How to trade forex without indicators services

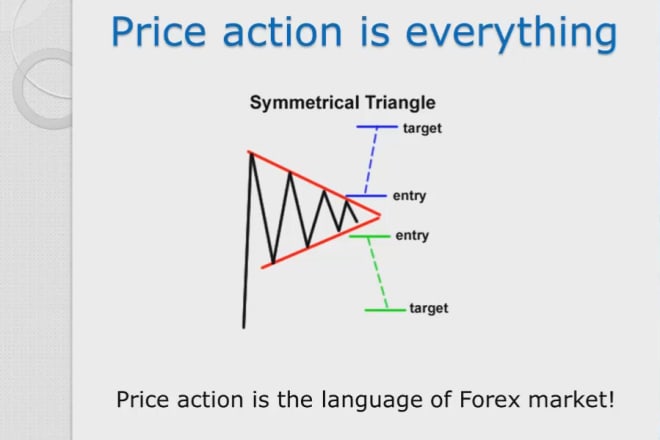

In the world of foreign exchange (forex) trading, there are many different ways to approach the market. Some traders prefer to use technical indicators to help them make decisions, while others choose to trade without indicators. Indicator-based trading can be a useful tool, but it is not the only way to trade forex. There are also many benefits to trading without indicators. One benefit of trading without indicators is that it can help you to avoid over-trading. Indicator-based trading can often lead to traders taking too many trades, which can lead to losses. Another benefit of trading without indicators is that it can help you to focus on the price action. This can be a more effective way to trade, as you are not relying on any indicators to make decisions. If you are new to forex trading, then it may be worth trying out a few different approaches to see what works best for you. However, if you are experienced, then trading without indicators can be a viable option.

In order to trade forex without indicators, one must first have a strong understanding of the underlying market trends. Without the ability to read and interpret market data, it would be nearly impossible to make consistent profits without the use of some form of market analysis. Many professional forex traders choose to trade without indicators because they provide a false sense of security and can often lead to over-trading.

The foreign exchange market is a global decentralized or over-the-counter market for the trading of currencies. This market determines the foreign exchange rate. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In a free market, one can trade forex without indicators or services, but it is often more beneficial to use them. Indicators and services can provide more information about the market and help you make better-informed decisions.

Top services about How to trade forex without indicators

I will give you 4 strategies to trade forex

I will teach you how to trade forex in minutes

I will teach you how to trade forex online

I will teach you how to trade forex like a professional

I will teach you how to trade forex

I will give more than 50 best trading bots and indicators for guaranteed winning trade

I will teach you how to trade forex, forex strategy, forex trading

I will teach you how to trade forex like professional traders

I will give you profitable forex indicators guaranted with training

I will teach you forex trading with profitable indicator

I will give you profitable forex indicators guaranted with training

I have three Indicators you can see result in pictures indicators always help you .

Three 80% Guarranted profitable indicators .

1st Give you when you sell and buy indicat to you.

2nd Give you three levels support and Resistance also Pivot point.

3rd Give Give you support resistance and day open line.

My three indicators working perfect and price 500$ but i will give you only 15$ Three perfect profitable indicators .

I will teach you how to use this indicators and get profit 100% use.

I will tell you which time is the best for use of this indicators.

Its amazing result if you want i will give you result of indcators .

I will teach you the most simple and effective forex strategy

I will teach you chart patterns to trade forex market

I will create expert advisor ea mq4 bot indicator forex mt4 platform

I will provide a profitable forex trading bot,forex trading bot

I will increase pips with profitable indicator

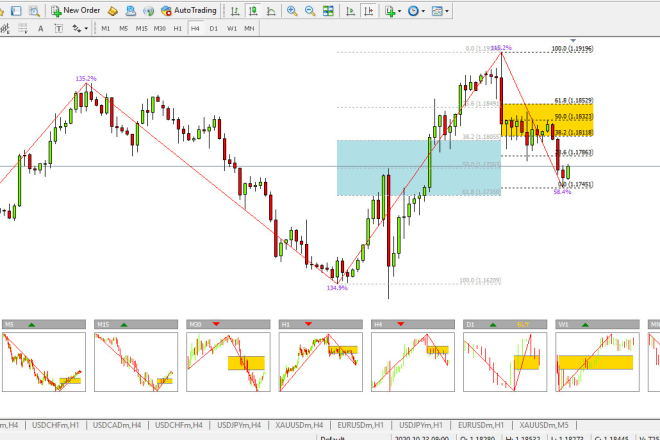

New forex traders can also win in the forex trading by my this FX win Profitable Strategy Template + Indicator, My system will tell you when and where you should trade. This is a highly profitable and simple to use forex strategy.

It comes with a Tutorial how to set up the indicators and template.

There is no need for prior knowledge in forex, markets or finances to use this strategy effectively. Anyone who can use a computer can use it. You can use this strategy on any type of Forex platform.

EXTRA

---------------------------