Invoice without abn services

As a business owner, you're legally required to have an Australian Business Number (ABN). An ABN is a unique 11-digit number that identifies your business to the government and the community. It's free to apply for an ABN. If you provide goods or services without an ABN, you may have to pay the GST. This is because the law requires businesses to include their ABN on invoices for all taxable supplies of goods and services. If you're registered for GST, you can't claim GST credits for purchases you make from suppliers who don't quote their ABN. You may also have to pay the GST on any taxable supplies you make if you don't quote your ABN on your invoices.

There are a few businesses that provide invoice without ABN services. This can be beneficial for those who are self-employed or do not have a registered business. This type of service can help you save time and money by not having to register your business or get an ABN.

The article discusses the pros and cons of using an invoice without an ABN service. Overall, the decision to use an invoice without an ABN service should be based on the needs of the business. If the business requires a high level of customization, then an invoice without an ABN service may be the best option. However, if the business does not require a high level of customization, then a service with an ABN may be a better option.

Top services about Invoice without abn

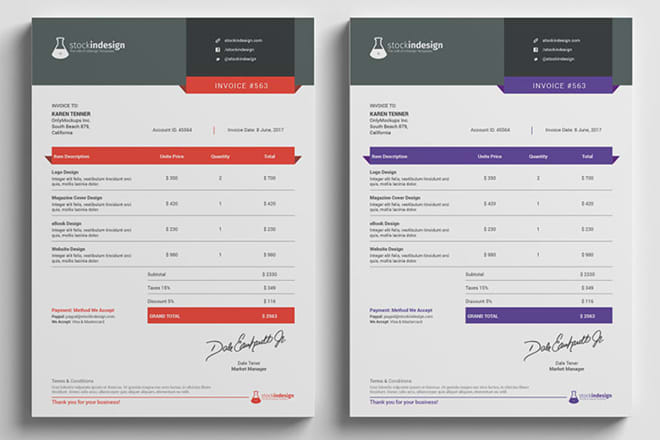

I will design invoice for business

I will interactive pdf order form and invoice

I will edit or design professional invoice templates

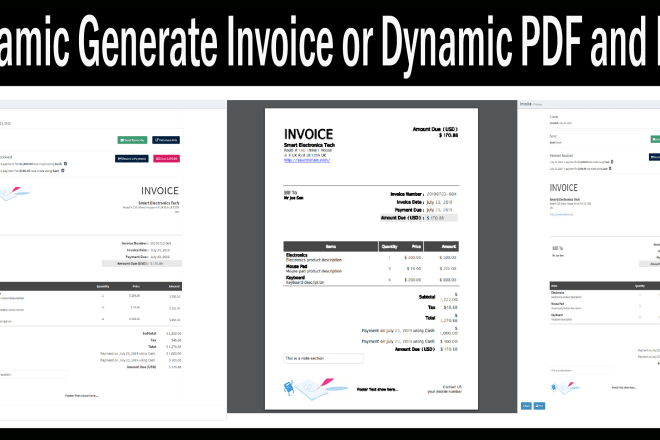

I will dynamic generate invoice or dynamic PDF and mail

I will design invoice, letterhead, receipt in 4 hrs

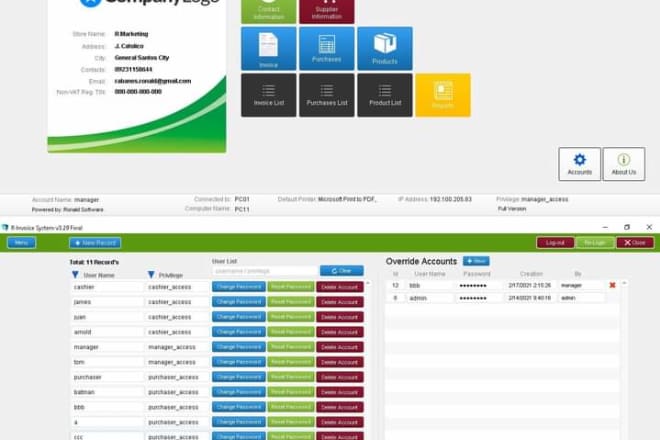

I will do invoice system fully updated

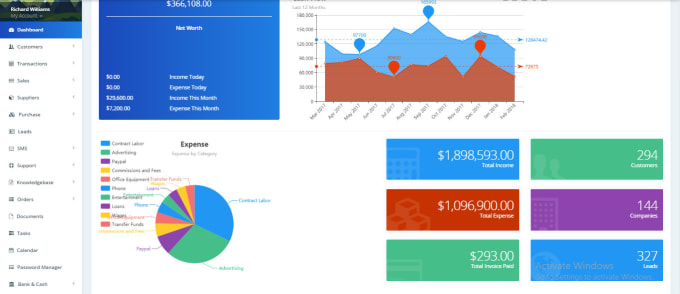

I will crm accountting and billing

Create invoices quickly Customize invoices including logo, notes and more Send Invoice directly to your Customer from the portal PDF Invoice, Customer can download PDF Invoice with Single Click

I will design invoice for your business branding

I will design invoice, letterhead template, and price list for you