Fpa analyst definition services

In the business world, analysts are important players who provide valuable insights and recommendations to help companies make better decisions. Financial analysts are a specific type of analyst who focuses on providing analysis related to financial matters. The role of a financial analyst can vary depending on the company, but generally, a financial analyst is responsible for researching and analyzing financial data, then providing recommendations based on their findings. There are different types of financial analyst roles, but the most common are buy-side analysts and sell-side analysts. Buy-side analysts work for companies that want to invest money, such as hedge funds and mutual funds. Their job is to find investment opportunities and provide recommendations to their clients. Sell-side analysts work for banks and other financial institutions that sell securities. Their job is to provide research and analysis to their clients, so that their clients can make informed decisions about buying or selling securities. Both buy-side and sell-side analysts need to have strong research and analytical skills, as well as the ability to communicate their findings clearly.

There is no one definitive answer to this question. However, broadly speaking, an FPA analyst is someone who provides financial planning and analysis services to an organization. This may include developing and maintaining financial models, preparing monthly/quarterly/annual financial reports, conducting variance analysis, and assisting with the budgeting and forecasting process.

In conclusion, FPA Analyst Definition Services is a company that provides financial planning and analysis services to businesses and individuals. They offer a wide range of services, including budgeting, forecasting, and financial modeling. They are a well-established company with a good reputation.

Top services about Fpa analyst definition

I will great braids with a definition

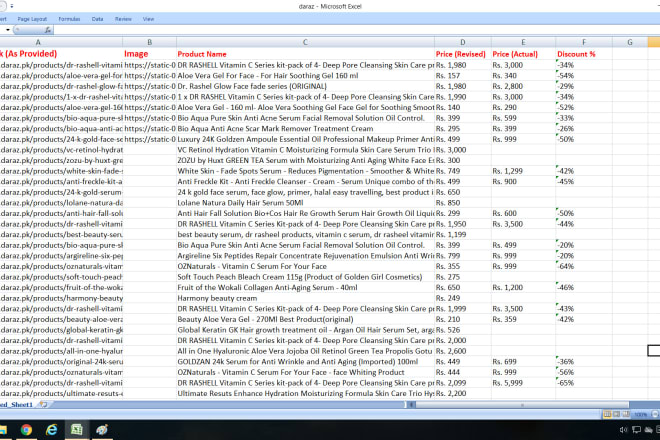

I will do data scrap, data extraction and data analysis expertly

I will financial analyst and micro soft excel expert

I will provide High PR 20 BackLinks

I will be your financial analyst

I will send you a Hafiz with definition in English

I will create dashboards and excel automated sheets

I will your profession forex account manager

I will develop qlik sense apps with best practices