How to prepare an investment proposal services

An investment proposal is a document that outlines how a company plans to generate returns for its investors. A well-written proposal will articulate the company's investment strategy and provide insights into its expected financial performance. While there is no one-size-fits-all template for an investment proposal, there are certain key elements that should be included. This article will provide guidance on how to prepare an investment proposal that will stand out to potential investors.

An investment proposal is a document that outlines the case for investing in a particular project, company, or financial asset. It is typically used by businesses to secure funding from investors, though it can also be used to solicit funding from grant-making organizations. An investment proposal typically includes an executive summary, an overview of the business or project, a description of the proposed investment, and an analysis of the risks and potential returns.

If you're looking to start or grow your business, you'll need to put together an investment proposal. This document outlines your business plan and how you plan to use investment funds to achieve your goals. To prepare an investment proposal, start by putting together a business plan that outlines your company's goals, products or services, target market, and financial projections. Then, create a detailed investment proposal that explains how you plan to use the investment funds to achieve your goals. Be sure to include information on your management team, your business's competitive advantages, and your track record (if you have one). Investors will want to see that you have a well-thought-out plan for how you'll use their money to grow your business. By taking the time to prepare a detailed and persuasive investment proposal, you'll increase your chances of getting the funding you need to succeed.

Top services about How to prepare an investment proposal

I will be your startup, loan or investment business plan writer

I will create a CEO ready presentation for you

I will create a professional business plan or loan proposal

I will prepare an outstanding startup pitch deck

I will design a world class powerpoint presentation for you

I will prepare a investment proposal, memorandum or teaser

I will prepare grant proposal for your projects

I will write a result oriented persuasive business proposal

I will analyse your real estate investment

I will analyse your real estate investment

- assess how much you should pay in order make a desired annual profit

- choose between two competing real estate investments - which one should you go for?

- prepare the necessary appraisals and analysis to support your loan application or investor pitch

- calculate and assess Key Performance Indicators of the investment (total profit, return on investment (ROI), Internal rate of return (IRR), return on invested capital (ROIC), annual dividend available, debt and interest coverage ratios and sensitivity and scenario analysis.

-

I will write business proposal, grant, sponsorship proposal,rfp

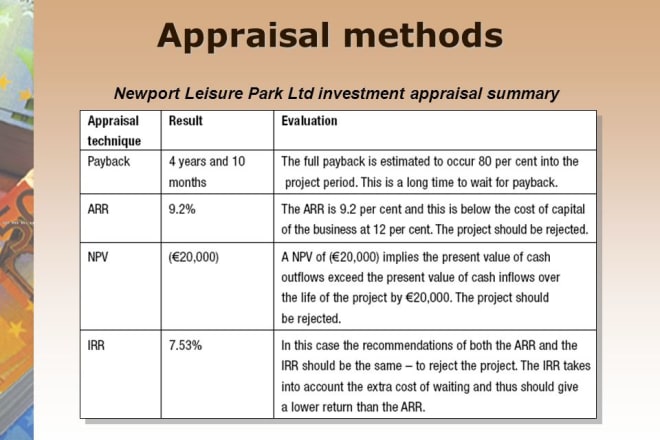

I will prepare net present value analysis and other investment appraisals

I will prepare business proposal, rfp, grant proposal, csr reports

I will prepare an information technology proposal and powerpoint presentation for you

I will prepare an information technology proposal and powerpoint presentation for you

MS Exchange server 2010/2013/2016, MS Sharepoint server, MS Lync/Skype for business server, MS Active directory,DHCP and DNS, Microsoft cloud solutions (Office 365 and Azure).

This GIG is in three categories; Basic, Standard and Premium.

Basic Category comes with Proposal for any of the solutions listed above

Standard Category comes with proposal and basic level presentation for the solutions listed above.

Premium category comes with proposal and high level presentation of all MS solutions listed above.