Fx indicators services

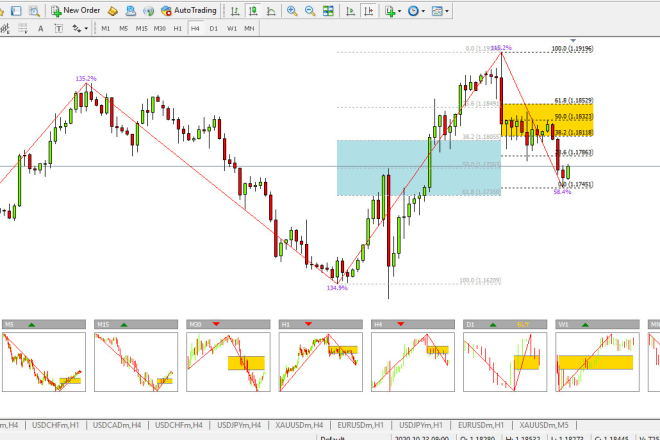

In the world of foreign exchange (FX) trading, indicators are used by traders to help make decisions about when to buy and sell currencies. There are many different FX indicators available, and some traders use a combination of indicators to make trading decisions. Indicators can be divided into two main categories: leading indicators and lagging indicators. Leading indicators give traders information about what is happening in the market right now, while lagging indicators provide information about what has happened in the past. Some popular FX indicators include the moving average convergence divergence (MACD) indicator, the relative strength index (RSI) indicator, and the stochastic oscillator. These indicators can be used to generate trading signals, and many traders use them in combination with other indicators and analysis techniques. Indicator-based trading is not without its risks, however. Indicators can produce false signals, and they should not be used as the sole basis for making trading decisions. In addition, indicators should be used in conjunction with other forms of analysis, such as price action and fundamental analysis.

There are a few different fx indicators services out there. Some are free, while others are paid. The paid services usually offer more features and customization options. The most popular fx indicators services are probably the MetaTrader 4 platform, and the Forex Tester software.

The fx indicators services market is growing rapidly as more and more traders seek out ways to improve their trading results. With so many different providers to choose from, it can be difficult to know which one is right for you. The best way to find the right provider is to research each one thoroughly and then test them out with a demo account. By doing this, you can find the provider that best suits your needs and start making more profitable trades.

Top services about Fx indicators

I will do investment research on fx, stocks, indices etc

I will do professional technical analysis, fx, indices and crypto

I will dream fx gold indicator mt4

I will guide in forex trading, day trading, trader, strategy and acct mngt

I will give profitable trading system

I will give you profitable forex indicators guaranted with training

I will give you profitable forex indicators guaranted with training

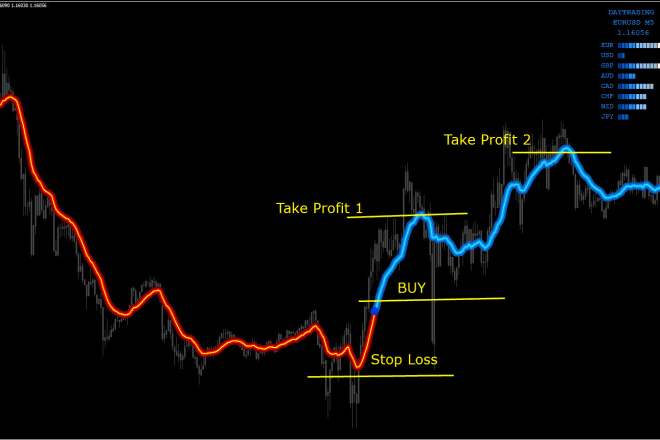

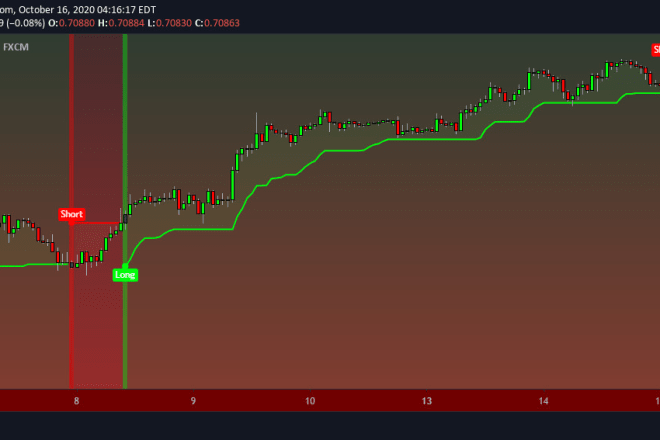

I have three Indicators you can see result in pictures indicators always help you .

Three 80% Guarranted profitable indicators .

1st Give you when you sell and buy indicat to you.

2nd Give you three levels support and Resistance also Pivot point.

3rd Give Give you support resistance and day open line.

My three indicators working perfect and price 500$ but i will give you only 15$ Three perfect profitable indicators .

I will teach you how to use this indicators and get profit 100% use.

I will tell you which time is the best for use of this indicators.

Its amazing result if you want i will give you result of indcators .

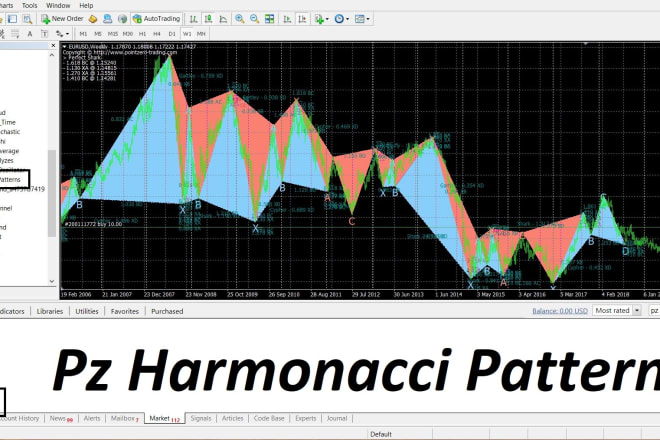

I will develop mql5 ea or indicators for mt5 platoform

I will convert a trading view indicator to ctrader

I will code your robot or indicator for ctrader or calgo

I will create your trading bots indicators for mt5 and mt4, coin base pro

I will create custom tradingview indicators for forex trading

I will provide you with perfect forex system and indicator

I will develop profitable arbitrage forex trading bot, mining bot, trading bot