Metatrader advisors services

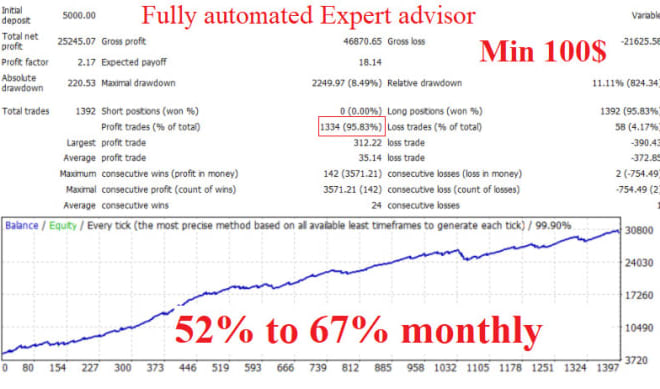

In recent years, the online trading industry has seen a significant increase in the number of so-called “metatrader advisors” or “MTAs”. These are third-party services that provide automated trading strategies, also known as “expert advisors” or “EAs”, to users of the popular MetaTrader 4 (MT4) trading platform. While there are a number of different MTAs available, they all typically work in a similar way. After subscribing to an MTA service, users are given access to a library of EAs that they can then choose to install on their MT4 platform. The EAs will then automatically execute trades on the user’s behalf according to the parameters that have been set. There are a number of advantages to using MTAs, including the ability to trade 24 hours a day, the elimination of emotions from trading decisions, and the ability to test out different trading strategies without incurring any real financial risk. However, it should be noted that MTAs are not a “miracle solution” and there is still a degree of risk involved in using them. If you’re considering using an MTA service, then this article will provide you with everything you need to know, including a rundown of the most popular MTAs, the advantages and disadvantages of using them, and some important considerations to keep in mind.

A metatrader advisor is a service that provides trading advice and recommendations to traders using the metatrader platform.

If you are looking for a reliable and affordable metatrader advisor, then you should definitely check out the services offered by FxStat. With over 10 years of experience in the industry, FxStat has a team of experts that can help you with all your metatrader needs.

Top services about Metatrader advisors

I will code a metatrader 5 indicator or expert advisor

I will create metatrader 4 and 5 expert advisors and scripts

I will create mt4, mt5 indicator or expert advisor metatrader

I will create mt4, mt5 indicator or expert advisor metatrader

I will code a metatrader 4 mt4 mt5 indicator or expert advisor forex robot ea

I will code a metatrader 4 mt4 indicator or expert advisor

I will code an expert advisor or trading robot in metatrader for mt4 or mt5 mql4 mql5

I will programming for forex ea and robots on metatrader 4 and 5

I will modify and develop ea, custom indicators and scripts for mt4, mt5

I will create mt4, mt5 indicator or expert advisor metatrader

I will create mt4, mt5 indicators or expert advisors metatrader

I will give you profitable forex expert advisor ea

I will code metatrader expert advisor or forex trading robot for mt4 mt5

I will create expert advisor ea mq4 bot indicator forex mt4 platform

I will create mt4, mt5 indicator or expert advisor metatrader