International investor services

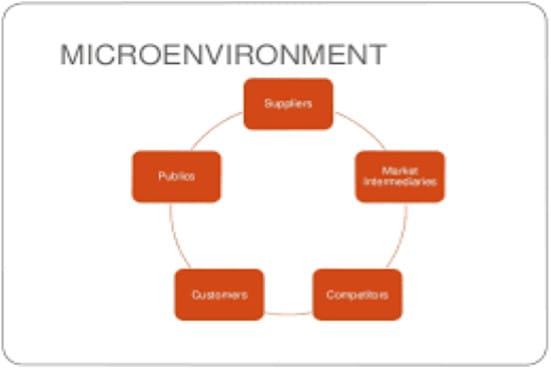

In today's global economy, more and more investors are looking for opportunities outside their home countries. And with good reason - a diversified portfolio can lead to greater returns and reduced risk. But investing internationally comes with its own set of challenges, from understanding different regulatory regimes to managing currency risk. That's where international investor services come in. From providing research on potential investments to helping with the administrative paperwork, these services can make investing in foreign markets easier and more efficient. In this article, we'll take a look at some of the different services available to international investors, as well as the benefits and drawbacks of using them.

There is a growing demand for international investor services. This is due to the globalization of the economy and the increasing number of investors who are looking to invest in foreign markets. There are a number of firms that provide these services, and they typically offer a wide range of products and services that cater to the needs of international investors. These firms typically have a team of experts who are well-versed in the various laws and regulations that govern foreign investment, and they can provide guidance and assistance to investors who are looking to enter the market.

Overall, international investor services can provide many benefits to individuals and businesses alike. They can help to diversify portfolios, raise capital, and provide access to new markets. While there are some risks associated with these services, they can be mitigated with proper research and due diligence. With the right provider, international investor services can be a valuable tool for anyone looking to expand their investment horizons.

Top services about International investor

I will write on international business, finance and investment

I will provide an international funding and investor database 3000 contacts

I will help you invest in the international stock market

I will make investment valuations, financial statements and assess internal controls

I will create thc or cbd business plan, pitch deck, financial model, startup, proposal

I will send you cbd business plan, pitch deck, financial projection

I will design an investor pitch deck

I will send you proven investor decks to help you raise money

I will design real estate website, investor carrot, oncarrot website, landing page

I will prepare investor ready business plan or financial model

I will prepare investor ready business plans for startup

I will assist marketing, sales ppt and investor pitch deck

I will be your international trade lawyer