Forex alert system services

In the past, currency trading was something that only big banks and institutional investors could do. But with the advent of the Internet and online forex brokers, anyone can trade currencies. Currency trading is done in the foreign exchange (forex) market. It's the largest and most liquid market in the world, with a daily trading volume of more than $5 trillion. There are many different kinds of currencies, but the most traded are the U.S. dollar, the Japanese yen, the euro, the British pound, and the Swiss franc. There are two basic ways to trade currencies: buying and selling. When you buy a currency, you're betting that it will appreciate in value relative to another currency. For example, if you buy the U.S. dollar against the Japanese yen, you're betting that the dollar will go up in value relative to the yen. If it does, you make money. If it doesn't, you lose money. Of course, currency values fluctuate all the time, so there's always risk involved. But with a well-thought-out forex trading strategy, you can minimize that risk and maximize your chances of making money. One way to do that is to use a forex alert system. A forex alert system is a software program that monitors the market and sends you alerts when certain conditions are met. For example, you can set up an alert to tell you when the U.S. dollar is about to strengthen against the yen. That way, you can get in on the trade early and make some quick profits. There are many different forex alert system services available, so it's important to choose one that's right for you. In this article, we'll take a look at some of the things you should look for in a forex alert system service.

Forex alert system services are designed to notify traders about potential trading opportunities. These services can be used to monitor the market for specific currency pairs or to track the progress of a particular trade. Forex alert systems can be customized to fit the needs of individual traders.

The forex alert system services industry has become increasingly popular in recent years, as more and more investors seek to protect their portfolios from currency fluctuations. These services provide real-time alerts to subscribers, informing them of changes in the currency markets. While there is no guarantee that these services will always be accurate, they can provide valuable information to investors looking to protect their assets.

