How to prepare bank reconciliation statement services

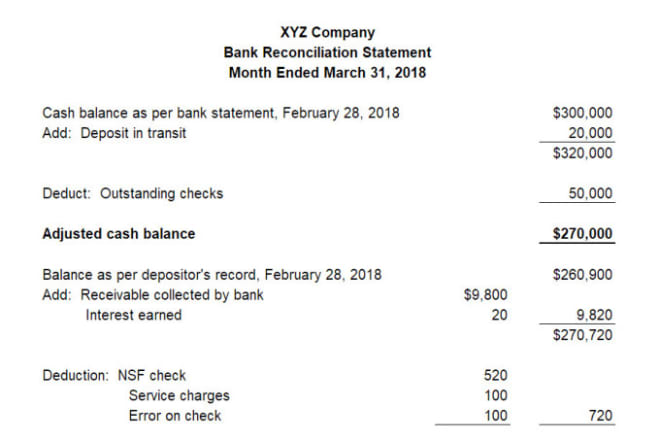

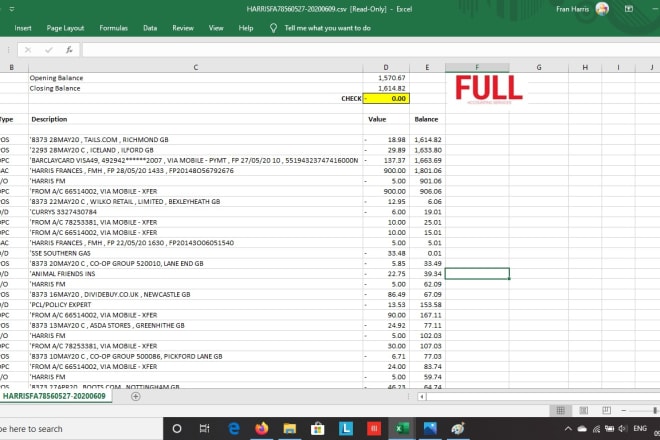

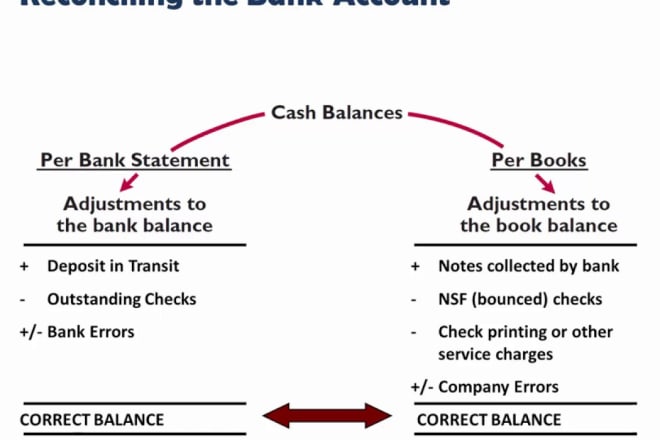

The process of reconciling a bank statement with your own records can be daunting, but it is essential to keeping track of your finances. By following a few simple steps, you can ensure that your bank reconciliation is accurate and up-to-date. First, you will need to gather your records. This includes your bank statements, checkbook, and any other documentation related to your finances. Next, you will need to match up your records with the bank statements. This may require some detective work, but it is important to make sure that all of your transactions are accounted for. Once you have all of your information gathered, you can begin to fill out your reconciliation statement. This form will help you to track your balance and make any necessary adjustments. Be sure to keep an accurate record of all transactions, both deposits and withdrawals. By taking the time to reconcile your bank statement, you can be confident that your finances are in order. This process can help you to identify any discrepancies and make corrections accordingly. A well-kept reconciliation statement is an important tool in managing your money.

In order to prepare a bank reconciliation statement, you will need to have access to your bank statements and records of your own transactions. You will need to compare these two sets of records and look for any discrepancies. Once you have found any discrepancies, you will need to investigate and determine the cause. Once you have determined the cause, you can make the necessary adjustments to your records and prepare the bank reconciliation statement.

If you are looking for a way to improve your business' bottom line, consider bank reconciliation statement services. This type of service can help you keep track of your finances and make sure that your books are in order. With the help of a professional, you can ensure that your business is running smoothly and efficiently.

Top services about How to prepare bank reconciliation statement

I will prepare bank reconciliation on quickbooks online, xero and excel

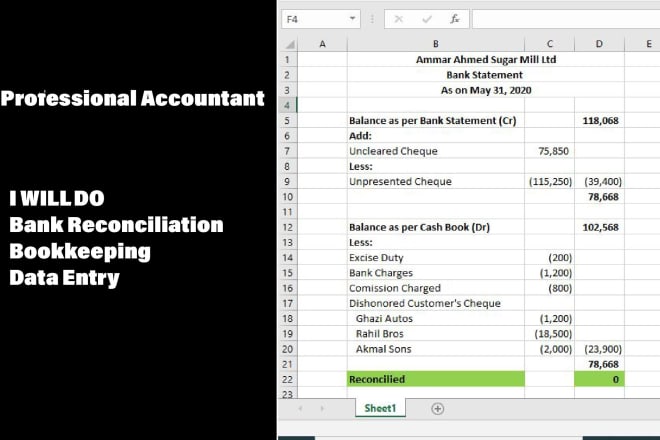

I will perfectly prepare bank reconciliation statements and bookkeeping in 24 hours

I will catchup, setup, and do bookkeeping in quickbooks online and bank reconciliation

I will prepare reconciliation from ledger credit card paypal quickbooks bank statements

I will prepare bank reconciliation statement

I will do bookkeeping and bank reconciliation

I will do bank reconciliation of your statement

I will do bank reconciliation statement super first

I will prepare bank reconciliation statement and bookkeeping

I will do bank statement or credit card reconciliation with quickbooks

I will do reconciliation from paystub, paypal, zelle, quickbooks bank statement

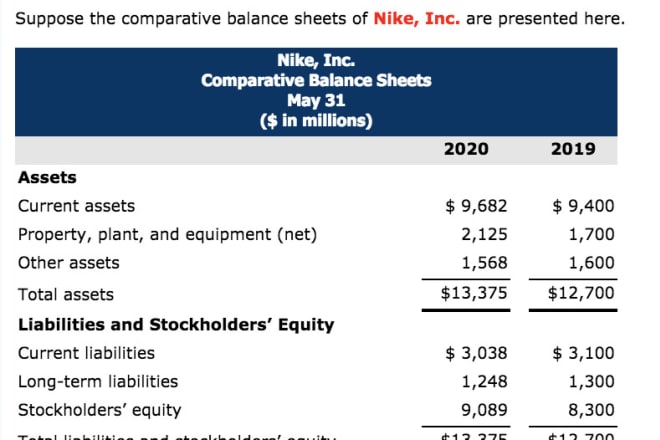

I will prepare financial statement income statement balance sheet

I will prepare bank reconciliation statement

I will prepare bank reconciliation and credit card reconciliations

I will prepare bank reconciliation statement

I will prepare bank reconciliation statement