Financial plan for a business services

Starting a business is a huge undertaking, and one of the most important aspects of ensuring its success is creating a solid financial plan. This financial plan will outline your revenue and expenses, as well as your short- and long-term financial goals. It is important to have a clear understanding of your financial situation before you start a business, so you can make informed decisions about how to grow your company. There are a few key components to a financial plan for a business services company. First, you will need to forecast your revenue and expenses. This will give you a good idea of how much money you will need to bring in each month to cover your costs. It is important to be realistic when forecasting your income and expenses, so you don't end up in a financial bind down the road. Next, you will need to set some financial goals. What are your short-term goals for the business? How much revenue do you want to bring in each month? What are your long-term goals? Do you want to eventually sell the business? These are important questions to answer so you can create a financial plan that will help you achieve your business goals. Finally, you will need to create a budget. This budget should include all of your business expenses, as well as your personal living expenses. It is important to stick to your budget, so you don't overspend and put yourself in a difficult financial situation. A financial plan for a business services company can seem like a daunting task, but it is an essential part of ensuring the success of your business. By taking the time to forecast your income and expenses, set financial goals, and create a budget, you will put yourself in a much better position to achieve your business goals.

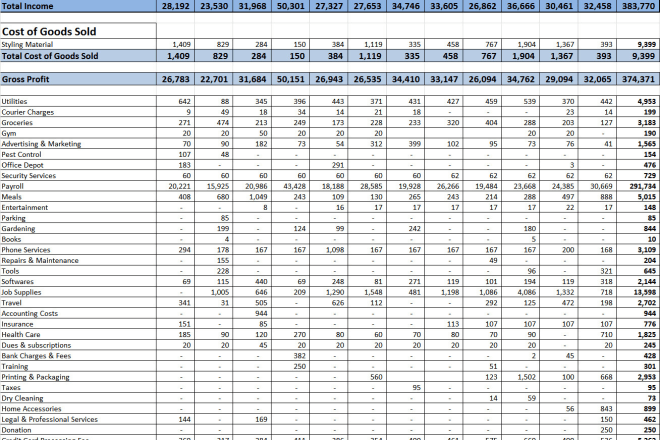

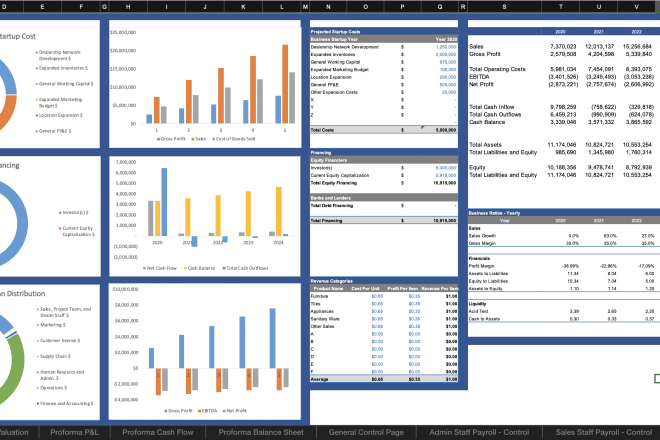

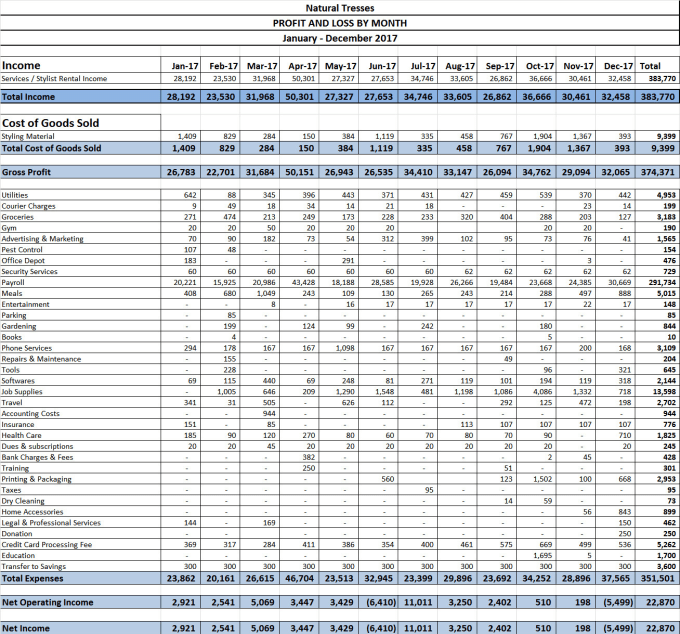

A financial plan for a business services company should include a sales forecast, a profit and loss statement, a balance sheet, and a cash flow statement. The plan should also include a description of the company's products and services, a marketing plan, and a description of the company's competitive advantages.

There are a number of important factors to consider when creating a financial plan for a business services company. First, it is important to accurately estimate the company's revenue and expenses. Next, it is important to create a realistic budget and cash flow forecast. Finally, it is important to monitor the company's financial performance on a regular basis and make adjustments to the plan as needed. By following these steps, you can create a financial plan that will help your business services company thrive.

Top services about Financial plan for a business

I will prepare strategic business and financial plan

I will create startup business plan financial plan, financial model

I will prepare a professional business plan for startups, business plan, financial plan

I will create a startup business plan with a financial model

I will do business plan, financial plan and financial model for startup

I will prepare a business plan, financial forecast, projection or analysis

I will craft a business plan with marketing and financial model

I will send you cbd business plan, pitch deck, financial projection

I will create thc or cbd business plan, pitch deck, financial model, startup, proposal

I will write startup business plan and financial plan

I will do a complete business plan with financial

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.

I will write a business plan for loan approval, financial plan, startups business plan

Do you know why most businesses fail?

No solid business plan, financial plan and marketing plan.

I will prepare financial model, business plan, projections and financial plan

I will develop a detailed business plan,proposal, market research

I will do a perfect business plan for you

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.

I will create startup business plan financial plan, financial model

I Will assist you in Financial Projections /Financial Model/Financial Statements Preparation/ Startup Business Plan/Financial Plan

Hello,

Welcome to an experienced seller with 180+ satisfied clients I have 5 years of professional experience in Accounting,Bookkeeping and Financial statements preparation. I am qualified ACCA

Silver Package

Silver Package for 1 year

I will create a business plan and a business financial model

The financial model on the other hand will show the plan feasibility, the forecast final accounts, ratio analysis and important calculations for making business decisions.