Howey test ico services

The U.S. Securities and Exchange Commission (SEC) has published guidance on initial coin offerings (ICOs), stating that ICOs may be considered securities offerings and therefore subject to the requirements of the federal securities laws. The SEC's guidance comes in the form of a "Howey Test" for ICOs, which is based on the U.S. Supreme Court's test for determining whether an investment contract is a security. The Howey Test requires that an ICO have all of the following features: 1. It is an investment of money 2. There is an expectation of profits from the investment 3. The investment is in a common enterprise 4. There is a promoter or other third party who manages the enterprise or the offering The SEC's application of the Howey Test to ICOs is significant because it means that ICOs may be subject to the same regulatory requirements as other securities offerings, such as registered public offerings. This could make it more difficult for ICOs to raise money from investors, as they would be required to comply with the same disclosure and registration requirements as other securities offerings. The SEC's guidance is not a formal rule or regulation, but it provides clarity on how the SEC views ICOs and how they may be regulated in the future.

The Howey Test is a test used to determine whether or not a particular transaction qualifies as an "investment contract." If a transaction is determined to be an investment contract, then it is subject to securities regulation. There are a few key factors that are considered when determining whether or not a transaction qualifies as an investment contract. Firstly, there must be an investment of money. Secondly, there must be a common enterprise. Lastly, there must be an expectation of profits derived from the efforts of others. If a transaction meets all of these criteria, then it will likely be considered an investment contract and subject to securities regulation. There are a few exceptions to this rule, however, so it is always best to consult with a qualified securities attorney to be sure. Howey test ico services can help you determine whether or not your transaction qualifies as an investment contract. These services can be extremely helpful in ensuring that you are in compliance with securities regulations.

The Howey Test is a tool that can be used to determine whether or not an Initial Coin Offering (ICO) is a security. While the test is not perfect, it is a good way to get a general idea of whether or not an ICO is a security. The Howey Test is just one tool that should be used when considering an ICO investment.

