Creating a balance sheet for a small business services

As a small business owner, you may not think you need a balance sheet. After all, isn’t that something only big businesses have? But even if your business is small, a balance sheet can be a helpful tool. It can give you a quick snapshot of your business’s financial health and can be helpful when you’re applying for loans or seeking investors. A balance sheet lists your assets, which are everything your business owns, and your liabilities, which are everything your business owes. Your assets are listed first, followed by your liabilities. The difference between your assets and your liabilities is your equity, which is also sometimes called your net worth. If you’re not sure how to create a balance sheet for your business, don’t worry. This article will walk you through the process step-by-step.

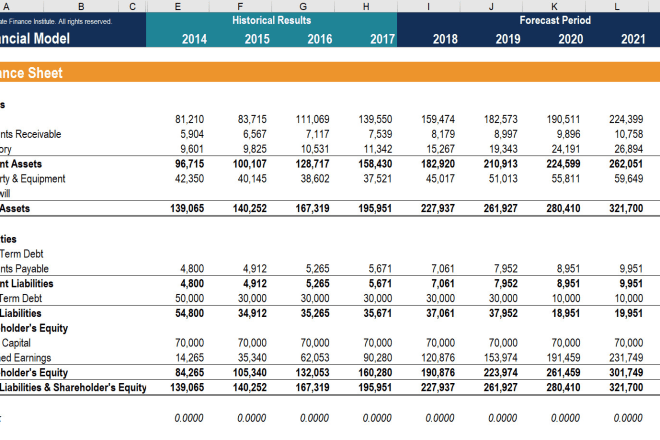

Assuming you would like tips for creating a balance sheet: 1. Know your purpose. A balance sheet is a snapshot of your company's financial health at a given point in time. It can be used to give creditors and investors an idea of your company's solvency, or to provide a detailed picture of your company's assets, liabilities, and shareholders' equity for financial reporting purposes. 2. Determine your format. The balance sheet can be presented in one of two formats: the account format or the report format. The account format lists assets and liabilities in separate sections with the equity section appearing last. The report format, on the other hand, combines all three sections into one. 3. Gather your data. In order to create a balance sheet, you will need to gather data on your company's assets, liabilities, and shareholders' equity. This information can be found in your company's financial statements, such as the income statement and the statement of cash flows. 4. Calculate your totals. Once you have all of the relevant data, you can begin calculating your totals. For assets, you will need to calculate the total value of all your company's assets. This can be done by adding up the values of your cash, inventory, accounts receivable, and other assets. For liabilities, you will need to calculate the total value of all your company's liabilities. This can be done by adding up the values of your accounts payable, loans, and other liabilities. Lastly, for shareholders' equity, you will need to calculate the total value of all your company's shareholders' equity. This can be done by adding up the values of your common stock, retained earnings, and other equity. 5. Format your balance sheet. Once you have calculated your totals, you can begin formatting your balance sheet. The account format and the report format are the two most common ways to format a balance sheet. If you are using the account format, you will need to list your assets in one section, your liabilities in another section, and your equity in a third section. If you are using the report format, you can combine all three sections into one. 6. Review your balance sheet. Once you have created your balance sheet, it is important to review it to make sure that all the information is accurate and up-to-date. This is especially important if you are using the balance sheet to give creditors

After reading this article, you should have a better understanding of how to create a balance sheet for your small business. This is an important step in ensuring the financial health of your business, and it can help you make informed decisions about where to allocate your resources. With a balance sheet in hand, you can more easily assess your business's strengths and weaknesses, and identify opportunities for growth.

