How much does it cost to transfer money from paypal services

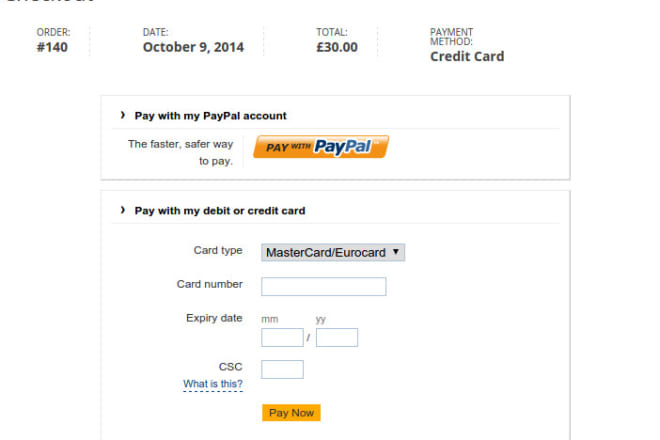

When it comes to transferring money from one account to another, there are a few different options available. One popular method is to use PayPal. PayPal is a service that allows users to send and receive money online. While it is a convenient option, it is important to know how much it will cost to transfer money from PayPal before using this service. According to PayPal, it is free to send money if the funds are coming from your PayPal balance or a linked bank account. If you are using a credit or debit card, there is a fee of 2.9% plus $0.30 USD. For international transfers, there is a fee of 4% plus a fixed fee based on the currency. For example, the fee for transferring money from USD to CAD is $4.99 USD. When it comes to receiving money, PayPal does not charge a fee if the funds are coming from your PayPal balance or a linked bank account. If you are using a credit or debit card, there is a fee of 2.9% plus $0.30 USD. For international transactions, there is a fee of 4% plus a fixed fee based on the currency. For example, the fee for receiving money from CAD to USD is $4.99 USD. There are a few things to keep in mind when using PayPal to transfer money. First, you will need to have a PayPal account. Second, the person you are sending money to will also need a PayPal account. Finally, it is important to know the fees associated with using PayPal so that you can budget accordingly.

As of December 2017, PayPal charges a fee of 2.9% plus $0.30 for domestic transfers made in U.S. dollars. For transfers made in other currencies, PayPal charges a fee of 3.4% plus a currency conversion fee.

Overall, Paypal is a reliable and affordable money transfer service for those who need to send or receive money quickly. There are a few fees associated with the service, but they are typically minimal and worth the convenience and security that Paypal offers.

Top services about How much does it cost to transfer money from paypal

I will guarantee top 10 ranking on google or money back

I will be your woocommerce website expert

I will create super authority affiliate site in wordpress

I will try to help you as much as possible

I will show you how to make 500 dollars per day

I will give you a new powerful CPA method make 300 dollar daily for year 2020

I will develop cash app, bank, loan and money transfer app with web

I will create a cash app, wallet app, payment app, bank app, online transfer

I will develop cash app, worldwide transfer app, loan app, payment app, online money

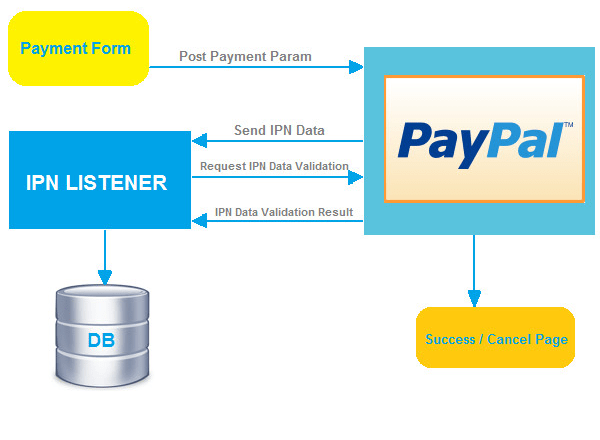

I will do stripe or paypal integration as payment gateway

I will do money transfer services with paypal and payoneer

I will add paypal payment gateway

I will do integrate paypal payment gateway for your website

I will integrate paypal, paypal express, securepay in wordpress

I will cash app,payment app,bitcoin wallet app,money transfer app,paypal app,venmo app