Most profitable forex strategy services

In the past decade, the foreign exchange (Forex) market has become increasingly popular with online investors. Forex is a decentralized market where global currencies are traded. The main participants in this market are commercial banks, central banks, currency speculators, corporations, governments, and other financial institutions. The Forex market is the largest and most liquid market in the world, with a daily trading volume of over $5 trillion. There are many different Forex trading strategies that investors can use to make profits in the market. Some of these strategies are more complex than others, and some require a higher level of experience and knowledge to be successful. However, there are also a number of Forex trading strategies that are relatively simple and easy to learn. These strategies can be used by investors of all levels of experience and can be adapted to different investment goals. One of the most popular and profitable Forex trading strategies is known as scalping. Scalping is a short-term trading strategy where investors attempt to make small profits on each trade by taking advantage of small price movements in the market. Scalpers generally trade with a very tight stop-loss, which limits their risk on each trade. This strategy can be very profitable, but it is also very risky. Another popular Forex trading strategy is known as swing trading. Swing traders generally hold onto their positions for a few days or weeks, and attempt to profit from larger price movements in the market. Swing trading is a more conservative approach than scalping, and can be more suitable for investors with a lower risk tolerance. There are a number of other Forex trading strategies that investors can use to make profits in the market. These include day trading, position trading, and currency carry trades. Each of these strategies has its own unique risks and rewards, and investors should carefully consider which strategy is right for them before entering the market. The Forex market is an exciting and dynamic place to invest. There are a number of different Forex trading strategies that can be used to make profits, and each has its own unique risks and rewards. Before entering the market, investors should carefully consider which strategy is right for them and their investment goals.

There is no one-size-fits-all answer to this question, as the most profitable forex strategy service depends on the individual trader's goals, risk tolerance, and trading style. However, some common features of profitable forex strategy services include sound money management principles, a well-defined trading plan, and a focus on long-term gains. Many profitable forex traders also use technical analysis to identify market trends and entry/exit points.

In conclusion, forex strategy services can be a very profitable business. However, it is important to choose a strategy that is right for you and your goals. There are many different strategies out there, so it is important to do your research and find one that fits your needs. A good forex strategy service will provide you with all the tools and resources you need to succeed in the forex market.

Top services about Most profitable forex strategy

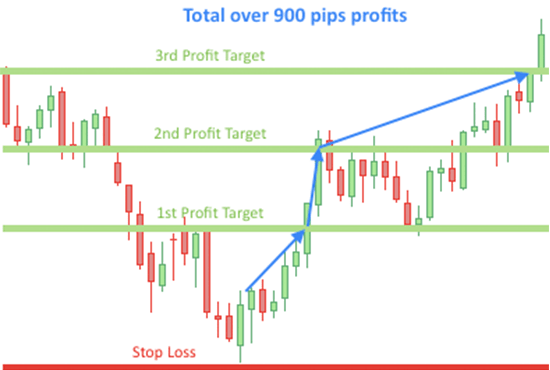

I will give you one of my most profitable trading strategies

I will give you the most powerful trading strategy that will make you win every days

I will teach you my profitable forex strategy, indices and krypto or day trade strategy

I will teach you a profitable forex trading strategy

I will give you my most profitable forex trading strategy

I will teach you most profitable forex trading forex strategy course

I will increase pips with profitable indicator

New forex traders can also win in the forex trading by my this FX win Profitable Strategy Template + Indicator, My system will tell you when and where you should trade. This is a highly profitable and simple to use forex strategy.

It comes with a Tutorial how to set up the indicators and template.

There is no need for prior knowledge in forex, markets or finances to use this strategy effectively. Anyone who can use a computer can use it. You can use this strategy on any type of Forex platform.

EXTRA

---------------------------

I will increase pips with profitable indicator

I will teach you my profitable forex strategy, indices or day trades strategy

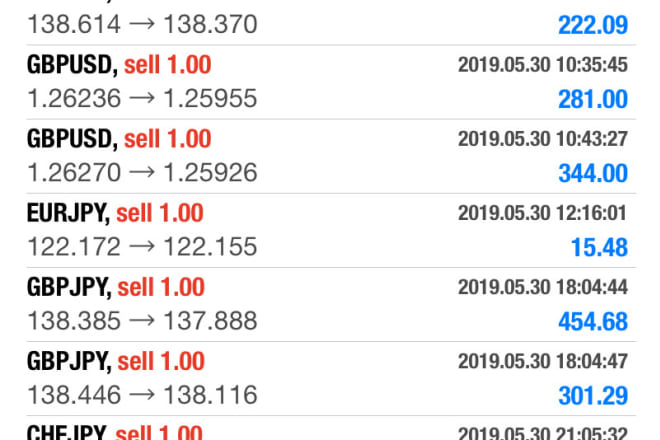

I will share with you a true profitable Forex strategy

It is a basic Forex trading strategy that can be traded every day if desired, it works with any currency pair and on any time frame.

Anyone can use it, all levels in Forex trading can trade this strategy as it is simple, yet very effective.

If you have any additional question regarding the Forex trading strategy itself, please do not hesitate in contacting me through Fiverr. I'm always available and ready to help.

Thank you and happy trading!

I will share with you a real profitable Forex strategy

I will teach you my winning 92 percent profitable forex strategy

I will teach forex trading, day trading, forex strategy on mt4,mt5