Bookkeeping for amazon sellers services

As an Amazon seller, you are responsible for keeping accurate records of your sales and expenses. This can be a daunting task, especially if you are new to online selling. Luckily, there are bookkeeping services that can help you keep track of your finances. Bookkeeping services can help you track your sales, expenses, and inventory. They can also help you create financial reports, such as profit and loss statements. This can be a valuable tool for Amazon sellers, as it can help you track your progress and make informed decisions about your business. If you are an Amazon seller, consider using a bookkeeping service to help you stay organized and on top of your finances.

There are many bookkeeping for Amazon sellers services available. Some of these services include QuickBooks, Xero, and Wave. Each service has its own set of features and benefits. QuickBooks is one of the most popular bookkeeping services available and offers a wide range of features. Xero is another popular service that offers a more streamlined approach to bookkeeping. Wave is a newer service that offers a free option for those who are just starting out with their business.

There are many bookkeeping for Amazon sellers services available. Each has its own strengths and weaknesses. Finding the right one depends on the size and needs of your business. The most important thing is to find a bookkeeping service that can save you time and money. A good bookkeeping service will help you keep track of your sales and expenses, so you can focus on running your business.

Top services about Bookkeeping for amazon sellers

I will assist amazon bookkeeping in quickbooks, xero, wave

I will provide a to z amazon pl virtual assistant services

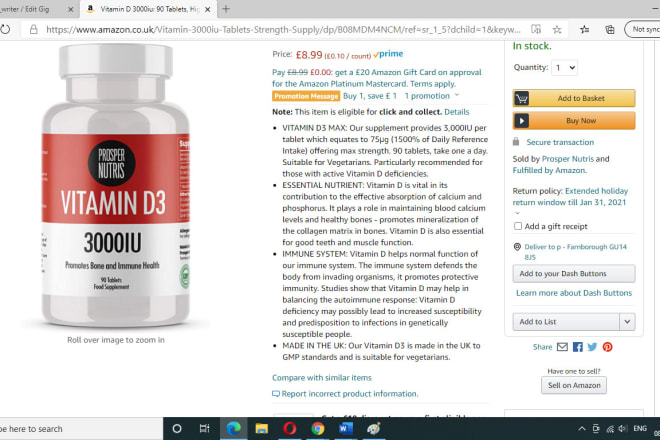

I will provide bookkeeping service to amazon UK and eu seller

I will provide bookkeeping for your amazon, ebay, or shopify business

I will provide US CPA services for bookkeeping for amazon sellers and startups

I will do bookkeeping of amazon sellers and online stores

I will do bookkeeping for ecommerce amazon fba, ebay, shopify

I will do your amazon accounting and bookkeeping, tax calculations and data entry

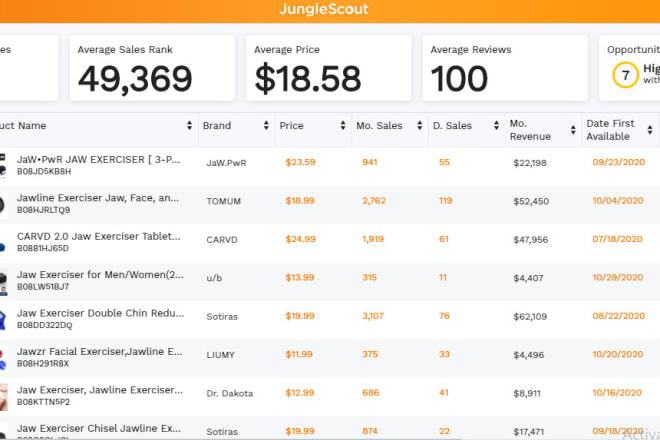

I will find a profitable amazon fba pl product for you

I will do a2x quickbooks bookkeeping for amazon fba online store

I will do product research for amazon fba, fba amazon product research

I will do accounting and bookkeeping for amazon

I will be your amazon fba seller consultant

I will do amazon and ebay accounting and bookkeeping