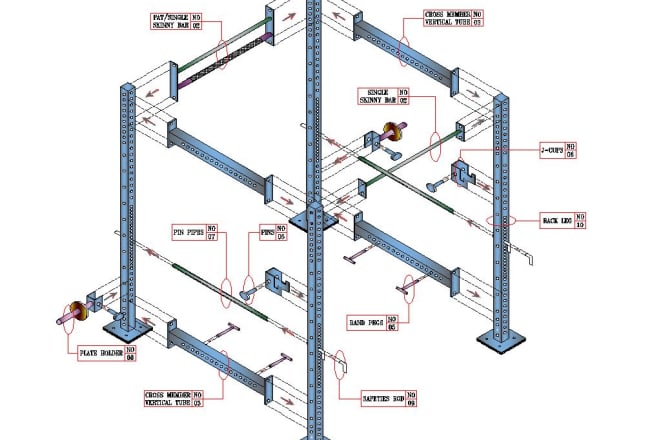

I will arch hvac plumbing shop drawings

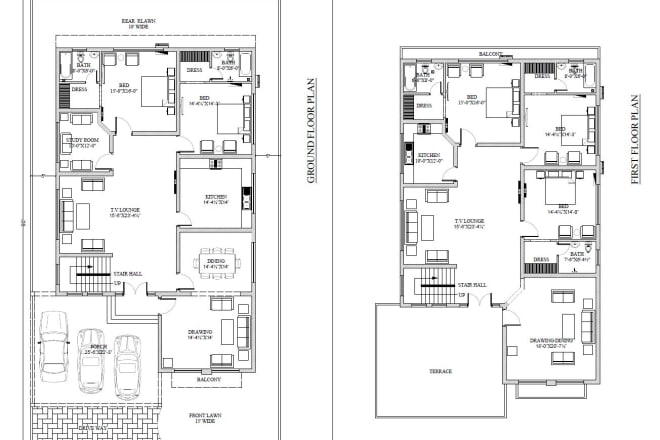

I will civil,architectural draftsman for cad drawings

I will provide you tax,sba,eidl loan and ppp loan services

I will deliver a 9 page interview prep packet to land a job

Interview-winning preparation packet with 9 pages of extensive information on everything from commonly asked questions, attire suggestions, insider tips, skills promotion, phone/video/technical/case interviews, question

preparation, etc...

This is the only preparation material you need to nail your interviews and secure job offers as it has been proven successful for thousands of my previous clients.

If you are also in need of a transformative, optimizing resume/CV, cover letter, or LinkedIn service, please see my other gigs.

I look forward to helping you achieve your top career potential, and the job of your dreams!

I will get you hired with my 12 page interview preparation pack

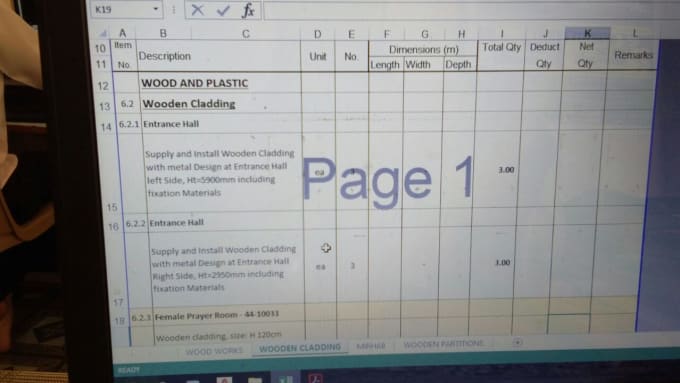

I will estimate building quantities draw architectural structural plans

· Preparation of Bill of Quantity (B.O.Q) as per CSI standard.

· Checking and certification of contractor’s bills.

· Taking off Architectural and Structural quantities as per drawings.

· Preparation of work order against approved budget.

· Preparation of purchase request and material recovery statement.

· Quantification and submission of monthly earned value report.

· Preparation of detailed Bills of Quantities and variations.

· Comparison of BOQs of contractors.

· Preparation of BBS.

Taking actual measurements at site as per work done by contractor.

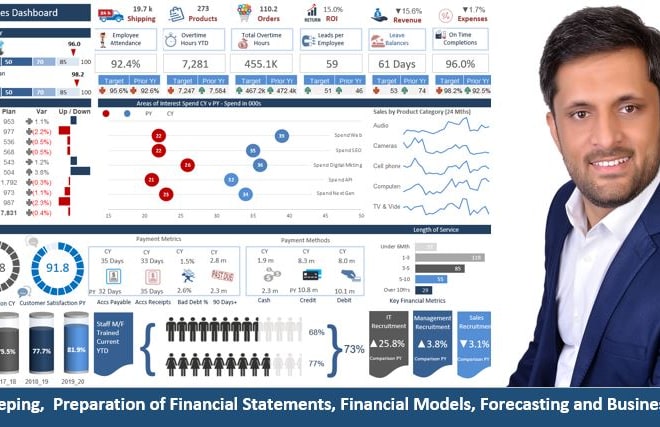

I will prepare financial statements and projections