Forex scalper ea services

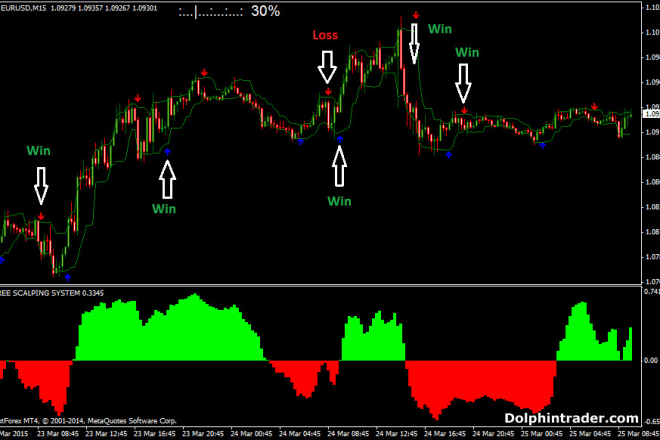

Forex scalping is a trading strategy that seeks to profit from small price changes in the market. The strategy involves opening and closing positions multiple times throughout the day, with the aim of making small profits that add up over time. Forex scalping can be a viable trading strategy for those who are looking to make quick and easy profits in the market. However, it is important to note that scalping comes with a higher level of risk than other trading strategies, and is not suitable for everyone. If you are considering using a forex scalping EA, there are a few things you should keep in mind. In this article, we will discuss some of the key factors to look for when choosing a forex scalping EA service.

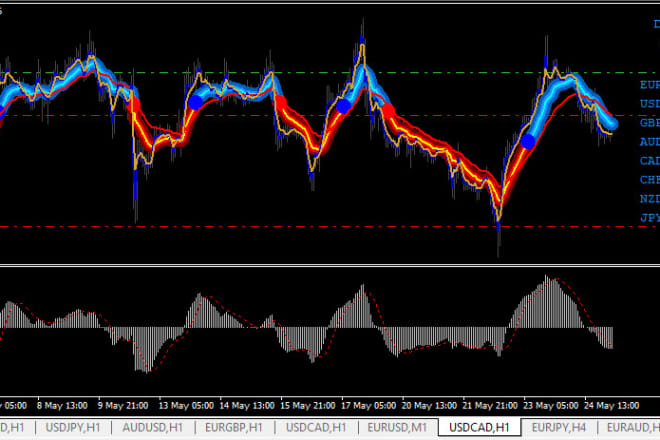

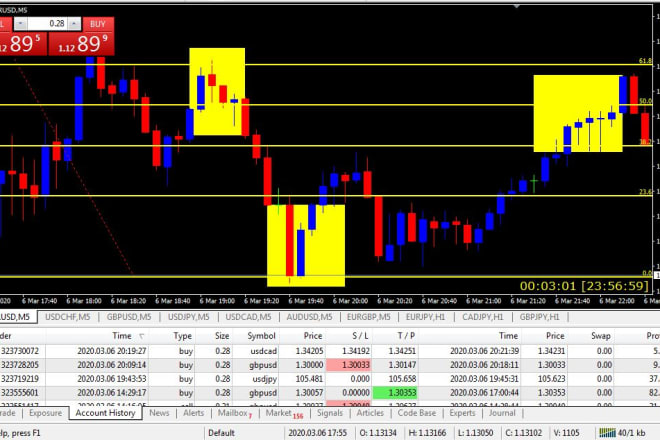

A forex scalper ea is an Expert Advisor that is designed to trade the foreign exchange market. The main purpose of a scalper ea is to take small profits from each trade by holding the position for a very short period of time. Scalpers ea can trade any currency pair, but they typically focus on the major pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF.

Overall, forex scalper ea services seem to be a helpful addition for those looking to trade forex, providing an easy way to make consistent profits. However, it is important to remember that these services are not without risk and should be used in conjunction with a solid trading strategy. As with any type of trading, there is always the potential for loss, so it is important to use stop-loss orders and to never risk more than you can afford to lose.

Top services about Forex scalper ea

I will develop forex robot intraday scalper ea and forex robots ea very fast profits

I will provide high profitable mt4 forex robot and ea scalper pro

I will profitable forex expert adviser ea

I will provide profitable forex ea trading bot ea autobot scalper mt4

I will provide a profitable scalper ea

I will build forex scalper bot, scalping trading and forex ea robot for mt4

I will forex trading bot, profitable forex ea, forex robot scalper

I will give guaranteed forex ea robot

I will ea robots best forex robots scalper stock market

I will forex account manege i am a profitable forex scalper

I will give you profitable forex scalper expert advisor

I will share my 1 minute forex scalping strategy

I will provide profitable making forex robot, scalping trading bot