Money in bank but not available services

A new study has found that a majority of Americans have money in the bank but are not using available financial services. The study, conducted by the Pew Charitable Trusts, found that 63 percent of Americans have money in savings accounts or other liquid assets, but only a fraction are using available services such as mobile banking and automated teller machines. The study's authors say that the findings highlight a "disconnect" between people who have money and those who are using financial services. They say that this disconnect may be due to a lack of awareness or mistrust of financial institutions.

If you have money in your bank account but the bank's services are not available, you may not be able to access your funds. This can happen if the bank is closed or if there is an issue with the bank's systems. If you need to access your money, you may need to find another way to get it, such as through an ATM or by using a different bank's services.

The article discusses the issue of people not being able to access their money even though it is in the bank. This is due to a number of reasons, including the fact that banks are not open on weekends and holidays, and that there are often limits on how much money can be withdrawn from an account. This can be a serious problem for people who rely on their bank account to pay for basic needs like food and shelter. There are a few potential solutions to this problem. One is for people to keep a small amount of cash on hand in case of emergencies. Another is for people to use ATMs or debit cards instead of relying on banks. Finally, people can consider using alternative financial services, such as payday loans or pawn shops, which can provide access to money even when banks are closed.

Top services about Money in bank but not available

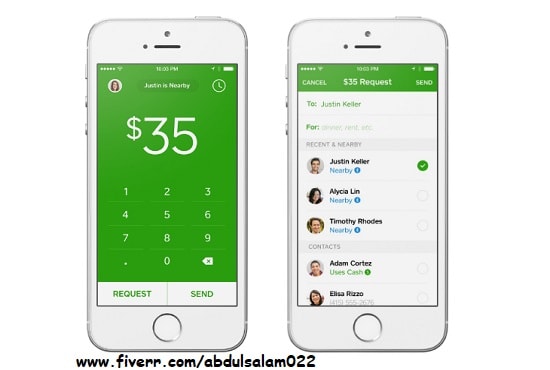

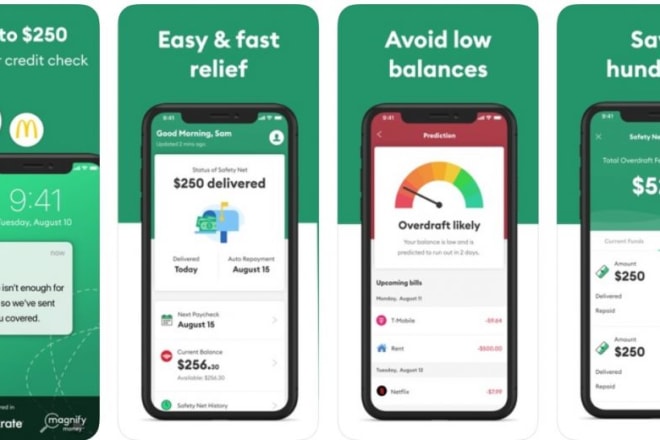

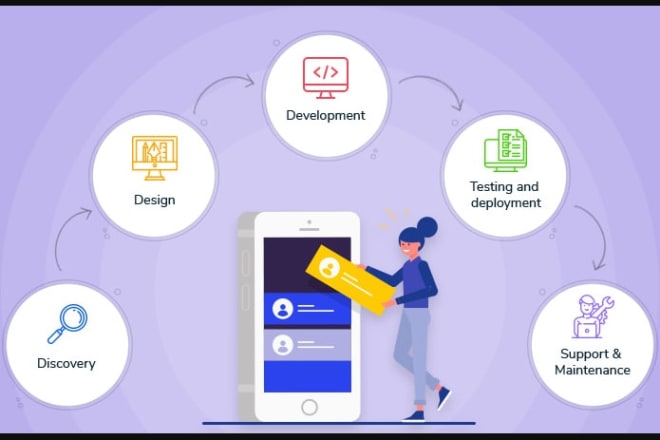

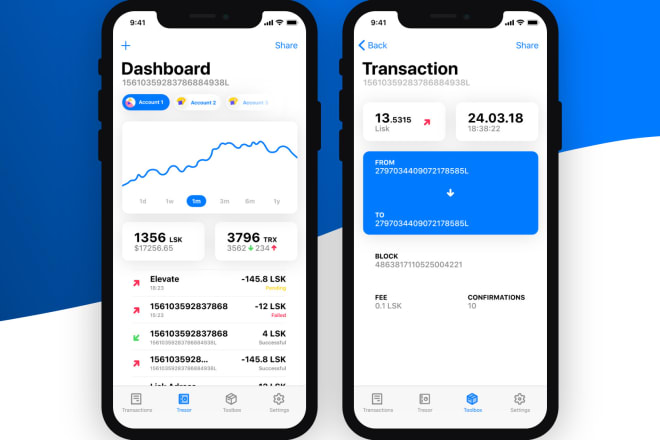

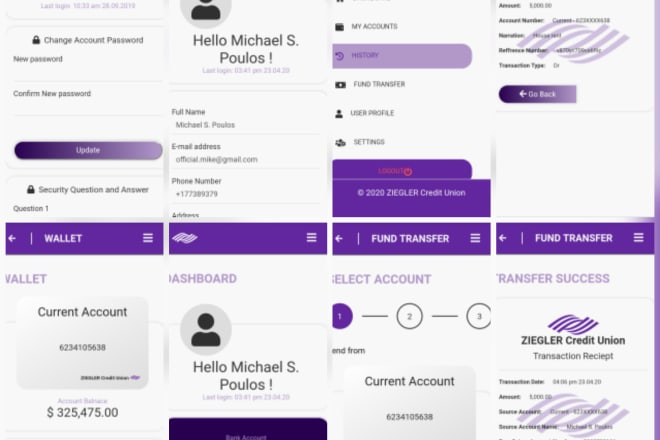

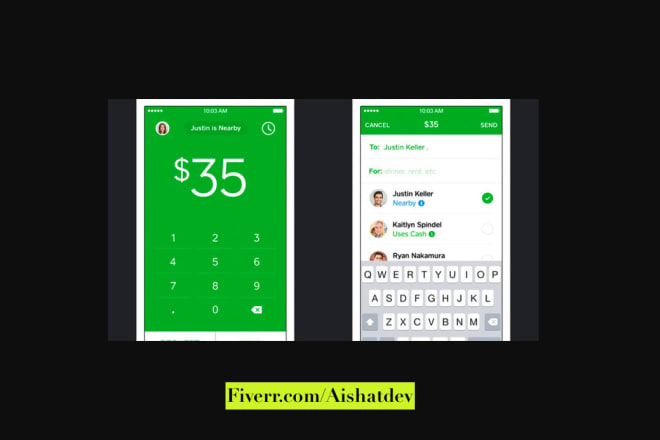

I will develop cash app, loan app, payment app, online money transfer app, bank app

I will develop money transfer app, bank app, cash app, loan app android and ios

I will build cash app, bank app,loan app, money transfer app

I will develop money transfer app,cash app, payment app, payment gateway,wallet app,

I will develop cash app transaction, loan app, transfer application

I will develop multi purpose cash app, payment app, bank app, loan app on all platforms

I will do powerful link building using money robot

I will cash app, exchange wallet app, money transfer app, banking app

I will money transfer app, cash app, bank app, loan app, cash transfer app, banking app

I will build cash app,bank app,loan app,payment app,money transfer app,wallet app

I will do reconciliation from paystub, paypal, zelle, quickbooks bank statement

I will cash app, money transfer app, loan app, payment app, bank app, wallet app

I will develop money transfer app, cash app, wallet app,bank app, payment app

I will do online banking responsive mobile app

I will build cash app,bank app,loan app,payment app,online money transfer app

I will create bank app online money transfer app cash app wallet app payment gateway