Top services about Howey test ico

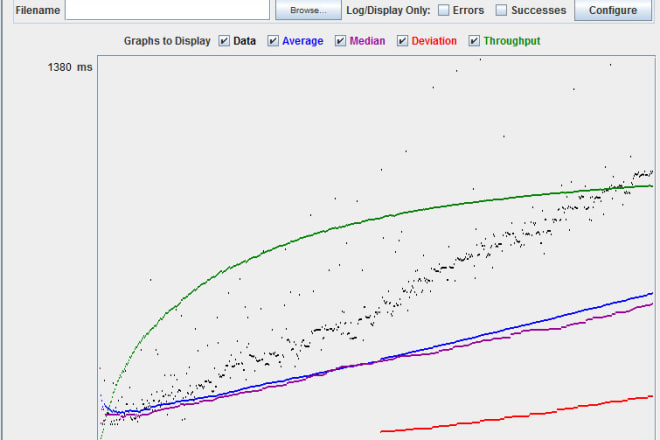

I will test your app on all platform

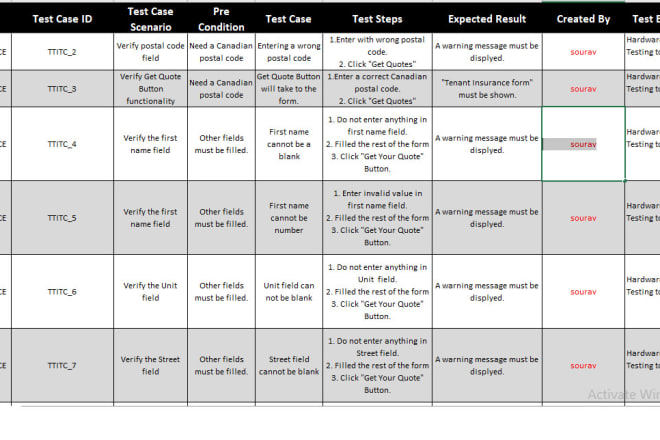

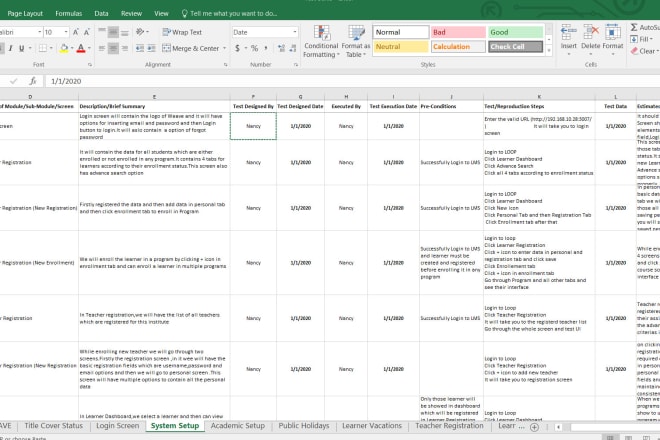

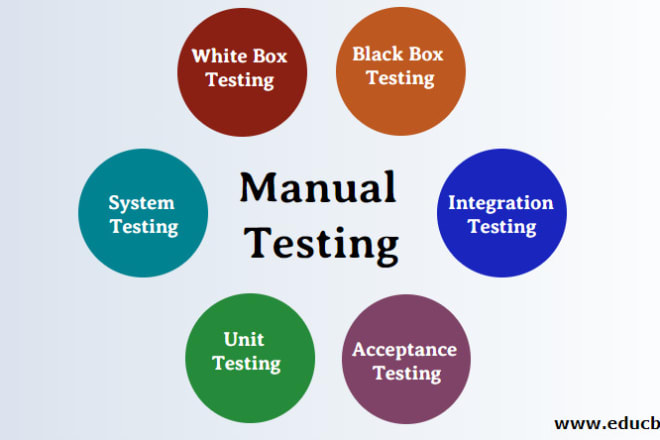

I will write test cases for software QA

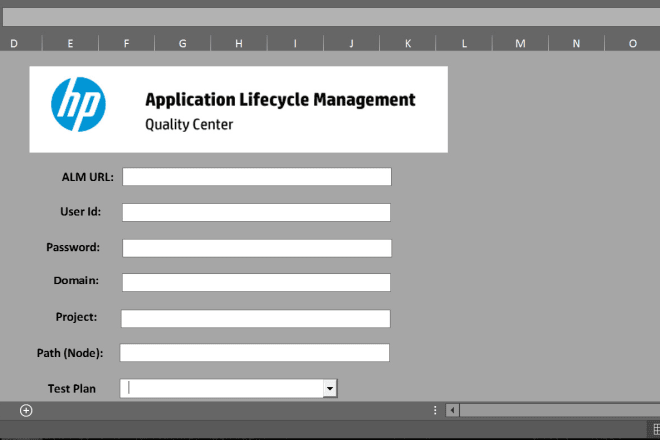

I will create macros to download test cases from hp qc

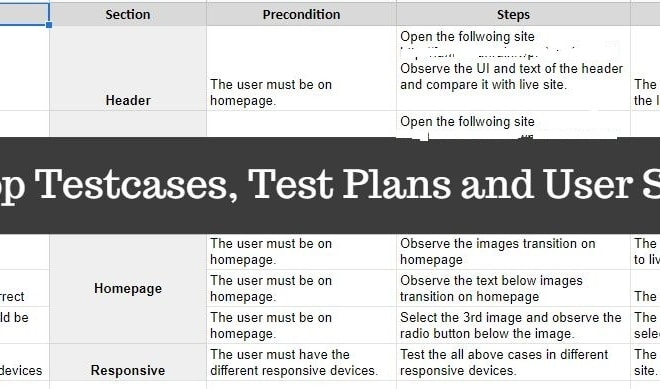

I will develop test plan, detail test case and user stories

I will write your test cases and scenarios in software quality assurance

I will write your manual test cases and document test plan in sqa

I will do advanced penetration testing of a website or web app with professional report

I will thoroughly test your iphone app

I will not write multiple reviews in the app store under different accounts. That is unethical. I will write a review though.

***NOTE***

I can only test your app if it is available for iPhone. I can't test Android devices. Also if the app isn't available in the UK for purchase i may not be able to download it.

I also will not purchase apps in order to test them. If your app isn't free in the app store, and you want me to test it, you can gift it to me.

I can't do any in-app purchases at this time as well

I will do manual and automation for your application