Expert adviser services

In recent years, the popularity of expert adviser services has exploded. This is likely due, in part, to the growth of the internet and online trading platforms. Expert advisers can provide a valuable service to traders and investors, offering insights and analysis that can help them make informed decisions. There are a number of different types of expert adviser services available, and it can be helpful to understand the different offerings before selecting one. Some expert advisers focus on a specific asset class or market, while others provide more general advice. Additionally, some expert advisers charge a fee for their services, while others are free. Selecting an expert adviser is an important decision, and it is important to consider a number of factors before making a choice. It is advisable to research a number of different expert advisers before selecting one, and to consider factors such as experience, fees, and focus. With the right expert adviser, traders and investors can gain a valuable edge in the market.

Expert advisers provide services to clients that need expert advice on a particular subject. The expert adviser will assess the situation and then offer their services to the client. The expert adviser may also offer their services to other clients in the future.

Overall, expert adviser services can be quite helpful in terms of providing objective and unbiased opinions on financial matters. However, it is important to remember that these services are not foolproof and that it is still possible to lose money even with the help of an expert. Therefore, it is important to always do your own research and to not blindly rely on the advice of others, no matter how qualified they may be.

Top services about Expert adviser

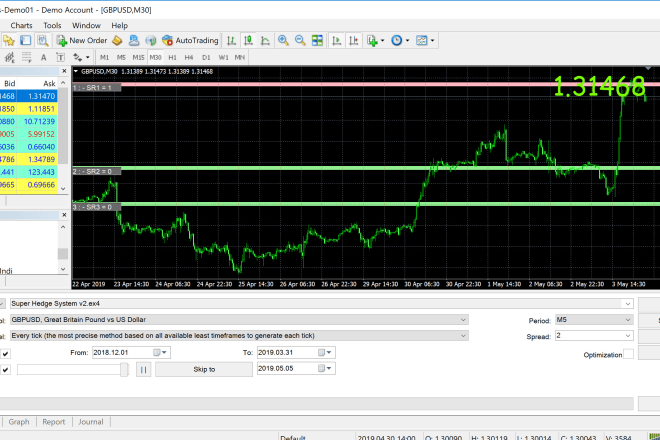

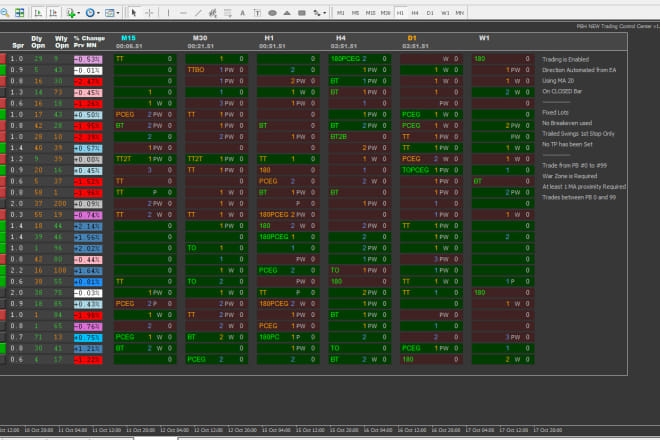

I will code a metatrader 4 mt4 indicator or expert advisor

I will mt4,mt5 coding service expert advisor indicators programmer

I will create mt4, mt5 expert advisors and custom indicators

I will code an expert advisor or indicator for mt4 mt5

I will code a metatrader 4 mt4 indicator or expert advisor forex robot ea

I will create your expert advisor

I will give you my expert advisor for consistent monthly profit

I will code mt4 expert advisor for your day trading strategy mq4

I will profitable forex expert adviser ea

I will give you best profitable forex expert adviser pro ea

I will be your personal relationship adviser

I will be your personal adviser

I take great pleasure in helping others feel better. I feel accomplished when I am able to assist in making even one person feel better about him/herself or a situation.

Confidentially is utmost. Anxiously awaiting to assist you!!!

Service above self

I will create your idea expert adviser for forex and binary

I will be your iranian adviser and assistant

I will program mql4 mql5 ea or indicator for you

I will be your relationship adviser and healer

I will be a good listener and a life adviser