Forex backtesting mt4 services

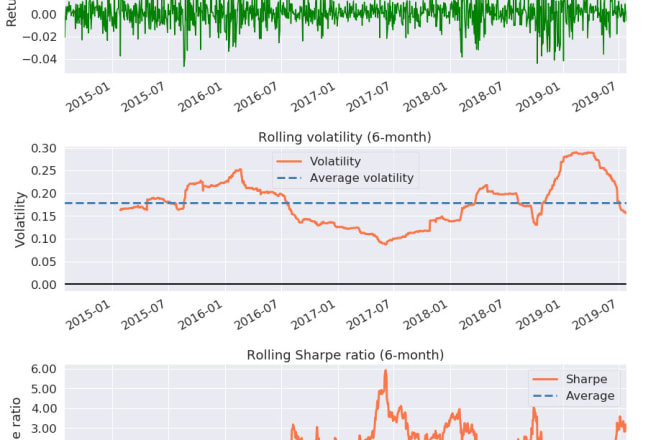

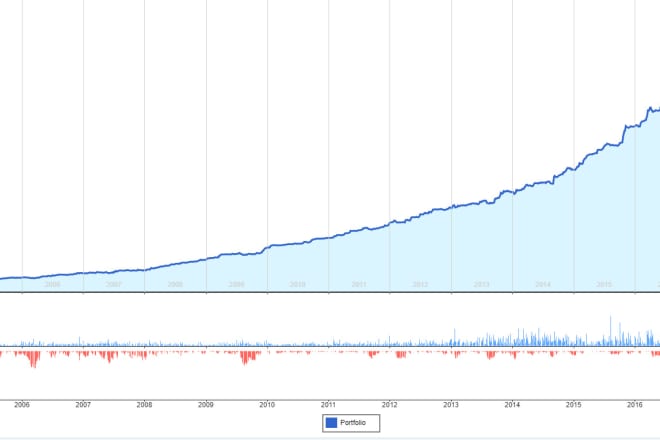

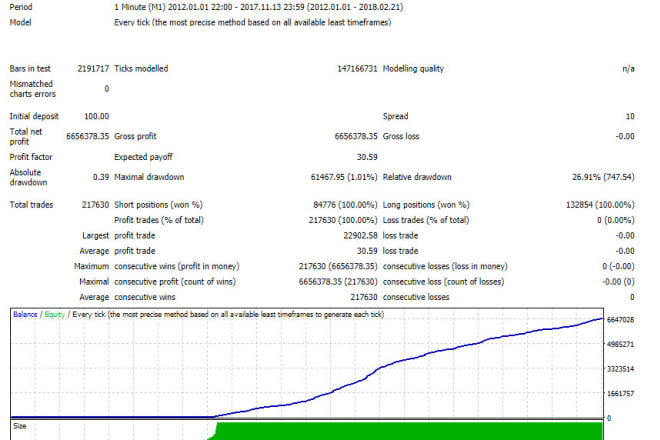

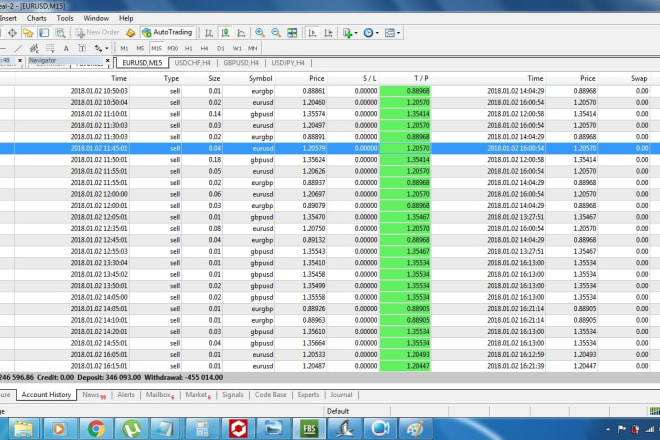

Backtesting is a term used in the financial world to refer to the process of testing a trading strategy using historical data. When backtesting a strategy, a trader will use software to simulate trading using historical data in order to determine whether the strategy is likely to be successful. There are a number of different backtesting software packages available, but one of the most popular is MetaTrader 4 (MT4). MT4 is a trading platform that is widely used by Forex traders, and it has a built-in backtesting facility. There are a number of Forex backtesting services available that can be used to test trading strategies. These services typically provide access to a large database of historical Forex data, and they allow users to test their strategies using this data. Backtesting is an important tool that can be used to assess the viability of a trading strategy. However, it is important to remember that backtesting is not a perfect science, and that the results of a backtest should not be taken as gospel. Ultimately, it is up to the trader to decide whether a strategy is likely to be successful or not.

Forex backtesting is a process that allows traders to test their trading strategies on historical data. By backtesting, traders can see how their strategy would have performed in different market conditions. This information can then be used to improve the strategy. There are a number of backtesting services available for MT4. These services typically allow traders to test their strategies on a range of historical data. This can be a useful tool for improving the performance of a trading strategy.

Forex backtesting services are a great way to test your trading strategies against historical data. By backtesting, you can identify potential issues with your strategy and make adjustments before putting your money at risk. While backtesting is no guarantee of future success, it can give you a better chance of success by helping you avoid common mistakes.

