Financial forecasting for startups services

Forecasting is a critical tool for startups services, as it can help them to make sound financial decisions and plan for the future. Financial forecasting involves predicting future revenue and expenditure, and is used to assess a company's financial health and viability. There are a number of different methods that can be used for financial forecasting, and the most appropriate method will depend on the data and information available. However, some of the most common methods include trend analysis, regression analysis, and Monte Carlo simulation. Trend analysis is a relatively simple method of financial forecasting which involves extrapolating past data to predict future trends. This method can be used when there is a reasonable amount of historical data available. Regression analysis is a more sophisticated approach which uses historical data to identify relationships between different variables. This information is then used to predict future trends. Monte Carlo simulation is a statistical approach which involves generating multiple possible outcomes based on random variables. This method is often used to forecast uncertain or volatile situations. Whichever method is used, financial forecasting is an important tool that can help startups services to make informed decisions about the future.

There is no one-size-fits-all answer to this question, as the financial forecasting needs of startups vary greatly depending on the products or services they offer, the stage of their business, and the specific goals and objectives of the founders. However, there are some general tips that can be useful for startups when it comes to financial forecasting. One of the most important things to keep in mind when forecasting for a startup is that the future is inherently uncertain. This means that your forecast should be based on a range of possible outcomes, rather than a single point estimate. You should also build in flexibility into your forecast, so that you can easily adjust it as new information arises. Another key tip is to focus on the drivers of your business's financial performance. For example, if you're a startup that sells a product, you'll want to focus on factors such as unit sales, pricing, and cost of goods sold. By understanding the drivers of your business, you can create a more accurate forecast. Finally, it's important to keep your forecast simple and easy to understand. This will help you communicate it effectively to your team and to investors.

Forecasting is a critical component of financial planning for any business, but it is especially important for startups. A good forecast will help a startup assess its financial needs and make sound decisions about how to allocate its limited resources. There are a number of different approaches to forecasting, but all share the common goal of helping a business plan for the future. The key to successful forecasting is to start with realistic assumptions and then use historical data and trends to develop a realistic picture of the future.

Top services about Financial forecasting for startups

I will write a perfect business plan for startups

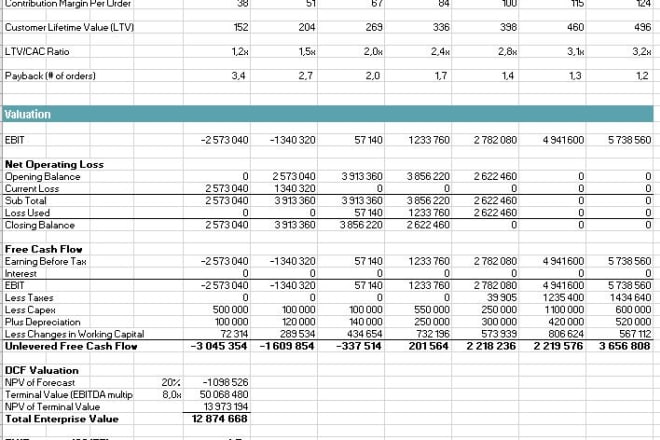

I will do financial forecasting, budgeting and valuations for ecommerce and startups

