Option seller services

Many people are familiar with the stock market, but there are other markets where investments can be made. The options market is one such market. An options market is a market where contracts are written for the purchase or sale of securities at a set price within a certain period of time. An options market is different from the stock market in that it is not a centralized exchange. Instead, it is a network of computers that match buyers and sellers. The options market is open 24 hours a day, from Sunday afternoon to Friday afternoon. There are two types of options contracts: call options and put options. A call option gives the holder the right to buy a security at a certain price within a certain period of time. A put option gives the holder the right to sell a security at a certain price within a certain period of time. Options can be used to speculate on the future direction of a security's price, or to hedge against the risk of a security's price movements. Options market participants include options buyers, options sellers, and market makers. Options buyers include individuals, institutional investors, and hedgers. Options sellers include individuals, institutional investors, and market makers. Market makers are participants in the options market who provide liquidity by quoting bid and ask prices for options contracts. They are typically banks or broker-dealers. Individuals who want to buy or sell options contracts can do so through a broker. Institutional investors typically trade options through a trading desk at a bank or a broker-dealer. Hedgers use options to protect against the risk of adverse price movements in the underlying security. For example, a hedger might buy a put option to protect against the risk of a decline in the price of the underlying security. Options can be traded on a variety of different securities, including stocks, bonds, commodities, and currencies.

Option seller services are typically provided by investment firms and allow investors to purchase and sell options contracts. These services can be used to speculate on the direction of the market, or to hedge against portfolio risk.

Overall, we found that option seller services were generally a bad deal for investors. The high fees charged by these firms ate into any potential profits, and the firms themselves were often not transparent about how they were making money. We would caution investors against using these services.

Top services about Option seller

I will build professional PHP freelancing marketplace or website like fiverr

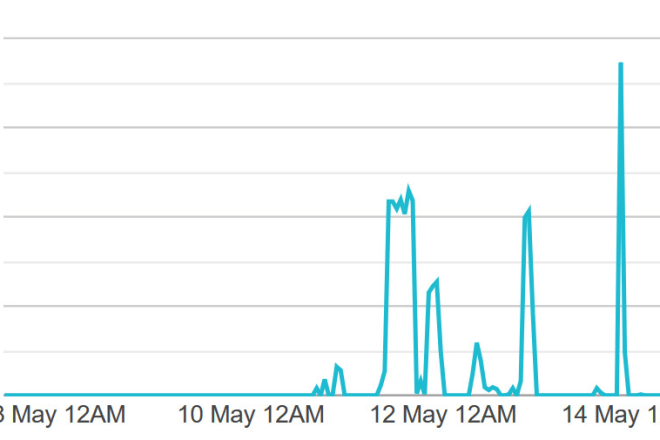

I will get USA web traffic and clicks for your website or blog with different USA ips

I will make a custom trippy art for you

I will build a pro fiverr freelance marketplace website look like

I will build freelancing marketplace website like fiverr in 24 hrs

I will deliver keyword targeted top quality search visitors

I will design your architectural presentation, poster or panel

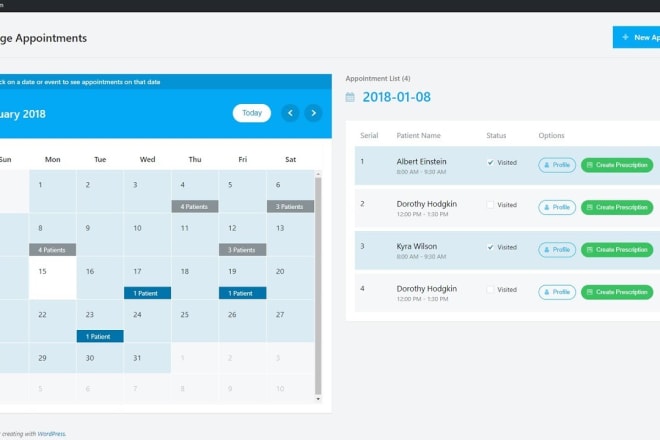

I will make appointment, booking, reservation website in wordpress

I will create freelance website like fiverr