Bollinger band breakout services

In recent years, online trading has become increasingly popular, as it offers investors the opportunity to trade stocks and other securities without having to go through a broker. One type of online trading that has gained popularity is bollinger band breakouts. Bollinger band breakouts occur when the price of a security breaks out of the upper or lower Bollinger band. The Bollinger bands are a technical analysis tool that is used to measure market volatility. When the price breaks out of the Bollinger band, it is an indication that the market is about to become more volatile. Many online trading platforms offer bollinger band breakout services. These services allow investors to trade on the breakout of the Bollinger bands. These services typically charge a fee for each trade. The bollinger band breakout strategy can be profitable if used correctly. However, it is important to remember that this strategy is not without risk. The most common risks associated with this strategy are false breakouts and whipsaws. False breakouts occur when the price breaks out of the Bollinger band but then quickly reverses course and falls back within the band. This can be a costly mistake for investors who enter into a trade at the breakout point and then exit at a loss when the price falls back within the band. Whipsaws are another risk associated with the bollinger band breakout strategy. Whipsaws occur when the price breaks out of the Bollinger band but then quickly reverses course and falls back within the band. This can be a costly mistake for investors who enter into a trade at the breakout point and then exit at a loss when the price falls back within the band. Despite the risks, the bollinger band breakout strategy can be a profitable way to trade the markets. Investors who are considering using this strategy should do so with caution and only after doing extensive research.

A Bollinger Band® is a technical analysis tool defined by a set of upper and lower bands plotted around a central point based on standard deviations. Bollinger Bands are typically used to identify overbought or oversold conditions in the market. A Bollinger Band Breakout occurs when the price of an asset moves outside of the Bollinger Bands. This is usually considered an indication that the price is about to make a move. There are a number of ways to trade breakouts, but the most common is to buy when the price breaks out above the upper Bollinger Band, and sell when the price breaks out below the lower Bollinger Band. There are a number of services that offer Bollinger Band breakouts. These services typically send out alerts when a breakout occurs, and provide trade recommendations.

Overall, bollinger band breakout services seem to be a reliable and affordable way to trade the markets. They provide a simple and effective way to trade a variety of assets, and their customer service is excellent. If you are looking for a reliable and affordable way to trade the markets, bollinger band breakout services may be the right choice for you.

Top services about Bollinger band breakout

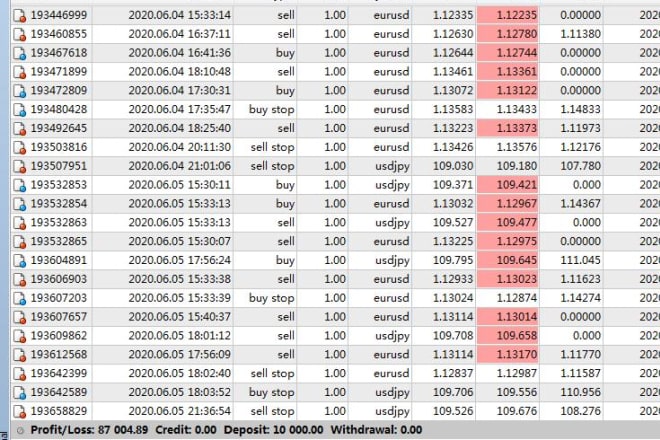

I will send you my 8 times profit forex expert advisor to earn real money

I will do the best forex account management service

I will develop a bot to buy the new ps5 and xbox xs on bestbuy

I will creative wristband for all

I will draw for metal, punk, rock, or hardcore band with my style

I will draw dark art, sad, horror pointillism for extreme band

I will design a powerfull emblem for your metal band

I will create the greatest album cover or band logo

I will give you eurusd breakout robot,ea