Financial projection in business plan services

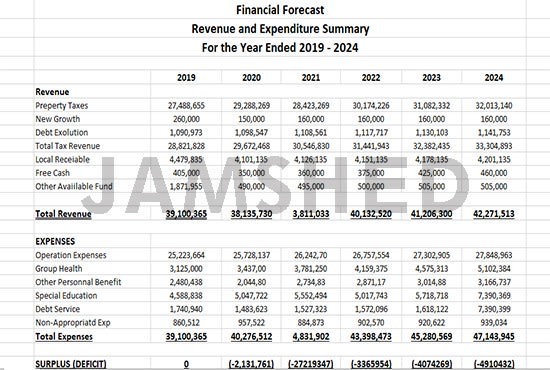

When it comes to financial projection in business plan services, it is important to remember that accuracy is key. This is because your financial projection is what potential investors will use to make decisions about whether or not to invest in your company. As such, you want to make sure that your financial projection accurately reflects your company's current financial situation as well as its potential for growth. There are a few things to keep in mind when creating a financial projection for your business plan. First, you will need to gather accurate financial data for your company. This data can be obtained from your company's financial statements, tax returns, and other financial records. Once you have this data, you will need to create a projection of your company's future revenue and expenses. This projection should be based on your company's current financial situation and its expected growth. After you have created your financial projection, you will need to review it with a professional. This is important to ensure that your projection is accurate and realistic. A professional can also offer helpful insight and advice on how to improve your financial projection. Once you have created an accurate and realistic financial projection, you can use it to secure funding for your business. This projection will show potential investors that your company has a solid plan for growth and is a good investment.

A financial projection is a forecast of a company's future financial performance. It is typically included in a business plan as a way to show potential investors the company's expected revenues, expenses, and profits. Financial projections can also be used to make internal decisions about where to allocate resources and how to plan for future growth.

Overall, financial projection in business plan services can be extremely helpful to small business owners looking to get their business off the ground. By providing clear and concise projections, these services can give business owners a much better idea of what they need to do in order to achieve their financial goals. In addition, these services can also help to identify potential problems early on, which can save a lot of time and money in the long run.

Top services about Financial projection in business plan

I will create investor ready business plan and financial projection

I will create a 5 year financial projection

I will write professional business plan with financial projection, non profit

I will do financial projection for business plan

I will write complete business plan with financial projection

I will do financial projection, finance and financial statements

I will send you thc or cbd business plan, pitch deck, financial projection

I will prepare a business plan, financial forecast, projection or analysis

I will write startup investment or loan business plan

I will do a complete business plan with financial

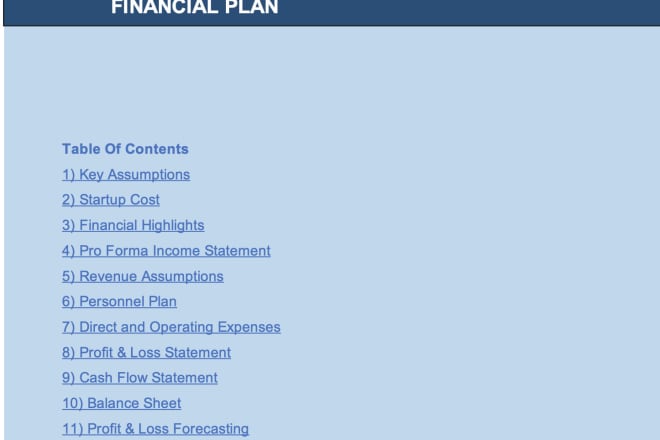

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.

I will create a financial plan

I will send you cbd business plan, pitch deck, financial projection

I will do a perfect business plan for you

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery.

I will prepare a complete business plan, business proposal for startup

I will do a detailed business plan

1. Complete business plan write-up.

2. 3 or 5 years financial forecast.

3. The plan is editable.

4. It is detailed and concise.

5. The plan is simple and easy to understand.

6. The plan includes tables and charts for the financial projection.

7. Fast and reliable delivery