I will create financial forecasts for startups business plan and loan approvals

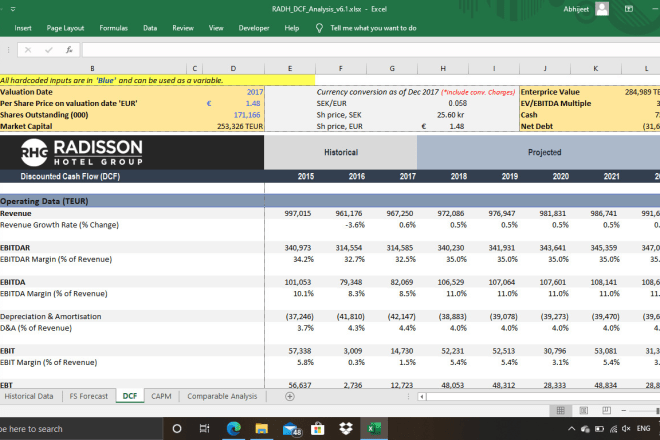

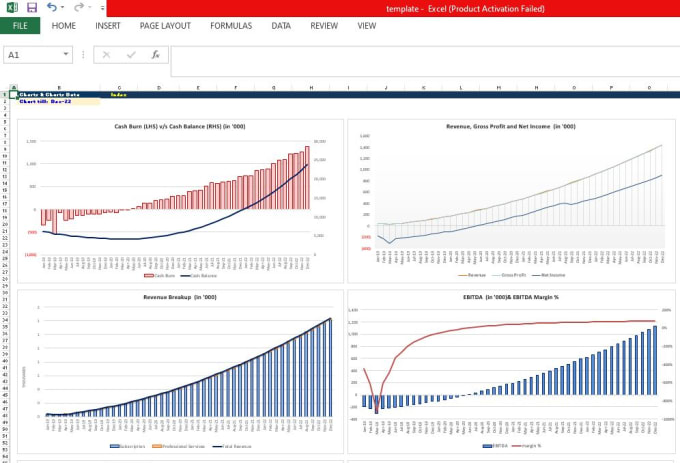

I will create financial models, forecasting and analysis

I will write a startup business plan

I will help to solve financial and cost accounting assignment

I will do financial forecasting, projection and modeling

I will provide financial analysis, project report, ratio analysis

Will help you in:

- Horizontal and Vertical analysis of financial statements

- Financial Projections / Forecasting, Ratio Analysis

- Preparation of financial statements

- Project report and forecasting for fundraising

- DuPont analysis

- Discounted Cash Flow (DCF) Mode

- Liquidity ratios

- Profitability ratios

- Activity ratios

- Financial leverage ratios

WHY ME????????

I have more than 9 years’ experience in accounts and finance industry. I worked in financial content departments of multinational companies. I am ACCA and also did MBA-Finance.

I have also practical experience of Stock trading so can also help you in this field.

I will also love to help students in their studies.

Regards,

Zia

I will create investor ready financial forecast,projection or plan

I will be glad to work with you and provide you below services: Please keep in your mind, these financial services are only for small businesses.

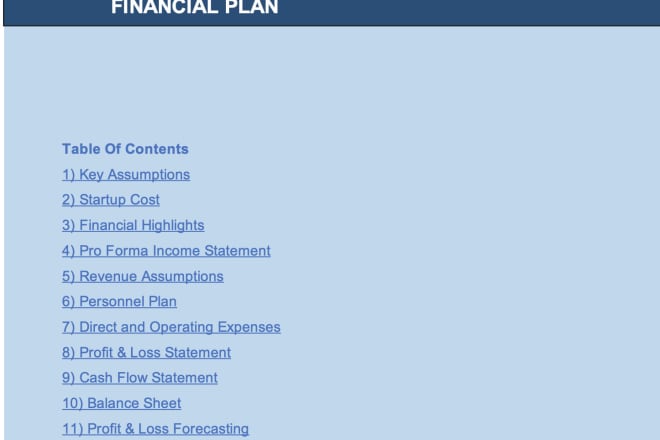

- Customized Financial Plan

1. Forecasting Revenue Model, Sales run rate and sales growth rate

2. Forecasting Balance Sheet - yearly and monthly

3. Forecasting Profit & Loss Statement - yearly and monthly

4. Forecasting Cash Flow Statement - yearly and monthly

5. Calculating Break-Even

6. Financial ratios and Ratio,s Analysis

7. Estimating Startup Costs, Funding Structure

8. Performance Analysis & Graphs

9. Expense break down

10. Amortization and depreciation schedule

11. Loan amortization schedule

I focus on providing quality work with in the specified deadlines. I can also provide you dedicated services.You should be quite satisfied with your 100% confidentiality while working with me.

So, what are you waiting for? Just inbox me to place your customized order and get the quote and let me help you.

I will do professional financial consulting

I will create a financial plan

I will create a financial model for startup and small business

I will provide financial modeling and consulting services