Top services about Creating a balance sheet for a small business

I will do financial statements cashflow, pnl, balance sheet

I will create a personal or small business budget

I will do balance sheet, cashflow and financial statements

I will create a financial model for startup and small business

I will write a professional business plan

I will prepare the balance sheet, profit and loss, tax return and bookkeeping

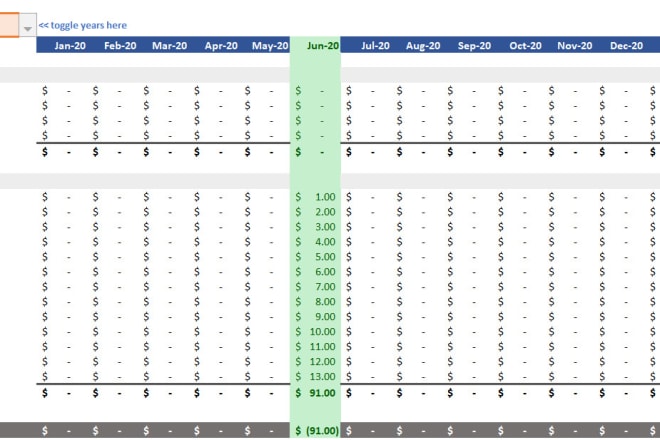

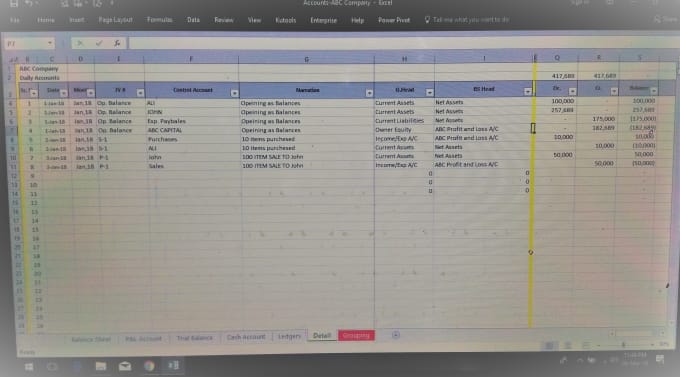

I will prepare excel sheet of accounts for your business

What You Get:-

1. you can view Vendor/Party wise ledgers.

2. You can get Daily sale/Purchase Reports.

3. You Can Get Trial balance.

4. you Can Get Daily/Monthly/yearly P&L Account.

5. You Get balance Sheet Of Your Business. Any time

6. Any Additional Report or chart as per requirement.

I will we create a tailored comprehensive business plan

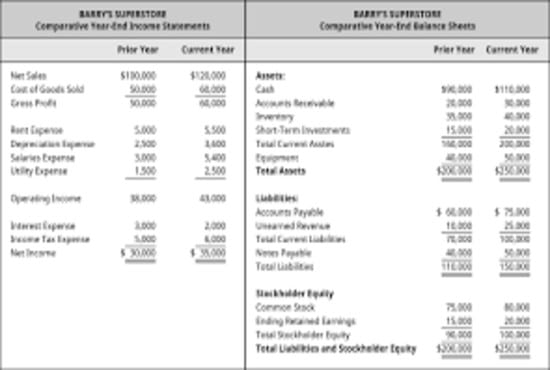

I will prepare financial analysis which consist financial statements Balance sheet and Profit and Loss statement for the operation of your business

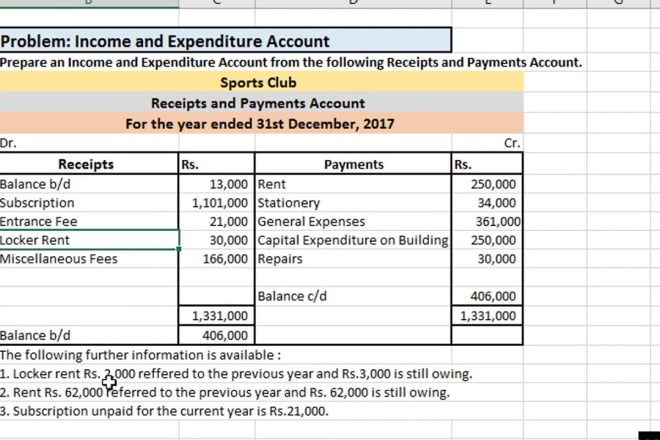

I will prepare income and expenditure account, balance sheet

I will do balance sheet and account statement analysis

I will prepare balance sheet profit and loss

I will do income statement balance sheet pay stubs

I will do financial statements balance sheet income statement

I will prepare profit and loss account and balance sheet

Thank you.