Paypal atm card services

Since its inception in 1998, PayPal has been a pioneer in digital payments, allowing customers to send money without sharing their financial information. Today, the company offers a suite of products and services that enable consumers and businesses to send and receive payments electronically. One of PayPal's most popular services is its ATM card, which allows customers to withdraw cash from their PayPal account at any ATM. The card also allows customers to make purchases anywhere MasterCard is accepted. PayPal's ATM card is a convenient way to access your PayPal balance, and it's a safe and secure way to make purchases. If you're looking for a convenient and secure way to pay, the PayPal ATM card is a great option.

Paypal is a financial services company that offers a variety of products, including a debit card. The Paypal Debit Card allows cardholders to access their Paypal balance at any ATM. There is no credit check required to obtain the card, and there are no fees associated with using it.

Overall, PayPal's ATM card services are a great way to withdraw money from your account. However, there are a few things to keep in mind. First, you will need to have a PayPal account in order to use the service. Second, you will need to find a participating ATM in order to withdraw money. And finally, there is a fee associated with using the service. But all in all, the service is a great way to get access to your money when you need it.

Top services about Paypal atm card

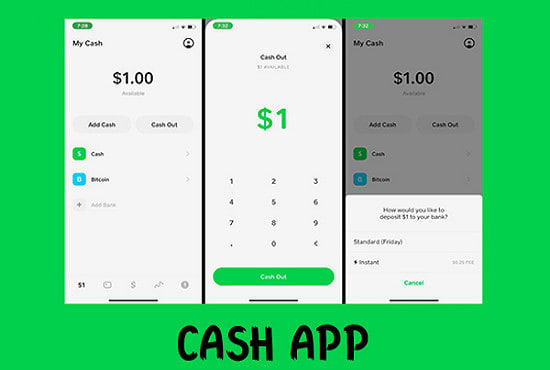

I will develop you complete mobile payment app from scratch on android and ios

I will create an ecommerce website with wordpress woocommerce

I will develop cash app, e wallet app, money transfer app, payment app

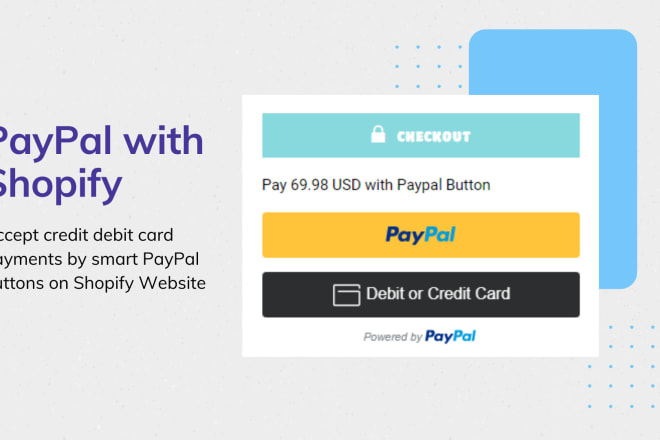

I will shopify integrate paypal credit debit card smart buttons

I will add paypal credit debit card payment smart buttons on shopify website

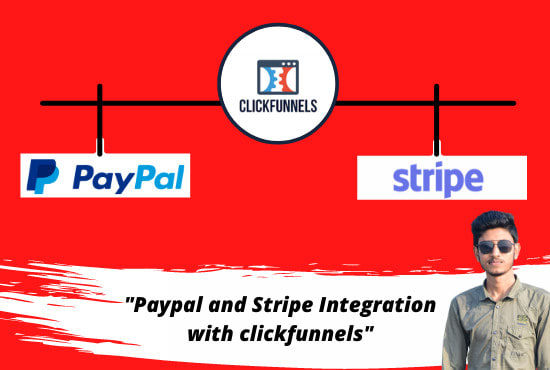

I will integrate stripe and paypal using all in clickfunnels payment integration

I will do paypal integration and accept payments by credit debit card

I will integrate shopify credit debit card paypal button

I will integrate paypal credit debit card payment smart buttons on wordpress website

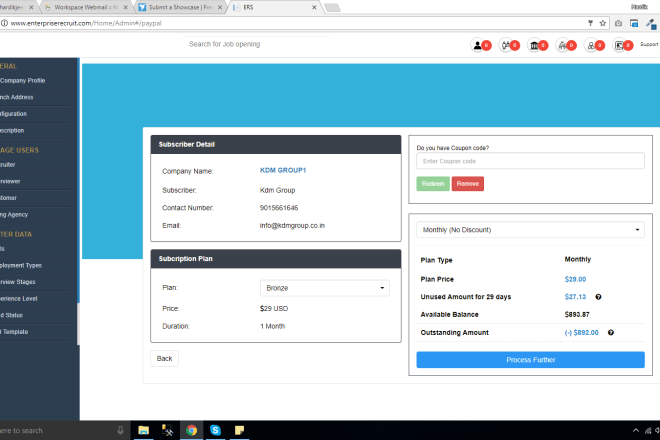

I will do paypal payment integration for any of your websit

I will be your clickfunnels membership site or clickfunnels sales funnel expert

I will let you be part of paypal