Cpa plan services

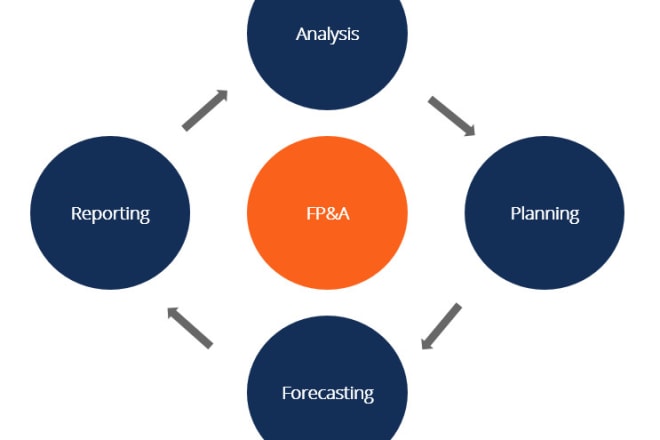

As a Certified Public Accountant (CPA), you provide critical financial planning and analysis services to clients. Your work helps businesses make informed decisions about how to allocate resources, manage risks, and grow their operations. To be successful in this role, you must be able to understand and interpret financial data, identify trends, and develop recommendations based on your findings. You also need to be able to effectively communicate your findings to clients and other stakeholders. This involves more than simply presenting numbers and charts; you must be able to explain the meaning of the data and how it can be used to make decisions about the future. The CPA Plan Services articles below will help you hone your skills in financial analysis and communication. You'll find tips on how to select and use financial data, as well as how to present your findings in a clear and concise manner. You'll also find guidance on how to manage client expectations and build strong working relationships.

There are a few different types of CPA plan services, but they all generally involve helping businesses with their finances and tax planning. This can include anything from helping them choose the right financial products and services to helping them file their taxes.

Overall, CPA plan services can be a great way to help you save money and time on your taxes. However, it is important to do your research to make sure you are getting the best possible service for your needs. There are a lot of different providers out there, so it is important to compare and contrast their services to find the one that is right for you.

Top services about Cpa plan

I will be your CPA, tax planner, accountant and consultant

I will provide US CPA service for financial plan, financial modelling and business plan

I will build a CPA landing page with marketing plan

I will be your cpa, do individual business tax planning consulting

I will give you a home your dreams

I will write startup business plan

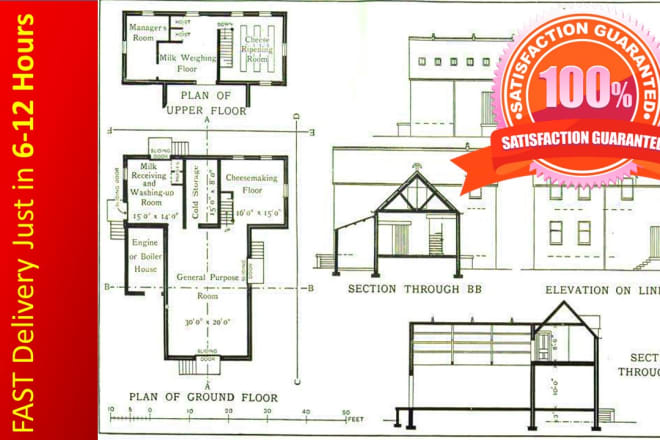

I will design floor plan of your home, house from your sketches

I will build a custom calisthenics home workout plan

I will render architectural site plan, master plan, floor plan, elevation, only 24hours

I will write a business plan for loan approval, financial plan, startups business plan

Do you know why most businesses fail?

No solid business plan, financial plan and marketing plan.

I will draw 3d floor plan from your 2d floor plan convert to 3d floor plan

I will draw blueprints sections in autocad for 2d floor plan elevation

I will develop awesome mlm website

I will do a perfect business plan for you

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.