Paypal atm services

In recent years, the paypal atm has become a popular way for people to receive their payments. The paypal atm is a service that allows people to withdraw money from their paypal account using an atm card. The paypal atm service is available in many countries, and it is a convenient way to receive payments.

Paypal is a company that provides online payment services. It allows users to send and receive money online. Paypal also offers a debit card, which can be used to withdraw money from ATMs.

As of July 2017, PayPal has invested in around seven companies that offer ATM services, totaling over $50 million. The move comes as the company looks to expand its services beyond online payments and into the physical world. This is a significant investment for PayPal, and it shows that the company is serious about providing ATM services to its users. With over 200 million active users, PayPal is one of the largest online payment platforms in the world. If it can successfully provide ATM services, it would be a major convenience for its users. It is unclear how exactly PayPal plans to provide ATM services, but it is likely that the company will partner with existing ATM providers. It is also possible that PayPal will roll out its own ATM network. Regardless of the details, PayPal's investment in ATM services is a positive development for the company and its users.

Top services about Paypal atm

I will build up a cash app, loan app and internet banking app

I will develop a cash app, loan app and online banking app recharge

I will build custom cash app,bank app, loan app,payment app

I will design a creative and unique website landing pages

I will develop online money transfer app,cash app,loan app,payment app

I will create an ecommerce website with wordpress woocommerce

I will build out cash app, payment app, bank app and loan app, for android and IOS

I will build custom cash app, wallet app, loan app, bank app, online money transfer app

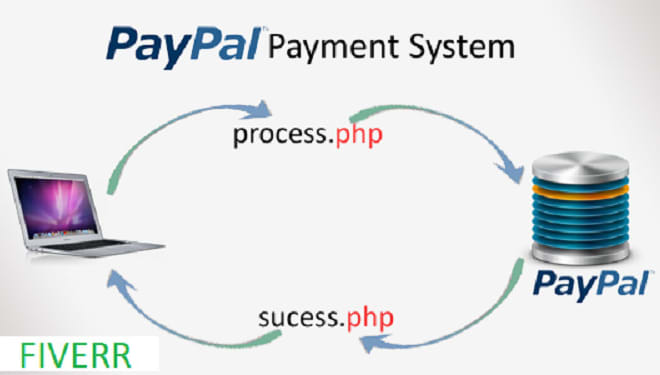

I will integrate paypal with your woocommerce

I will do paypal integration and solve paypal payment issues

I will implement PayPal payment method

I will add paypal smart buttons to your shopify store

I will integrate paypal in PHP asp csharp vb dot net

I will quickly integrate paypal payment gateway to your website

I will do stripe paypal payment method integrate and api expert

I will add unsupported paypal currency to woocomerce

I will paypal api work using php script

I shall implement paypal in your website in very short time.