Top services about Forex alert system

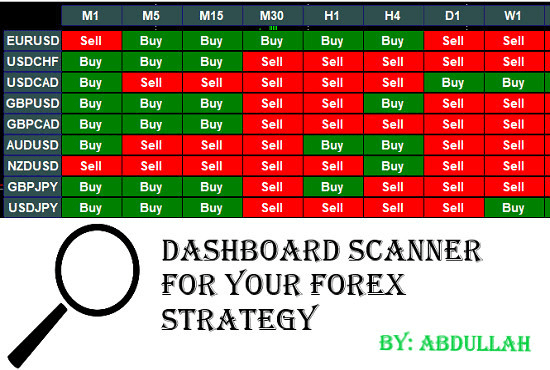

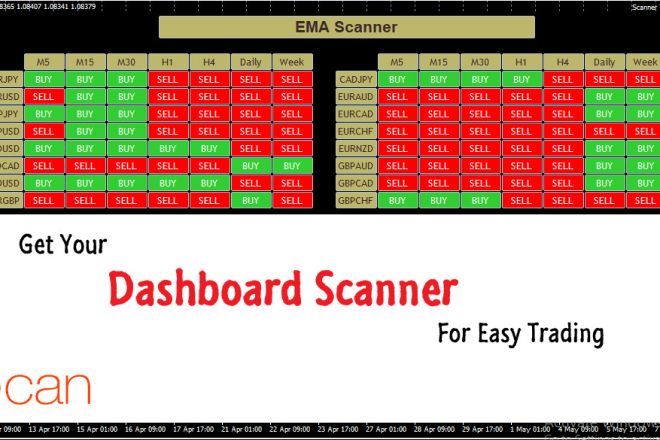

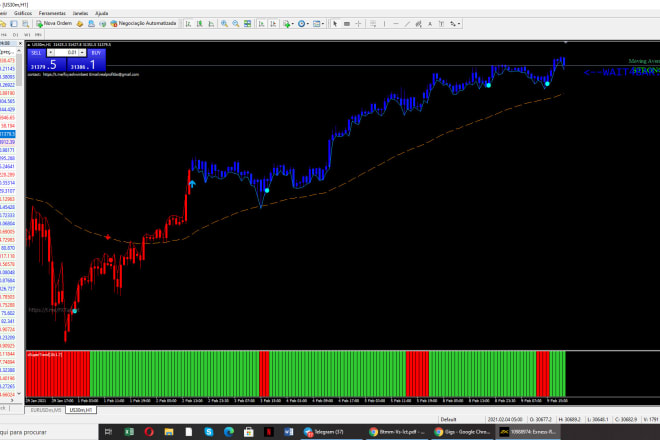

I will convert your indicator or forex strategy into dashboard scanner mt4

I will develop forex dashboards and trading panels

I will code forex mt4 dashboard scanner for any custom indicator

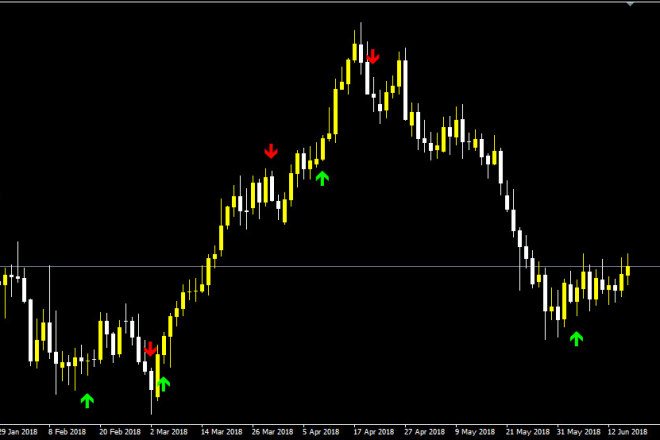

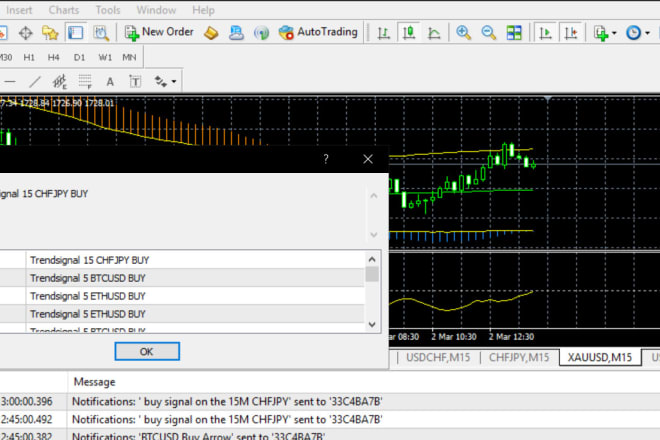

I will create an alert for your arrow signal metatrader 4 indicator

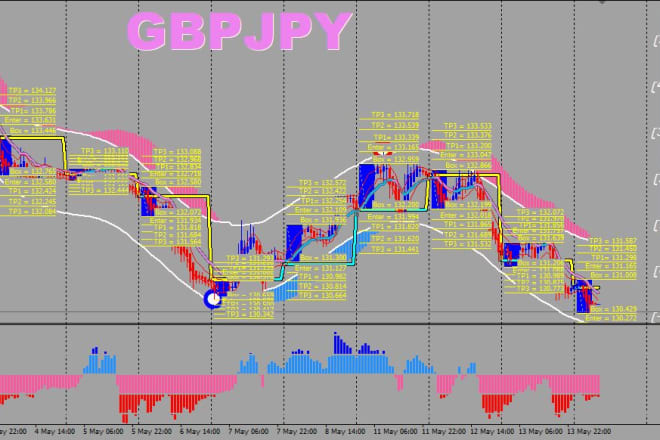

I will code a metatrader 4 mt4 mt5 indicator or expert advisor forex robot ea

I will make forex mt4 indicator and ea

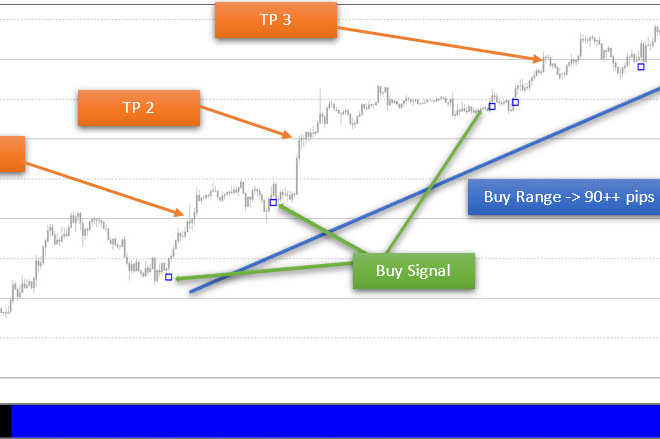

I will build you a trading plan and send forex alerts

I will give the best forex trading system with powerful indicators

I will give you forex trade alert on telegram

I will send you our successful forex scalping trading system

I will provide an forex non repaint system

I will guide you trade forex with real no repaint system

I will add alert to your mt4 or mt5 indicator

I will give you a highly profitable technical forex system

I will do forex account management service

I will grant you higly guaranteed profitable forex trading ea robot