Forex currency strength meter trading system services

In the Forex market, currencies constantly move up and down against each other. This is due to a number of factors including economic news, central bank policy, and global events. As a result, it can be difficult to determine which currency is strong or weak at any given time. However, there are tools available that can help. A Forex currency strength meter is one such tool. It measures the strength of a currency based on a number of factors and provides traders with an easy-to-understand visual representation. There are a number of different currency strength meters available, each with its own advantages and disadvantages. In this article, we will take a look at some of the most popular Forex currency strength meters and see how they can be used to help you make better trading decisions.

There is no one-size-fits-all answer to this question, as the best forex currency strength meter trading system services will vary depending on the needs and goals of the individual trader. However, some key factors to consider when choosing a forex currency strength meter trading system service include the system's accuracy, its ease of use, the level of customer support provided, and the fees charged.

The Forex Currency Strength Meter Trading System Services is a great way to get an edge in the foreign exchange market. The service provides users with an easy to use interface that allows them to monitor the strength of different currencies. This information can be used to make informed decisions about when to buy and sell currencies. The service is available for a reasonable price and offers a free trial so that users can try it out before committing to a paid subscription.

Top services about Forex currency strength meter trading system

I will give super profitable best forex trading system indicators

I will share you highly profitable forex trading system

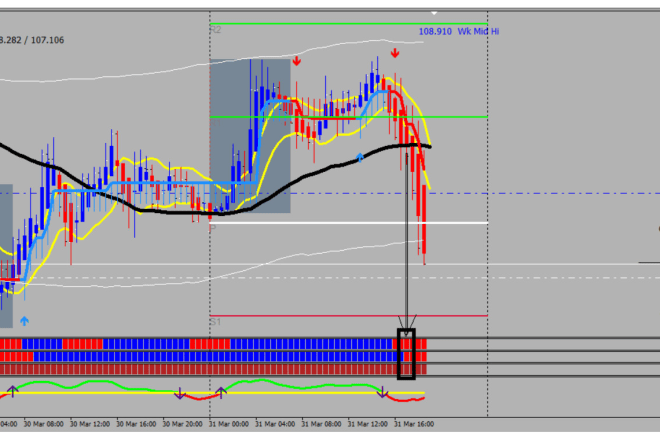

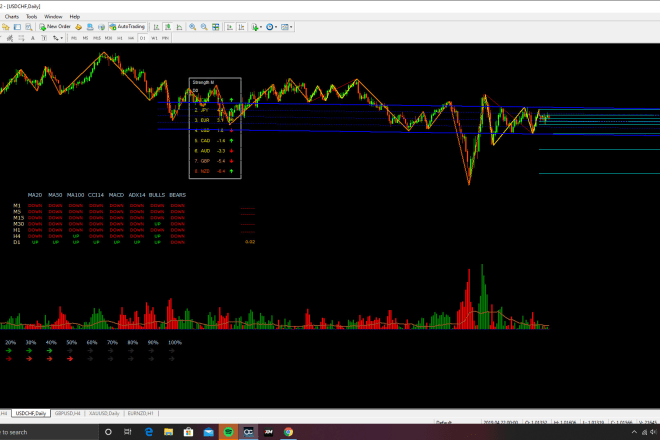

I will send you a forex currency strength meter for mt4

I will give profitable trading system

I will provide complete indicator trading system in forex

I will design a professional forex course website for you

I will forex ea robot,forex trading bot and setup fast profitable forex trading bot

I will build a well paying forex broker website for any broker

I will create forex, forex ea, and arbitrage trading bot

I will do forex account management service

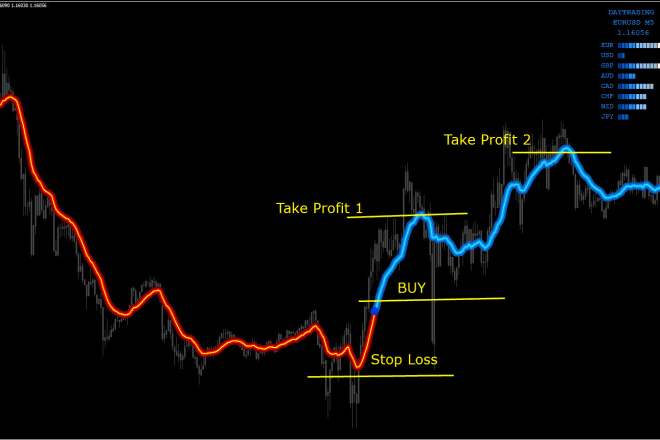

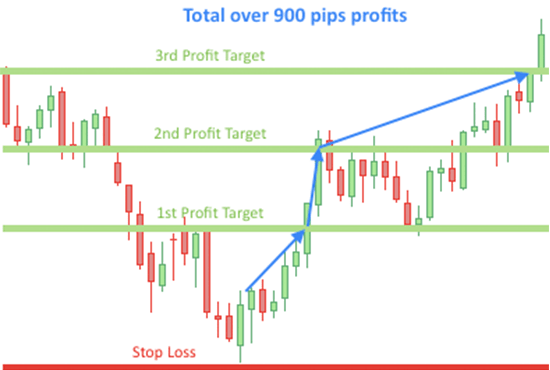

I will share with you a real profitable Forex strategy

I will share with you a true profitable Forex strategy

It is a basic Forex trading strategy that can be traded every day if desired, it works with any currency pair and on any time frame.

Anyone can use it, all levels in Forex trading can trade this strategy as it is simple, yet very effective.

If you have any additional question regarding the Forex trading strategy itself, please do not hesitate in contacting me through Fiverr. I'm always available and ready to help.

Thank you and happy trading!