How to make a capitalization table services

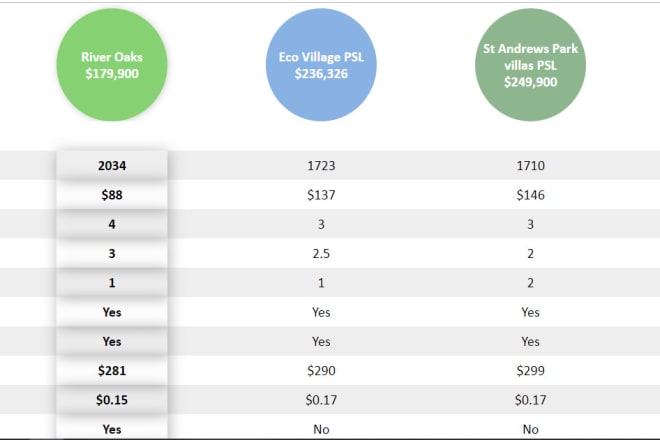

A capitalization table is a financial document that lists a company's shareholders and how much capital each has invested in the company. The table also shows what percentage of the company each shareholder owns. A capitalization table can be used to determine a company's valuation and to negotiate equity agreements between shareholders. It is also a useful tool for managing a company's finances and understanding its ownership structure. Capitalization tables can be created using software or by hand. There are many different ways to format a capitalization table, but all tables should include the following information: -The names of the shareholders -The amount of capital each shareholder has invested -The percentage of the company each shareholder owns shareholders' equity.

A capitalization table is a tool used by startup companies to track the ownership of the company and the equity held by each shareholder. The table is used to determine the value of the company and the percentage of ownership held by each shareholder.

A capitalization table is a tool that can be used to track the ownership structure of a company. The table can be used to track the percentage of ownership for each shareholder, the value of the company's equity, and the dilution of the ownership interests over time. The capitalization table can also be used to calculate the value of the company's equity for potential investors.

Top services about How to make a capitalization table

I will be your ebook writer, ghostwriter, and kindle writer

I will be your ebook writer, ghostwriter, and kindle writer, do ebook ghostwriting

I will introduce you to a new way to earn daily and monthly income on autopilot

I will be your ghostwriter, ebook writer, script writer

I will write a full detailed business plan, business proposal, business plan writer,

