Forex investment plans services

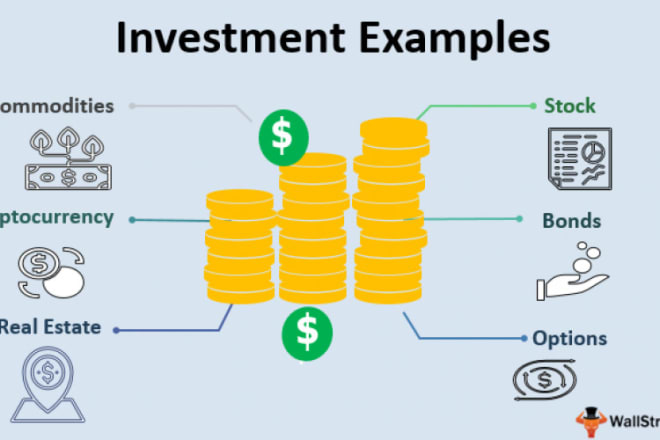

In recent years, more and more people have been turning to forex investment plans as a way to make money. There are a number of reasons for this, but the most common one is that forex investment plans offer a lot of flexibility and freedom. You can choose to invest in a wide range of assets, including stocks, bonds, and even commodities. Another reason why people are attracted to forex investment plans is that they offer a higher potential return than other investment options. For example, if you invest in a stock, you might get a return of 10% per year. However, if you invest in a forex investment plan, you could potentially make a return of 20% or even 30%. Of course, with any investment, there is always a risk of loss. However, if you carefully research the market and choose a reputable forex investment plan provider, you can minimize the risk and maximize your chances of making a profit.

There are a number of different types of forex investment plans services available to investors. These services can provide a number of different benefits, including the ability to trade in a variety of different currencies, access to expert analysis and advice, and the ability to take advantage of leverage.

There are many different types of Forex investment plans services available to investors. Some services offer managed accounts, while others offer signals or advice. There is no one-size-fits-all solution for every investor, so it is important to do your own research and find a service that meets your specific needs.

Top services about Forex investment plans

I will write SEO article on investment, financial markets, insurance or trading

I will provide insights on investment options in india

I will write investment and finance research articles

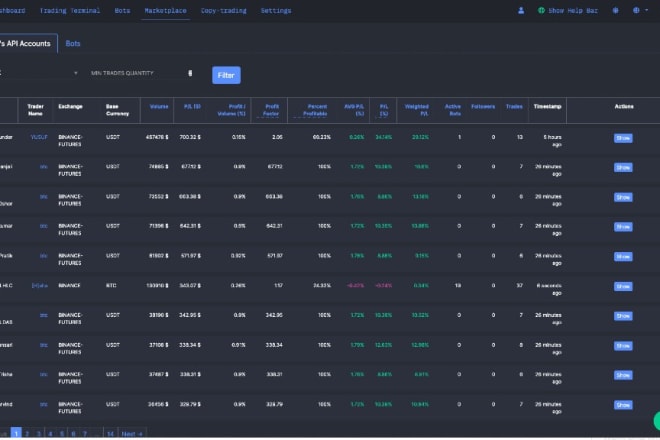

I will develop cryptocurrency investment bot and trading bot

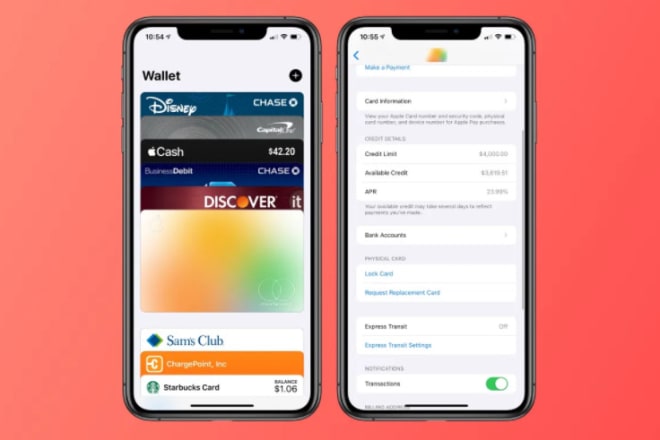

I will develop web forex wallet app, crypto investment,blockchain wallet app

I will create an automated investment trading website

I will write an article on investment, financial markets, insurance or trading

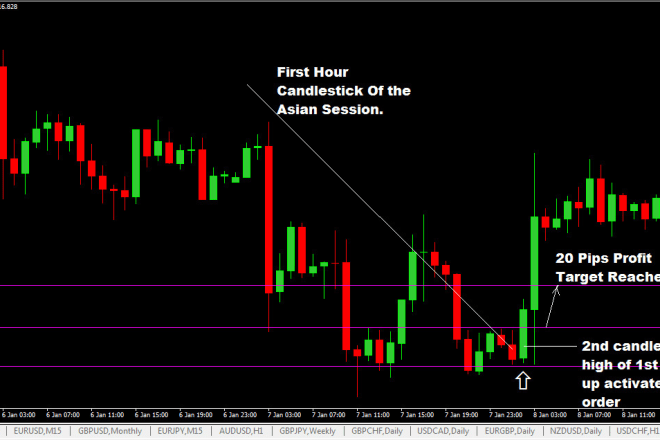

I will give you best forex trading strategy

I will give you my profitable forex trading bot, steam ea bot, tsr forex ea

I will build a responsive forex website, forex investment website

I will generate forex leads, crypto leads to your website and lead generation

I will forex trading bot, profitable forex ea, forex robot with low loss

I will develop automated forex ea robot, forex ea bot

I will code mt4 expert advisor crypto trading bot

I will provide forex robot, scalping bot, goldnix bot, gold ea trading bot

I will build forex ea robot, ea robot, mt4 ea