Coffee shop business plan financials services

In order to open a coffee shop, business owners need to create a comprehensive business plan that outlines the financials of their proposed venture. This article provides an overview of the financial planning and analysis that must be completed in order to ascertain the viability of a coffee shop business. It includes a discussion of the start-up costs, expected revenue, and necessary expenses. Additionally, it provides a brief overview of the financial services that are typically required for coffee shop businesses, such as accounting and bookkeeping.

There is no one-size-fits-all answer to this question, as the financial needs of coffee shop businesses vary greatly depending on the size and scope of the operation. However, some common financial services that coffee shops may require include business banking, merchant services, and funding.

Assuming the coffee shop in question is a small, local business, the financials services required to get the business up and running are not particularly complicated or expensive. The most important thing is to make sure that the shop has enough capital to cover start-up costs and to sustain itself during the early months when revenue is likely to be low. Beyond that, the coffee shop will need to keep track of its income and expenses in order to make informed decisions about pricing, marketing, and other aspects of the business. There are a number of software programs and online services that can help with this, and many accounting firms offer affordable small business packages that include bookkeeping and tax services. By carefully planning and monitoring its finances, the coffee shop can increase its chances of success.

Top services about Coffee shop business plan financials

I will do social media marketing of your business

I will give you 450k spain b2b database with business information

I will design food, cafe, coffee shop, and restaurant logo with source file

I will deliver a coffee shop business plan

I will create a restaurant, cafe, coffee shop business plan

I will give you my coffee shop business plan

I will send a coffee shop startup business plan template

I will write a coffee shop business plan

I will deliver a coffee shop business plan template

To find out who we are and what we provide view this video: https://youtu.be/NZTNA8nvRuM

See all the pages of the business plan here: https://www.youtube.com/playlist?list=PLTN9-n8N4WmJF9yg0rAhAnNuaWM8RBupV

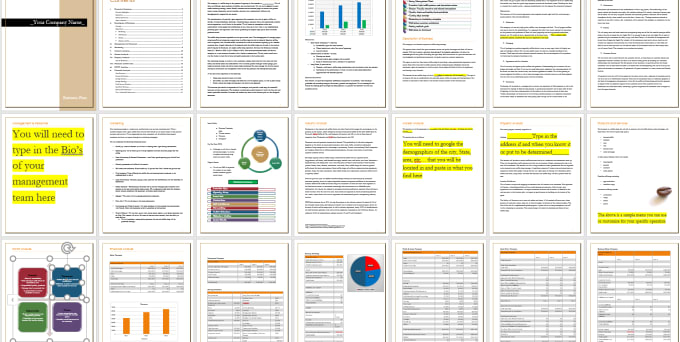

This easy to use business plan template comes with a lot of well written example content and a full sample financial model. You can use the existing content for your business and just add your company name, management team, and a few other specifics for your operation and you will have an investor / lender ready business plan to start a coffee shop, or you can use it as a base to customize for your coffee Shop business plan.

Extended Video below in FAQ's

See the PDF attached to the gig next to the pictures for details on the document and how it is used.

Extras for this gig include an Excel worksheet with cell formulas for the financials which make for an easy customization.

A PowerPoint Pitch Deck which allows a quick yet professional presentation of the company.

This business plan gives you a strong template to get your own coffee house up and running.

I will sell this coffee shop logo

I will create financials for your business plan

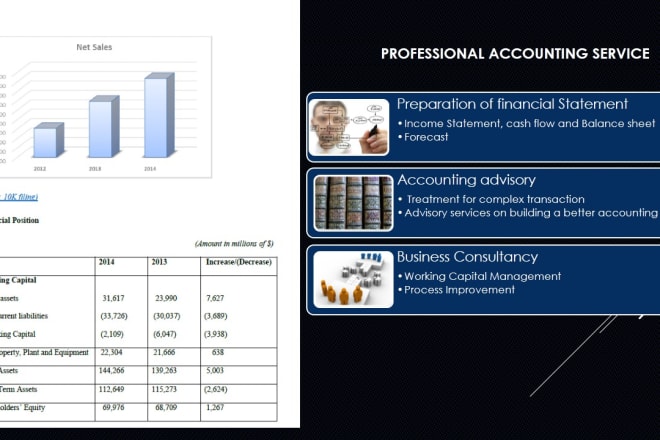

Creating financials for the start-up is one of the most important task in the business plan writing process and it requires a lot of experience and attention to create accurate and reliable financials. I have a wealth of experience in writing business plans and have written over 20 of them for various clients both in the UK and overseas – 5 countries in all (helping to raise finance between £30,000 and £5 million).

IT INCLUDES

- Start-up expenses forecast

- Personal plan forecast

- Profit and loss statement.

- Cash flow statement

- Balance sheet,

- Break even analysis

- Appendix

I will prepare financial statement for business plan