Forex strategy tester services

In the world of online forex trading, there are many different ways to test out trading strategies before actually putting any real money on the line. One popular method is to use a forex strategy tester service. These services provide a way to test trading strategies using historical data, so that traders can see how their strategy would have performed in different market conditions. There are a number of different forex strategy tester services available, and they all have their own strengths and weaknesses. In this article, we will take a look at some of the most popular forex strategy tester services and see how they can help traders in their quest for profitable forex trading.

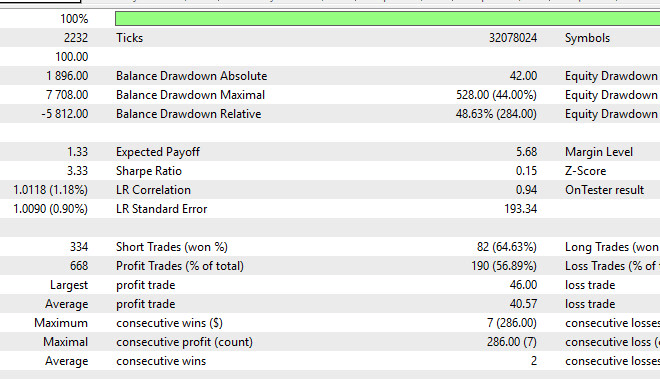

Forex strategy tester services are used to test the viability of a trading strategy before implementing it in live trading. This is done by running the strategy through historical data to see how it would have performed in the past. This can be used to test a wide variety of trading strategies, from simple trend following to complex arbitrage strategies.

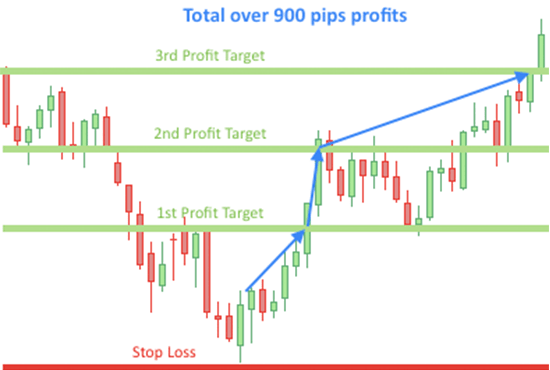

forex strategy tester services can be a great way to test out new forex strategies without risking any real money. However, it is important to remember that no forex strategy is perfect and that there is always some risk involved. Therefore, it is important to use a forex strategy tester service in conjunction with other risk management tools, such as a stop-loss order.

Top services about Forex strategy tester

I will backtest your trading strategy

I will give you this powerful non repaint, forex mt4 indicator

I will provide you with a profitable trading strategy

I will code an indicator, strategy, script for forex tester

I will give you forex strategy that you can test first

I will build no loss trading bot stock trading robinhood, and strategy tester app

I will back test your trading strategy

I will give profitable binary strategy amlm for consistent profit

I will business this Gig Test

I will increase pips with profitable indicator

New forex traders can also win in the forex trading by my this FX win Profitable Strategy Template + Indicator, My system will tell you when and where you should trade. This is a highly profitable and simple to use forex strategy.

It comes with a Tutorial how to set up the indicators and template.

There is no need for prior knowledge in forex, markets or finances to use this strategy effectively. Anyone who can use a computer can use it. You can use this strategy on any type of Forex platform.

EXTRA

---------------------------

I will increase pips with profitable indicator

I will give you top forex trading strategy

I will share with you a true profitable Forex strategy

It is a basic Forex trading strategy that can be traded every day if desired, it works with any currency pair and on any time frame.

Anyone can use it, all levels in Forex trading can trade this strategy as it is simple, yet very effective.

If you have any additional question regarding the Forex trading strategy itself, please do not hesitate in contacting me through Fiverr. I'm always available and ready to help.

Thank you and happy trading!

I will teach you a forex intraday scalping strategy

I will share with you a real profitable Forex strategy

I will code expert advisor forex robot mt4 mt5