Credit business cards services

In the United States, a credit business card is a type of credit card that is issued by a financial institution to business owners and corporate employees. Business credit cards are different from personal credit cards in a number of ways, including the type of rewards and perks that they offer. Business credit cards can be a valuable tool for small business owners and corporate employees. They can help business owners manage their expenses and can provide employees with a convenient way to make purchases on behalf of their employer. However, business credit cards also come with some risks. For example, if a business owner does not manage their account carefully, they may end up with a high balance that they will struggle to pay off. When used responsibly, business credit cards can be a valuable asset for business owners and employees. When choosing a business credit card, it is important to compare different offers and to select the card that best meets the needs of your business.

There are many different credit business cards services available. Some offer cash back or rewards points for using their card, while others offer lower interest rates. It is important to compare different credit business cards services before choosing one to ensure you are getting the best deal.

Based on the information provided in the article, it seems that credit business cards services can be a great way to help manage your finances and credit score. However, it is important to be aware of the potential fees and charges that may be associated with these services. Overall, credit business cards services can be a helpful tool if used correctly.

Top services about Credit business cards

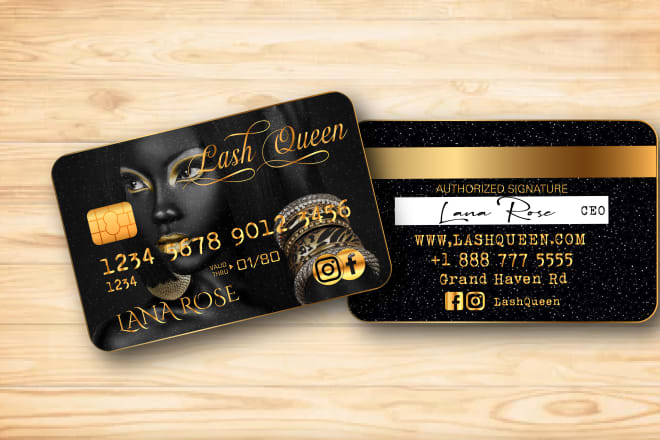

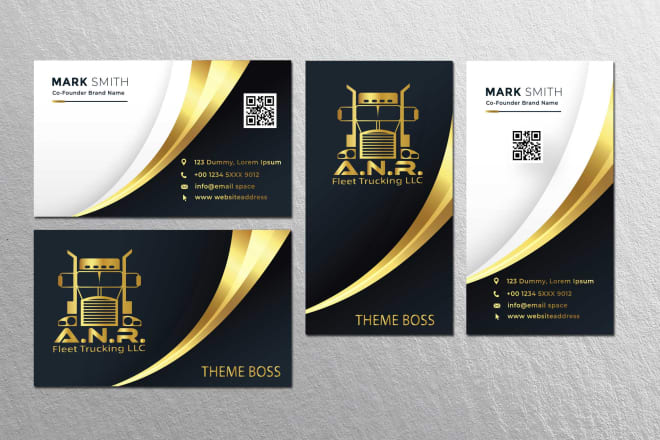

I will design credit card style business cards, flyer and pricelist

I will do credit card design, business card design and other cards

I will design credit card style business card for credit repair business

I will credit card style business cards

I will design credit card, debit card style business cards

I will design business card debit and credit card for your business

I will design credit card, debit or business cards

I will make credit card, visa or business card design

I will do credit card design for your credit repair business

I will be your business card designer credit and debit card, designer

I will professional excellent business card designer,

I will do credit card, business card design

I will show you hidden secrets to get best credit cards

This is one of the best e-books on credit available here on the platform.

Also I have a list of "hidden" credit bureaus that are used to determine how much you pay for car, health and house insurance. These are called "specialty" bureaus and you should access these files at least once a year just as you do from the big three.

Finally, If you want to learn how to boost your file by adding positive credit to without having to get an expensive authorized user tradeline then get the bible on adding positive credit to any personal or business credit report. If you have a thin business or personal credit file, this e-book shows you what to do step-by-step to boost your info in days

Don't Delay, order Right Away!!!

I will make invitation cards, credit cards designs