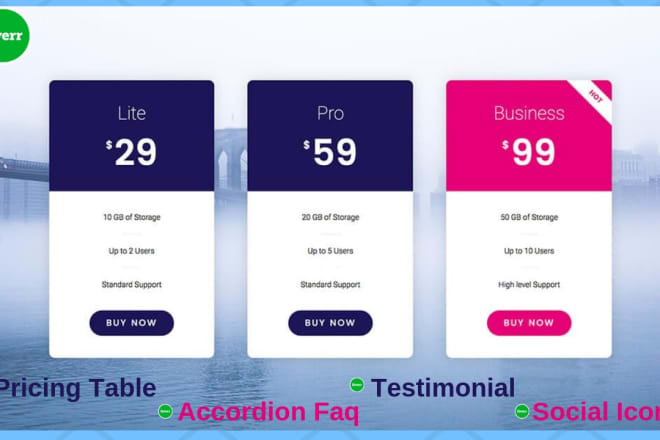

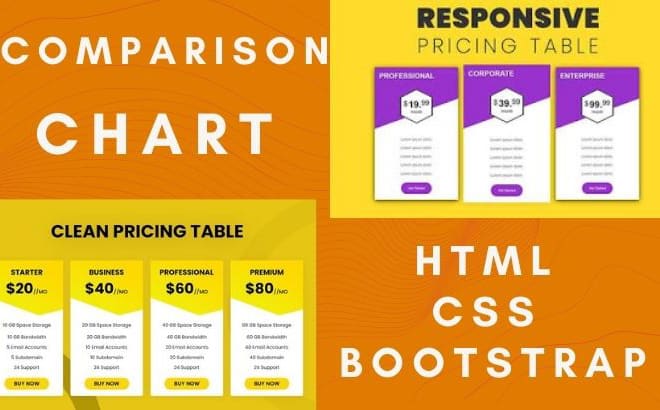

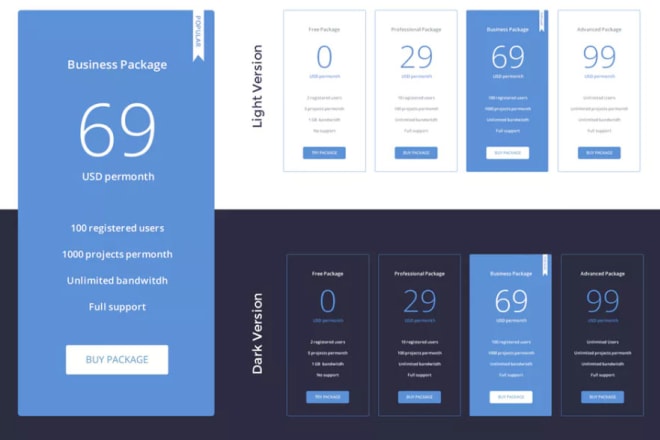

I will create table, pricing table,comparison table using html,css

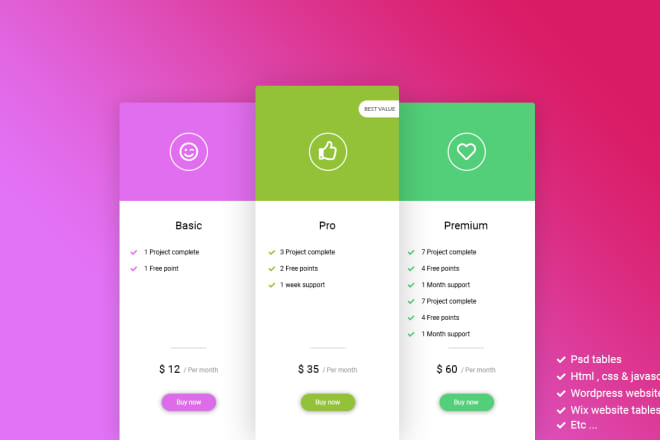

I will design wonderful PSD pricing table,comparison table, chart

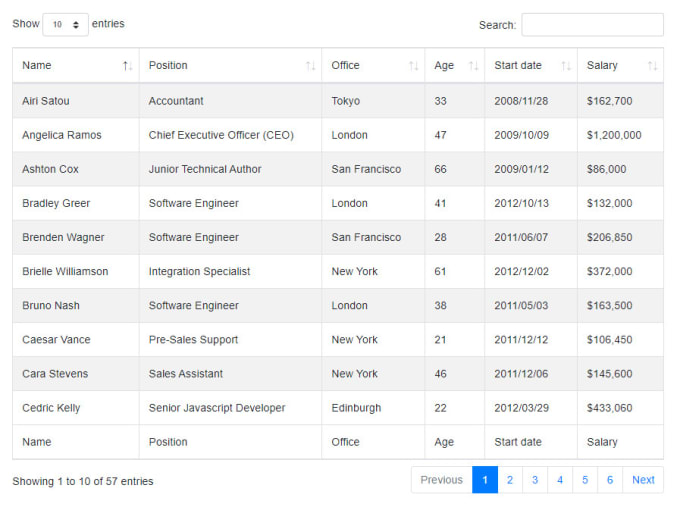

I will add or edit jquery datatables or js grid table

DataTables is a plug-in for the jQuery Javascript library. It is a highly flexible tool, based upon the foundations of progressive enhancement, and will add advanced interaction controls to any HTML table.

Benefits of DataTables & Js-Grid Table

- Adds Sorting functionality to the table

- Adds Search functionality to the table

- Adds Row Manage By Controlling Total Number Of Raws functionality to the table

- Adds Pagination functionality to the table

Below are the things that I can do for jQuery DataTables & Js-Grid Table:

- Convert your Table to DataTable OR Js-Grid Table

- Can modify the functions of the DataTable OR Js-Grid Table

- Modify the design of the DataTable OR Js-Grid Table

- Add TOTAL of any particular column to it's footer

- Add the custom number to sorting to the DataTable OR Js-Grid Table

DO NOT CONTACT ME FOR YOUR SCHOOL/COLLEGE ASSIGNMENTS.

Reason: The School/College Assignments are for Student's Practice which can help them to improve their knowledge about programming.

I will design professional pricing table or pricing list

I will sculpt miniatures for 3d printing in real tabletop scale

I will do price list, pricing table, comparison chart diagram using html,css,bootstrap

I will design your next table runner or throw design

This gig covers the graphic design only of your next trade show or expo table runner or throw. If you are interested in our printed and physical display packages please contact us and we will provide you a custom fiverr estimate for the design, print and shipping of your next trade show display.

Sizes of table throws:

- 6'

- 8'

Types of table throw cover prints:

Print on the front panel only (Front Panel Dye Sublimation)

Print on the entire throw (Full Dye Sublimation)

Logo on the front panel only (Perma-logo)

Standard sizes of table runners:

- 24'

- 30"

- 36"

- 60"

Types of table throw cover prints:

All table runners are fully printed with dye sublimation and typically finished with hemming around all the edges. They drape over the table allowing your message to hang down the front of the table.

I will create wordpress pricing table or comparison chart or table

I will create professional pricing table