Payday loan leads services

In recent years, payday loan leads services have become increasingly popular among consumers. These services provide a way for consumers to get quick and easy access to cash when they need it. Payday loan leads services typically work by connecting consumers with lenders who are willing to provide them with short-term loans. These loans are typically repaid on the consumer's next payday. While payday loan leads services can be a great way for consumers to get access to cash when they need it, it is important to remember that these services can also be very expensive. In some cases, the fees associated with these services can be higher than the interest rates charged by traditional lenders. As such, it is important to carefully consider the costs and benefits of using a payday loan lead service before using one.

There are many companies that offer payday loan leads services. These companies typically sell leads to payday loan providers. The leads may be generated through online marketing efforts or through offline sources such as telemarketing or direct mail.

If you're considering using a payday loan lead service, be sure to do your research first. There are a lot of scams out there, and you don't want to end up being taken advantage of. Make sure you understand the terms and conditions of the service before you sign up, and always read the fine print. Payday loans can be a helpful tool if used correctly, but they can also be a financial trap if you're not careful.

Top services about Payday loan leads

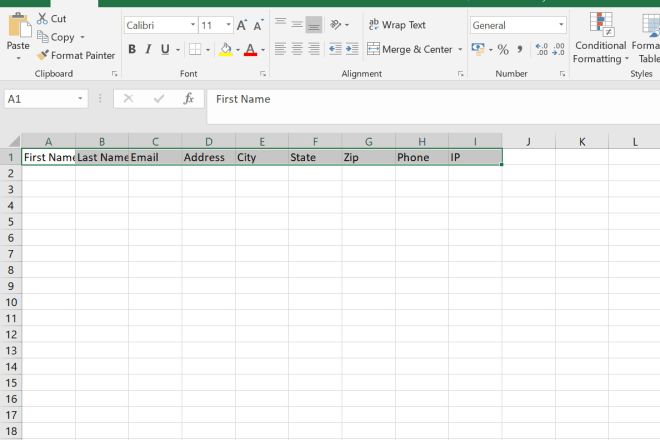

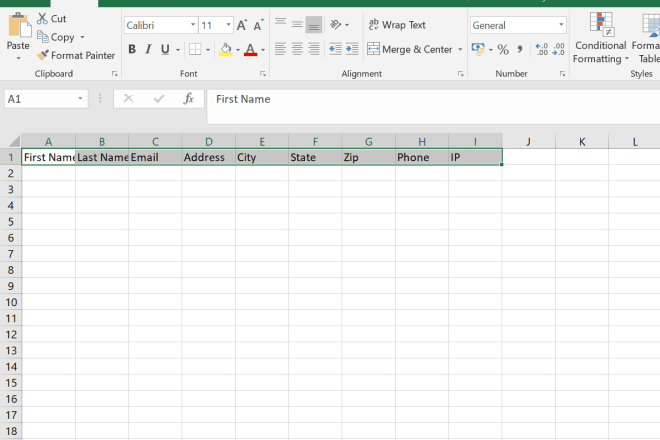

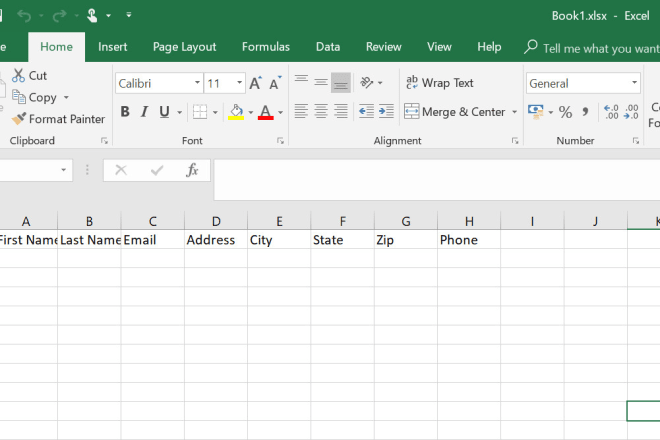

I will provide 100 USA payday loans leads 24hrs old

I will provide active valid email list 2020

I will provide 100 USA payday loans leads 7days old

I will provide high quality payday loan leads for USA

I will provide 1000 USA payday loans leads 30days aged

I will provide fresh exclusive USA payday loan leads

I will provide high quality payday loan leads for USA and UK

I will generate verified student loan leads car loan leads home loan leads

I will generate unique car loan leads auto loan leads with high convert

I will get mortgage loan leads business loan leads for mortgage broker using facebook

I will generate exclusive car loan leads auto loan leads with high convert

I will give you 4000+ PLR articles the loan niche and 200K+ loan keywords