Market microstructure forex services

In recent years, a new area of financial research has emerged that focuses on the microstructure of markets. This research has important implications for the way in which market participants trade and interact with each other. In particular, market microstructure research has shown that the way in which trades are executed can have a significant impact on the prices that are observed in the market. This is especially true in the foreign exchange market, where a large number of market participants trade on a daily basis. Market microstructure research has led to the development of new forex trading services that aim to improve the way in which trades are executed. These services typically make use of advanced technology to execute trades in a more efficient and effective manner. The use of market microstructure research is likely to become more widespread in the forex market in the years to come. This is because the benefits of using this type of research to improve the way in which trades are executed are becoming increasingly apparent.

In financial markets, microstructure refers to the detailed structure of how transactions are made and the associated market participants. In the foreign exchange (forex) market, microstructure forex services are specialized firms that provide a range of services to market participants, including data and analytics, trading platforms and connectivity, and market commentary and analysis. These firms play an important role in helping market participants trade effectively and efficiently in the forex market.

In conclusion, market microstructure forex services can provide a number of benefits to traders and investors. By understanding the microstructure of the forex market, traders can gain a better understanding of how the market works and how to trade in it. In addition, microstructure forex services can help investors to better understand the risks and rewards associated with trading in the forex market.

Top services about Market microstructure forex

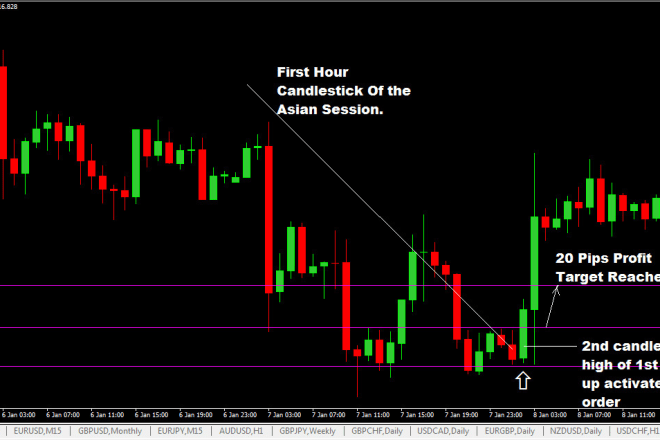

I will give you best forex trading strategy

I will help to trade forex like a bank and institutions

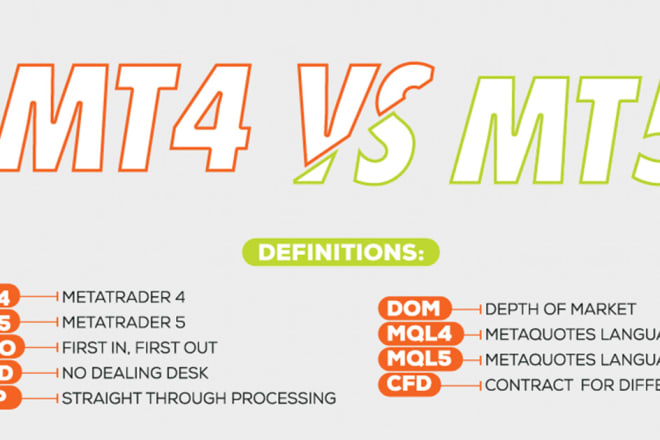

I will build profitable forex trading robot mining bot for mt4 and mt5 crypto traders

I will write the best forex trading articles for your websites and blogs

I will provide profitable forex trading bot, mt4 forex robot, forex ea robot

I will give you forex trading tutorial

I will build complete forex trading website and forex trading app ios, android

I will forex ea robot,forex trading bot and setup fast profitable forex trading bot

I will design a professional forex course website for you