Financial forecast services

Forecasting is a critical component of effective financial decision-making. The goal of financial forecasting is to estimate future financial outcomes, typically for a business or individual, and to develop a plan that will optimize those outcomes. Most businesses produce some kind of internal forecast, whether it’s a simple projection of sales revenue or a more sophisticated financial model. But many organizations also rely on outside firms to supplement their own forecasting efforts. There are a number of reasons why businesses might turn to financial forecast services. They may lack the in-house expertise to produce their own forecasts. They may not have the time or resources to dedicate to the forecasting process. Or they may simply want an independent, objective opinion on their financial prospects. Whatever the reason, there is no shortage of firms offering financial forecasting services. These services can range from simple projections of future revenue to complex financial models that take into account a wide range of factors. When choosing a financial forecast service, it’s important to consider the firm’s track record and its ability to meet your specific needs. You should also make sure that the firm has a good understanding of your business and its financial situation. The right financial forecast service can provide valuable insights that can help your business make better, more informed decisions about its future.

There are a variety of financial forecast services available that can help individuals and businesses make informed decisions about their finances. These services can provide insights into future trends, helping users to make more informed choices about investments, spending, and saving. Financial forecast services can also help users identify opportunities and risks associated with specific financial decisions.

In conclusion, financial forecast services can be a great tool for businesses and individuals alike. They can help you plan for the future and make better financial decisions. However, it is important to remember that these services are not perfect. They are based on models and assumptions, so there is always some uncertainty involved. But if you use them wisely, they can be a valuable asset in your financial planning.

Top services about Financial forecast

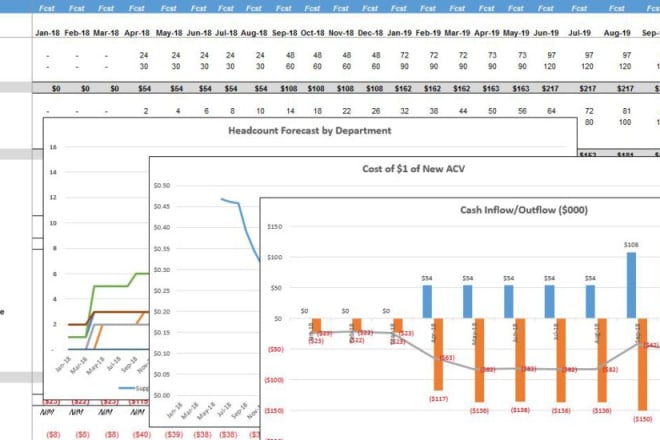

I will do financial forecasting, projection and modeling

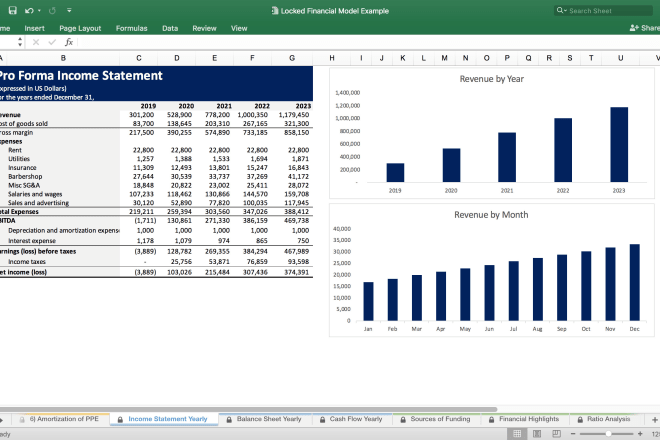

I will do excel report, financial forecast, financial modeling, assignment, accounting

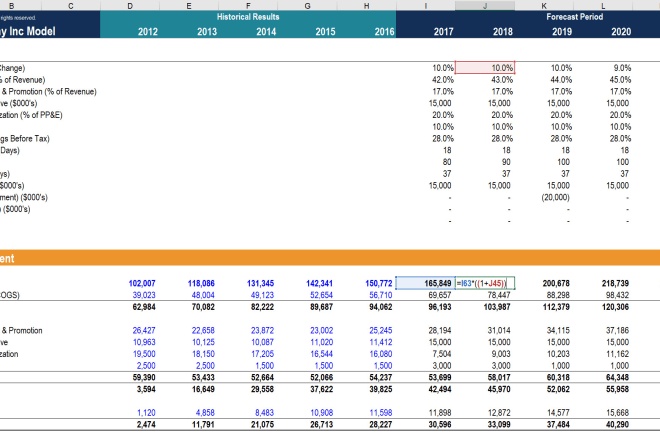

I will build excel financial model, forecasts,budget, business plan

I will prepare a financial forecast, projection or plan

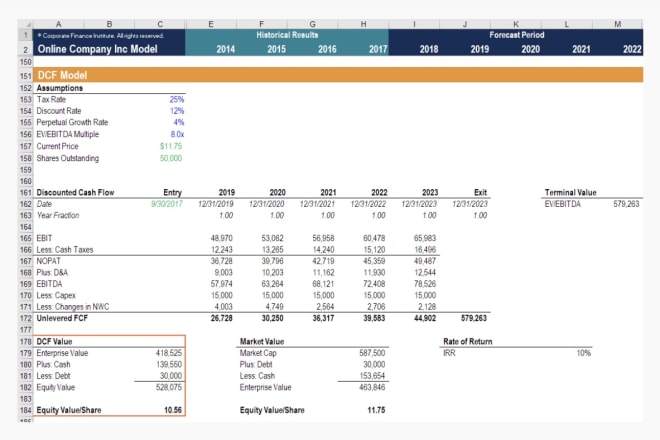

I will prepare financial model, financial plan, business plan

I will create investors financial plan, model, and forecast

I will prepare business plans, proposals and financial projections

I will create financial forecasts for startups business plan and loan approvals

I will create a 5 year financial projection

I will do financial modelling, projections and valuation

I will develop a 3 to 5 year business plan and financial forecast

I will do financial analysis for you