Hedging ea services

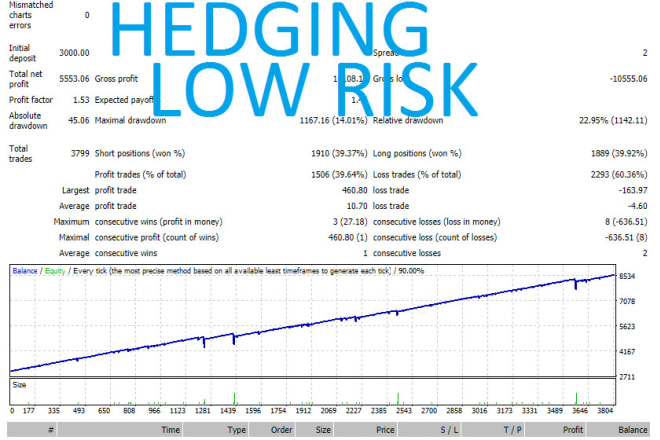

Hedging is a risk management technique used in trading to protect against losses. A hedging EA is a software program that helps traders to automatically place and manage hedging trades. There are many different types of hedging EAs available, and they can be used in a variety of ways. Some EAs will place hedging trades automatically, while others will provide traders with alerts when a hedging opportunity arises. Hedging EAs can be very helpful for traders who want to protect their positions from losses, but they can also be risky. It is important to carefully research and test any hedging EA before using it in live trading.

Hedging EA services is a company that provides expert advisors, or EAs, to help clients trade in the foreign exchange market. The company promises to help clients make money by using its EAs to automatically trade on their behalf. However, some clients have complained that the EAs do not work as advertised, and that they have lost money after signing up for the service.

Hedging EA services can be a great way to protect your investment portfolio from market volatility. By using a hedging EA, you can take advantage of opportunities to buy and sell when the market is favorable, and avoid losses when the market is unfavorable. While there is no guarantee that you will always make a profit with a hedging EA, it can be a valuable tool for managing your portfolio and minimizing risk.

Top services about Hedging ea

I will provide you my own hedge gold ea bot, forex robot, forex bot, forex trading bot

I will give you best high profitable forex ea robot mt4 mt5 hedging

I will give high profitable and fully tested forex hedging ea

I will give you my own hedge gold ea bot, forex robot, forex bot, forex trading bot

I will give quality high profitable forex ea robot mt4 mt5 hedging

I will give best high profitable forex ea robot mt4 mt5 hedging

I will do profitable forex ea robot mt4 mt5 hedging

I will setup high win rate forex ea trading bot, forex robot

I will provide Martingale No Loss Forex Robot Close in Profit

I will provide Martingale No Loss Forex Robot Close in Profit

With this EA you can recover your all Forex Losses easily, If you run it with proper money management then you can't loss your money in anyway.

Now you have No need any high education and information to get profits in the FX market and trading, you have just need a computer, internet connection and MT4.

It will work with only MT4 trading platform.

I will do price action analysis l equities l commodities l currencies

I will code tradestation, ninjatrader, metatrader, tradingview,mt4,mt5 indicator

I will teach you hedging forex trading strategy

This is a highly profitable and simple forex strategy.

There is no need for prior knowledge in forex, markets or finances to use this strategy effectively. Anyone can use this method. I will Tell you How professional traders trade in the market. They will wish I never reveal the secret.

For Extra Gigs you will get the following:

Video clips for sample trades (Recorded Live).

Excel sheet for numbers calculations (Simple)

Question and answer session

I am confident If you buy the full package you will be happy to go in to the market and start trading with profit.

Note: The Forex market is risky, You may lose what you have with simple mistake. Please do not buy this gig if you are not confident with your capability in simple numbers and the use of computers.

Hedge means the market is going up or down you will win and get profit.