Online investment services

In recent years, there has been a boom in online investment services. This has been driven by a number of factors, including the rise of online brokerages, the growth of mobile investing, and the increasing accessibility of data and analytics. For individual investors, online investment services can provide a convenient and cost-effective way to access a wide range of investment products and services. Online brokerages, for example, offer investors the ability to buy and sell stocks, bonds, and other securities online. Mobile investing apps allow investors to trade on the go, and data and analytics tools provide investors with access to real-time market data and analysis. For financial advisors, online investment services can be a valuable addition to their practice. By using online tools, advisors can more easily manage their clients' portfolios, monitor their investments, and provide timely advice and guidance. In addition, online investment services can help advisors attract and retain clients, as well as grow their businesses.

There are a few key things to know about online investment services. First, these services allow you to invest in a variety of different assets, including stocks, bonds, and mutual funds. Second, online investment services typically have lower fees than traditional investment firms. Finally, online investment services offer a variety of tools and resources to help you make the best investment decisions.

In conclusion, online investment services can be a great way to diversify your portfolio and increase your returns. However, it is important to do your research and understand the risks involved before investing.

Top services about Online investment services

I will teach you the best investment strategies

I will online customer services,online data entry, online invoice

I will answer at 10 questions about trading online

I will give you the best bitcoin investment system to make great monthly profits

I will write you an incredible startup business plan for investment

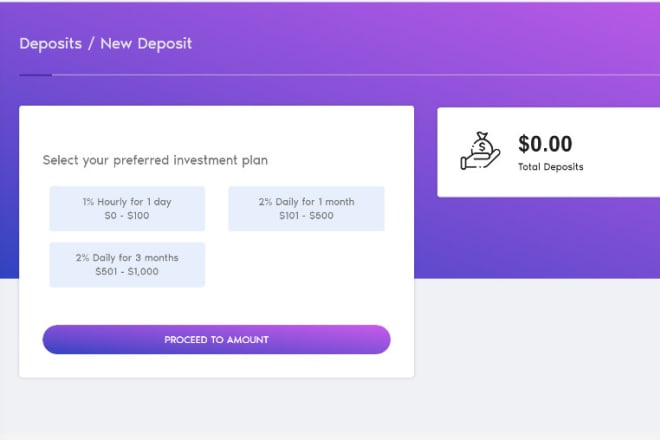

I will make MLM website with online investment daily ROI

I will turn your presentation slides into elearning online course I english and german

I will create a bitcoin mining and investment sites

I will deliver your research needs as our agreement entails

I will create a bitcoin investment website

I will develop online game for your crypto game app, bitcoin game, crypto game website

I will grow your online business from the ground up

I look forward to working with you and providing you with the best services around!

I will do financial management and investment appraisal work

I will provide 10 unique business ideas, online startup ideas

I will develop stock market prediction software

I will analysis on the best stocks buy, hold and sell

I will create a financial model in excel

I will create a custom workable, simple financial and investment model in Excel that will enable you to:

- create financial plans and projections for new businesses

- assess the profitability of a business or development project

- assess the viability of an investment

- assess how much investment income is needed to cover debt service

- see the potential returns an investment could generate for you

- compare the proposed investment with alternatives

- consider the key risks associated with the investment so you can make the best possible decisions

- understand the impact of mortgage and debt on your investment

- run a sensitivity analysis of the key investment inputs

The model can be customised for real estate investments decision-making, financial projections and other alternative investments.

I will build a model around your initial assumptions and inputs and allow for future changes, should your assumptions change.

***PLEASE CONTACT ME BEFORE PLACING THE ORDER. THE BASIC GIG IS FOR A SIMPLE THREE-VARIABLE MODEL (PURCHASE PRICE, INCOME, EXPENSES/SELLING PRICE). FOR MORE COMPLEX MODELS I CAN PREPARE A CUSTOM OFFER BASED ON YOUR REQUIREMENTS***