Modified vat invoice services

In many countries, Value Added Tax (VAT) is a consumption tax levied on the sale of goods and services. VAT is levied on the value added to goods and services at each stage of production or distribution. Businesses registered for VAT collect it on behalf of the government and pay it over to the tax authority. VAT invoices are issued by businesses to their customers to document the VAT charged on supplies of goods and services. A modified VAT invoice is one that has been changed after it was originally issued, for example to correct an error. Businesses may issue modified VAT invoices without the approval of the tax authority, but they must be careful to ensure that the changes made are within the law. This article sets out the rules for issuing modified VAT invoices in [insert country name].

A modified VAT invoice is a document that is used to claim a refund of VAT paid on goods or services. It is similar to a regular VAT invoice, but includes additional information such as the name and address of the recipient, the reason for the refund, and the amount of VAT to be refunded.

Overall, modified vat invoice services can save businesses a lot of time and money. They can help businesses keep track of their finances, as well as save on administrative costs.

Top services about Modified vat invoice

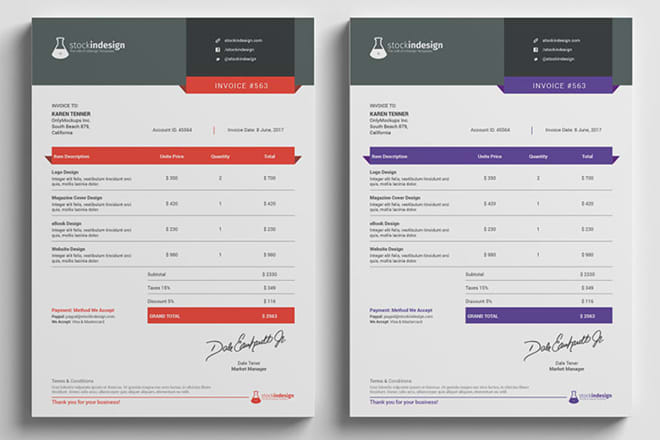

I will design invoice for business

I will interactive pdf order form and invoice

I will edit or design professional invoice templates

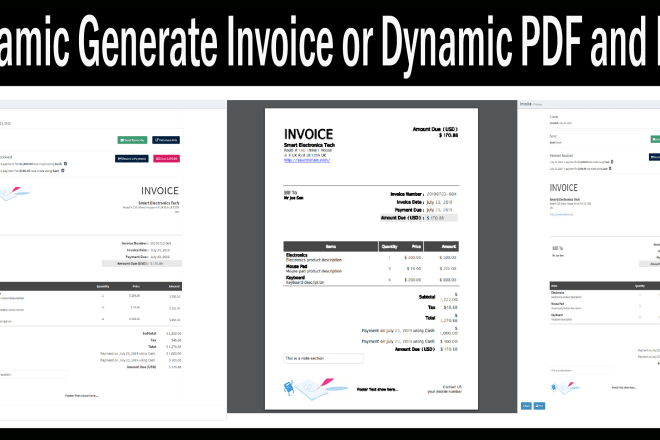

I will dynamic generate invoice or dynamic PDF and mail

I will design invoice, letterhead, receipt in 4 hrs

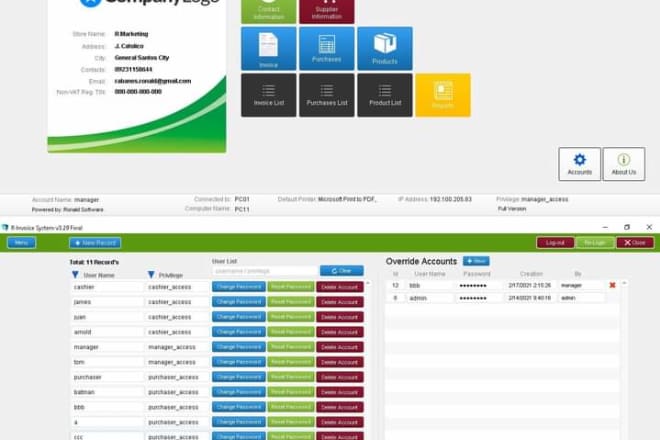

I will do invoice system fully updated

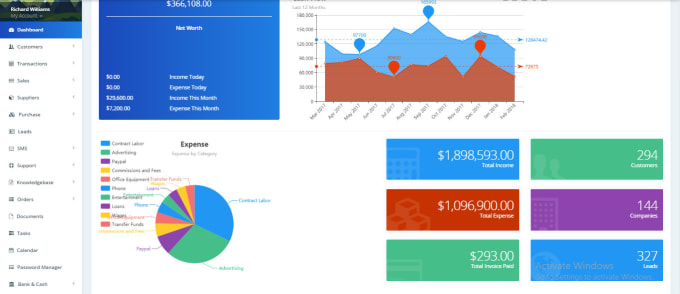

I will crm accountting and billing

Create invoices quickly Customize invoices including logo, notes and more Send Invoice directly to your Customer from the portal PDF Invoice, Customer can download PDF Invoice with Single Click

I will design invoice for your business branding

I will design invoice, letterhead template, and price list for you