Top services about Forex backtesting mt4

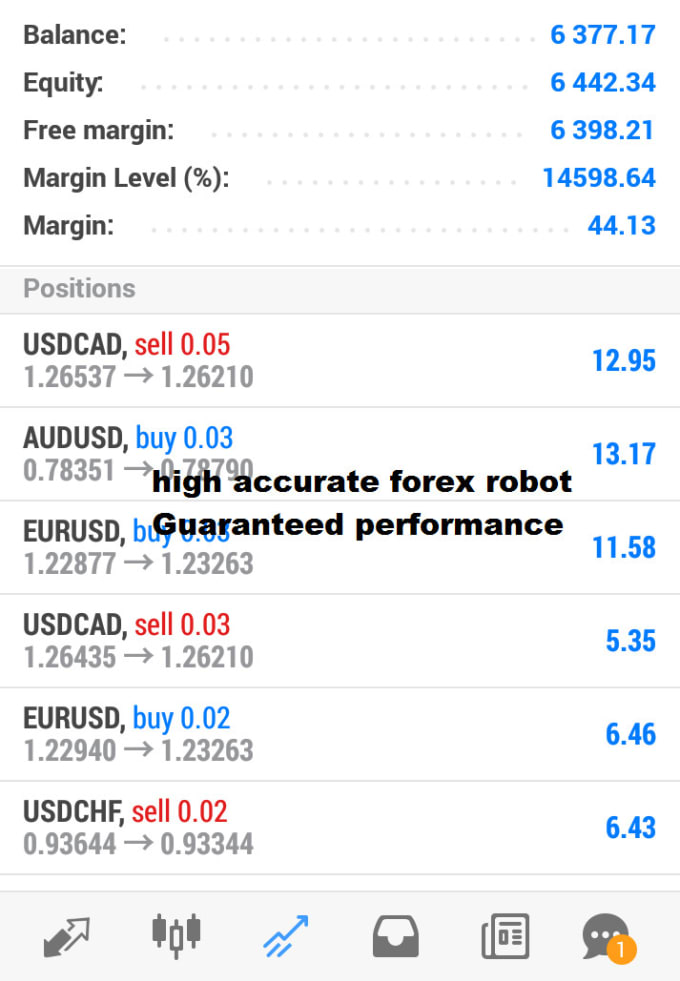

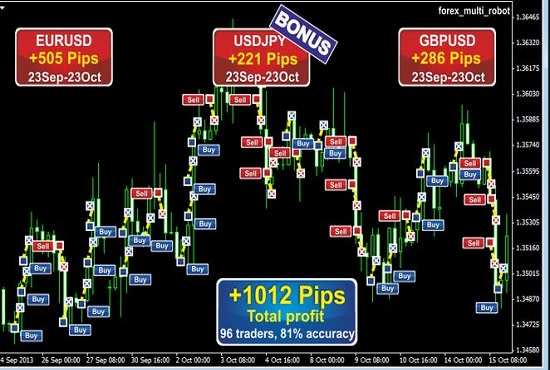

I will provide one backtested forex robot ea for mt4 and mt5

I will provide you 190 forex ea robots for mt4

I will provide accurate forex trading robot

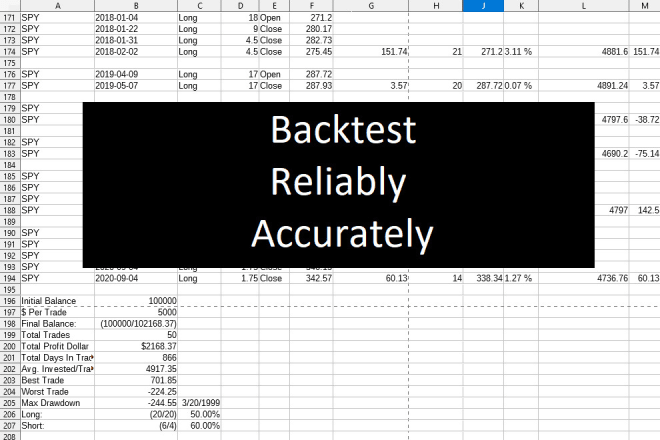

I will do stock market analysis algotrading and backtest historical data

I will sell mt4,mt5 expert edvisors for forex and gold backtested with 15 to 20 years

I will make a profitable forex trading,algo trader robot and a backtest historical data

I will do backtest with real data for forex ea

I will develop trading tools and apps

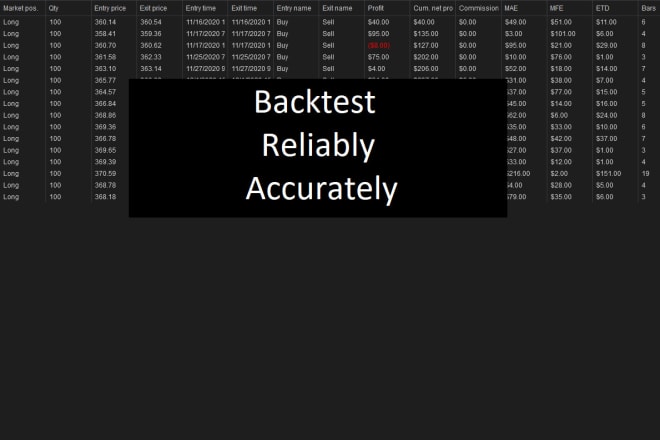

I will backtest your day trading strategy

I will backtest your swing trade strategy

I will give you my profitable forex trading bot, steam ea bot, tsr forex ea

I will code renko forex robot ea metatrader mt4 mt5

I will gives you my forex bot, forex ea robot, mt4 forex ea, forex trading bot

I will gives you my forex bot, forex ea robot, mt4 forex ea, forex trading bot

I will give profitable trading bot, forex trading bot, forex ea bot, forex bot

I will code expert advisor forex robot mt4 mt5

I will forex marketing, forex promotion, and forex leads