Forex autotrader services

In recent years, the foreign exchange (forex) market has become more accessible to individual investors and traders. This is due in large part to the development of online forex trading platforms and the availability of forex autotrading services. Forex autotrading is a type of trading that uses software to automatically place trades on your behalf. This can be a helpful tool for investors and traders who don't have the time or expertise to trade manually. There are a number of different forex autotrading services available, each with its own unique features and benefits. In this article, we'll take a look at some of the most popular forex autotrading services and discuss their pros and cons.

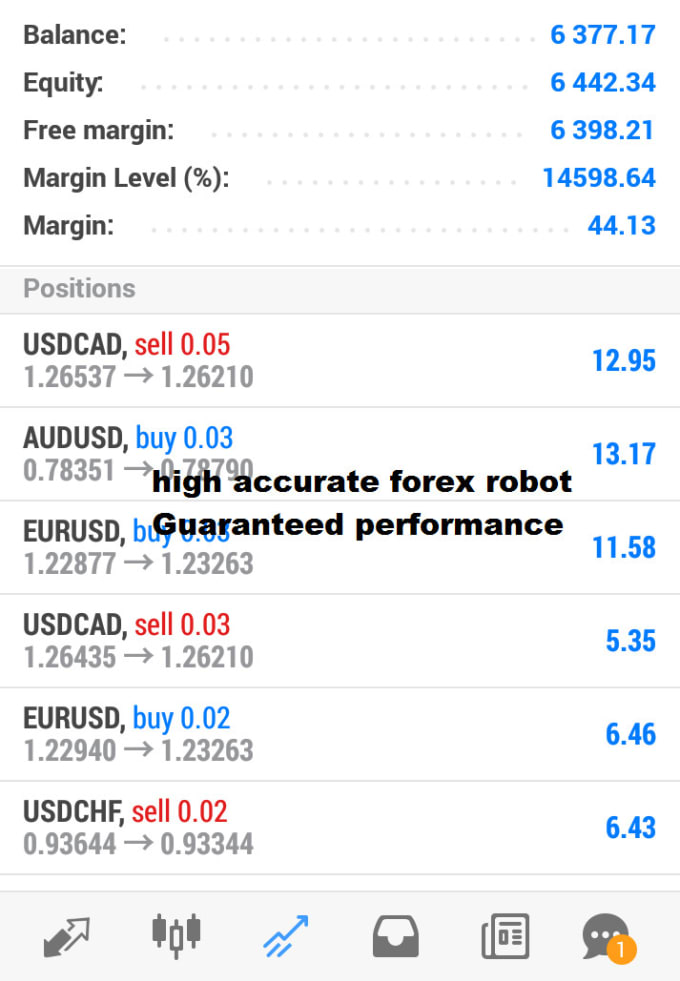

Forex autotrader services are computer programs that automatically trade forex on behalf of their clients. These programs are also known as forex robots or expert advisors. Clients of forex autotrader services can typically set parameters for the program, such as the amount of risk they are willing to take, and the program will then trade accordingly. Many of these programs use complex algorithms to make decisions about when to buy and sell. Forex autotrader services can be a useful tool for traders who do not have the time or expertise to trade forex themselves. However, as with any automated system, there is the potential for loss, so it is important to choose a reputable service and to understand the risks involved.

There are many forex autotrader services available online, and choosing the right one can be difficult. Do your research and read reviews before selecting an autotrader service. Make sure to select a service that has a good track record and is reputable.

Top services about Forex autotrader

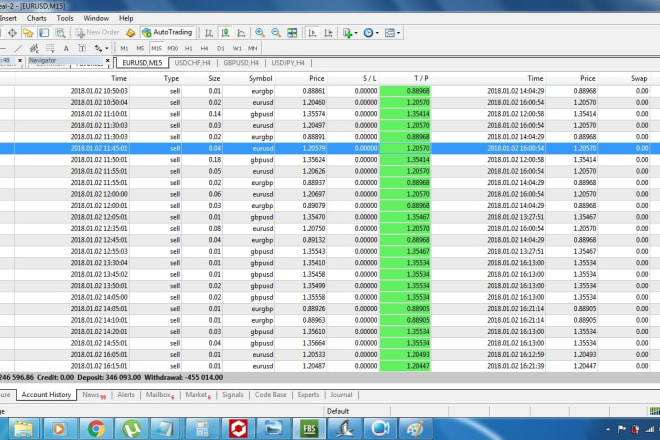

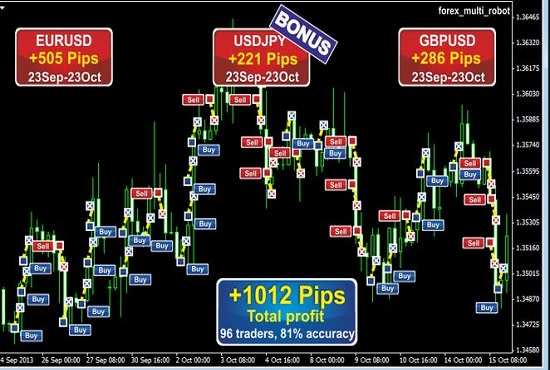

I will develop the best autotrading forex ea trading bot

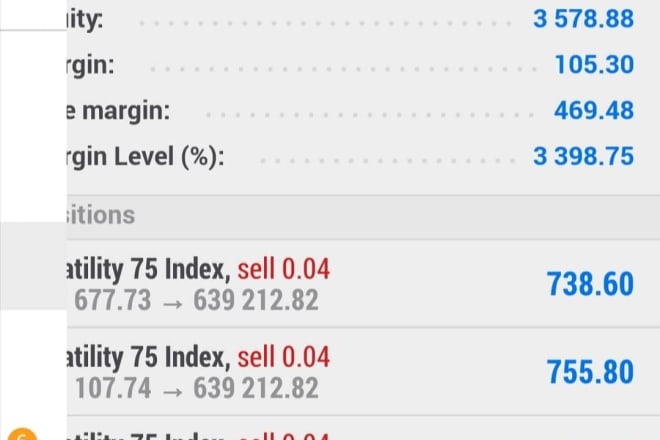

I will provide your deriv volatility mt5 automatic trading robots

I will share best forex autotrading ea robot with unlimited licence

I will forex autotrading ea robots with unlimited license in 1 hour

I will forex autotrading ea robot

I will design a machine learning forex predictor and autotrader

I will give forex autotrading robot

I will forex autotrading ea robot

I will give you my profitable forex trading bot, steam ea bot, tsr forex ea

I will code renko forex robot ea metatrader mt4 mt5

I will gives you my forex bot, forex ea robot, mt4 forex ea, forex trading bot

I will gives you my forex bot, forex ea robot, mt4 forex ea, forex trading bot

I will give profitable trading bot, forex trading bot, forex ea bot, forex bot

I will code expert advisor forex robot mt4 mt5

I will forex marketing, forex promotion, and forex leads

I will give you forex ea with highest accuracy,guaranteed profit