Event study stata services

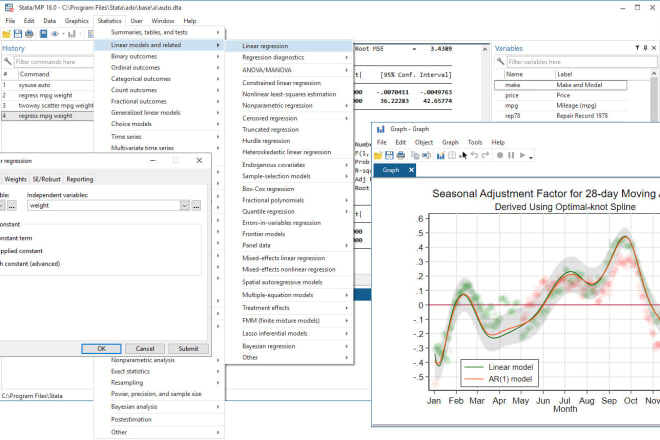

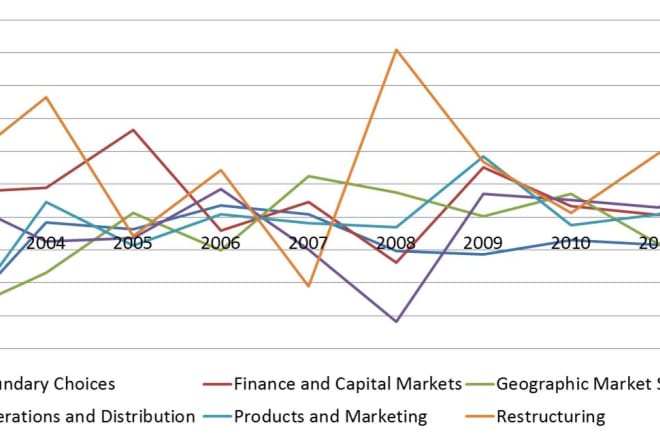

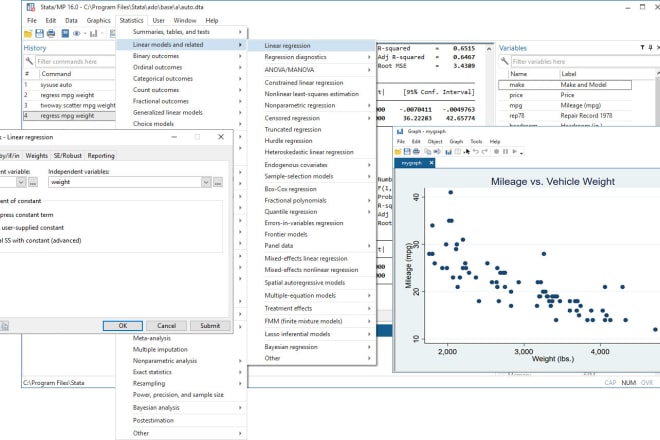

In academic research, an event study is a statistical method used to study the effects of an event on the prices of publicly traded assets. Event studies have become increasingly popular in recent years, as they allow researchers to measure the economic impact of events such as natural disasters, terrorist attacks, and policy changes. The event study methodology was first developed in the early 1970s, and has since been used in a wide variety of fields, including finance, economics, marketing, and political science. Event studies are typically conducted using statistical software such as STATA, which allows researchers to control for a variety of factors that could potentially affect asset prices. In this article, we will provide an overview of the event study methodology, and discuss how it can be used to measure the economic impact of events. We will also provide a step-by-step guide on how to conduct an event study using STATA.

There is not much information available on "event study stata services." However, it appears that this is a statistical software service that can be used to analyze data from events.

Overall, the event study stata services provided by different companies are quite similar. The main difference lies in the price and the quality of the services. It is important to choose a company that offers good quality services at a reasonable price.

Top services about Event study stata

I will do econometric analysis for you using stata

I will carry out data analysis with eview, stata, spss, amos, nvivo

I will do statistical data analysis using spss stata excel eviews

I will do data science, machine learning and visualization task

I will solve your stata issue on your PC

I will help with your Event Study

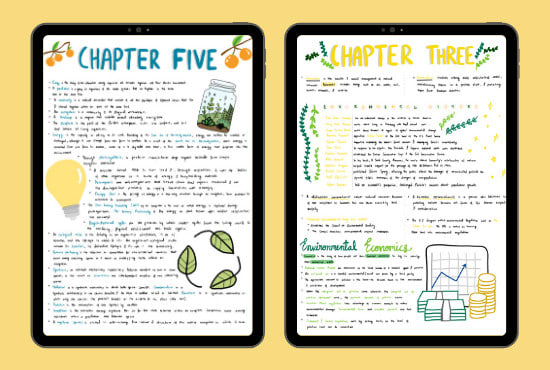

I will make study guides and notes to help you get better grades

I will data analysis using stata and spss

I will help you pass the series 65 exam to become a certified financial advisor

I will write you amazing and helpful study notes for any class

We all known how important study notes are and how much it can make your studying easier. So I'm here to help you with that. I'm currently at my final year of law school, so I have a lot of experience with study notes.

For 5$ I will write you quality notes for a text that's up to 5 pages long.

All you need to do is to send me the chapter you need to study and I will send you the finished product in Word or PDF file within 2 days.

If you need study notes for a longer text,you can choose one of my gig extras.

Please contact me before ordering to avoid any misunderstanding.

Thank you and have a great day!

I will handwrite comprehensive and aesthetic notes for you

I will assist in case study analysis, evaluation, discussion