Mode of payment services

In recent years, the way we pay for goods and services has changed dramatically. Gone are the days of carrying around cash and coins to pay for purchases. Instead, we now have a variety of payment options available to us, including credit and debit cards, mobile apps, and even digital currencies. With so many different payment options available, it can be hard to keep track of them all. That's why we've put together this guide to the most popular mode of payment services. We'll discuss the pros and cons of each payment method, as well as when and where you can use them.

There are many mode of payment services available today. Some of the most popular include: -Credit cards -Debit cards -Prepaid cards -E-wallets -Mobile payments Each of these payment methods has its own advantages and disadvantages. For example, credit cards offer convenience and flexibility, but can also lead to debt if not used carefully. Debit cards are a good alternative to cash, but can be easy to lose track of spending. Prepaid cards are a great way to control spending, but may not be accepted at all locations. Mobile payments are becoming increasingly popular, as they offer a convenient and secure way to pay for goods and services. However, not all businesses accept mobile payments yet. Which mode of payment you use will depend on your own personal preferences and needs.

In conclusion, various mode of payment services have been introduced and each has its own unique features. While some services are more popular than others, all of them provide a convenient way to pay for goods and services.

Top services about Mode of payment

I will do face sketch by hand in realistic mode

I will establish fastest secure or responsive mod wordpress website

I will create, install, mode your online course, elearning website with learndash

I will bring dark mode in your wordpress site

I will install and setup your new shopify store to working mode

I will create your landing page with fully responsive mode

I will do payment on your behalf in india

I will setup best forex ea trading robot crypto trading mt4 mt5 arbitrage trading bot

I will provide you already developed full featured desktop pos

I will create stickman ragdoll online pvp game

I will create awesome graffiti tagging with hand drawn

I will give readymade woocommerce mobile app

I will playing counter strike global offensive with you

I will help you to win your game

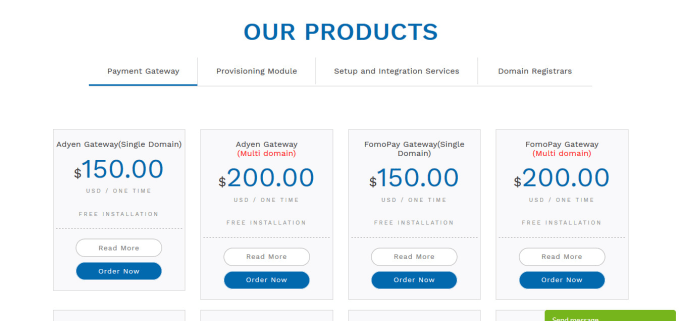

I will develop whmcs payment gateway modules

1.) ByteSeller Payment Gateway

2.) J-Payment Co.(Cloudpayment Payment) Module

3.) Chase Paymentech HostedCheckout Module

4.) Omise Paymet Gateway(Credit card Only) Module

5.)Zooz Payment Gateway

6.)Omise Payment Gateway

7.) MultiCards Module

I will integrate payment gateway to woocommerce