Financial forecast business plan services

Forecasting is a critical component of effective financial planning for businesses of all sizes. Whether you are developing a business plan or evaluating your company's current financial health, accurate forecasting can help you make sound decisions about where to allocate resources and how to plan for future growth. There are a number of different forecasting methods that can be used, and the best approach for your business will depend on a number of factors, including the type of business, the size of the company, and the data available. However, there are some general principles that all businesses should keep in mind when creating a forecast. The first step is to identify the key drivers of your business's financial performance. This can be sales volume, production costs, or any other metric that has a significant impact on your bottom line. Once you have identified the key drivers, you can begin to develop hypotheses about how these drivers will change in the future. Next, you will need to gather data to support your hypotheses. This data can come from a variety of sources, including financial reports, surveys, industry data, and company data. Once you have collected this data, you can begin to develop your forecast. There are a number of different ways to develop a forecast, but one of the most common approaches is to create a spreadsheet model. This type of model can be used to simulate different scenarios and test different assumptions. Once you have developed a model that you are confident in, you can begin to use it to make decisions about your business. If you are not comfortable developing your own forecast, there are a number of professional financial forecast services that can provide you with the tools and expertise you need. These services can help you develop a forecast that is tailored to your specific business and can provide you with the support you need to make sound financial decisions.

There are many financial forecast business plan services available that can help you create a detailed and accurate forecast for your business. This can be a valuable tool in helping you to make sound financial decisions and to plan for the future. A good service will take into account your business's history, current financial situation, and your goals for the future. They will then create a customized plan that will help you to reach your financial goals.

There are a number of financial forecast business plan services available to business owners and entrepreneurs. These services can provide valuable insights and guidance when it comes to developing and implementing a business plan. When selecting a financial forecast business plan service, it is important to consider the specific needs of your business and choose a provider that can offer customized solutions.

Top services about Financial forecast business plan

I will prepare financial plan, model, forecast and analysis

I will create investor ready financial plan forecast and projection

I will prepare an outstanding business plan along financial projections and forecast

I will create a financial plan, model, and forecast for you

I will prepare business plan, research tailor marketing strategy, or financial forecast

I will create a financial model, plan, forecast

I will prepare a business plan, financial forecast, projection or analysis

I will prepare financial model, financial plan, business plan

I will create financial forecasts for startups business plan and loan approvals

I will do a complete business plan with financial

1. Complete business plan write-up.

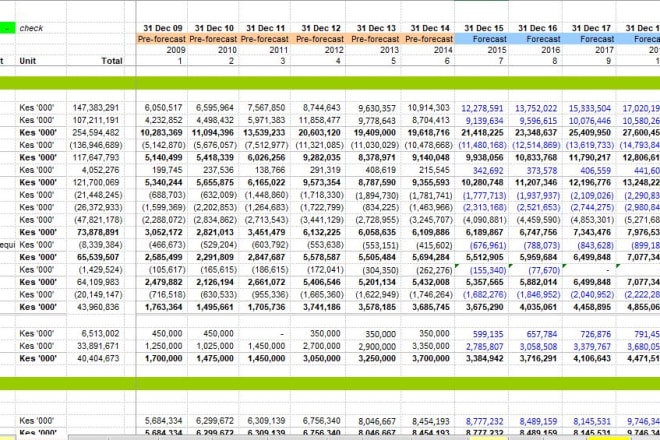

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.

I will create a professional startup business model plan with a forecast financial plan

I will write rfp,forecast,sba,marketing strategy,app business plans

I will write a premium business plan

Have you heard this before?

90% of businesses fail due to poor planning.

Do not let your business to go there.

I will write you Detailed Professional Business Plan

Your Plan will consist of ALL the MAIN FEATURES of a Unique Complete Professional Business Plan

- Executive Summary

- Mission Statement

- Vision

- Keys to Success

- Legal and Ownership

- Business Outline

- Products and Services

- Strategic and Implementation Plan ( Marketing Plan with 6 sub sections)

- Organizational and Management Plan

- Development Plan

- Financial Forecast

The Premium Plan includes almost 8 main sections, 30+ sub headings and overall 30+ pages in total.

It consists of a Web Related Market Research and Financial Forecast as well.

Let Us be a part of your business success...!

I will get this done for you.

I will do a perfect business plan for you

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.

I will write an investor business plan,forecast and analyze data

I will do a detailed business plan

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery